Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

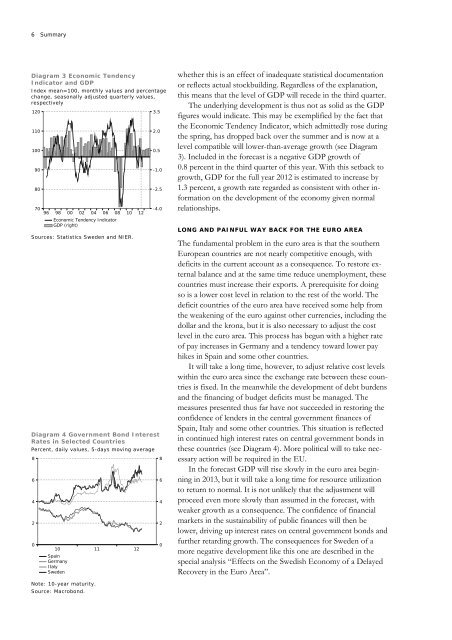

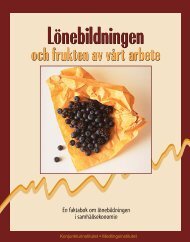

6 SummaryDiagram 3 Economic TendencyIndicator and GDPIndex mean=100, monthly values and percentagechange, seasonally adjusted quarterly values,respectively120110100908070969800020406Economic Tendency IndicatorGDP (right)0810Sources: Statistics Sweden and NIER.123.52.00.5-1.0-2.5-4.0Diagram 4 Government Bond InterestRates in Selected CountriesPercent, daily values, 5-days moving average8642010SpainGermanyItalySweden111286420whether this is an effect of inadequate statistical documentationor reflects actual stockbuilding. Regardless of the explanation,this means that the level of GDP will recede in the third quarter.<strong>The</strong> underlying development is thus not as solid as the GDPfigures would indicate. This may be exemplified by the fact thatthe Economic Tendency Indicator, which admittedly rose duringthe spring, has dropped back over the summer and is now at alevel compatible will lower-than-average growth (see Diagram3). Included in the forecast is a negative GDP growth of0.8 percent in the third quarter of this year. With this setback togrowth, GDP for the full year <strong>2012</strong> is estimated to increase by1.3 percent, a growth rate regarded as consistent with other informationon the development of the economy given normalrelationships.LONG AND PAINFUL WAY BACK FOR THE EURO AREA<strong>The</strong> fundamental problem in the euro area is that the southernEuropean countries are not nearly competitive enough, withdeficits in the current account as a consequence. To restore externalbalance and at the same time reduce unemployment, thesecountries must increase their exports. A prerequisite for doingso is a lower cost level in relation to the rest of the world. <strong>The</strong>deficit countries of the euro area have received some help fromthe weakening of the euro against other currencies, including thedollar and the krona, but it is also necessary to adjust the costlevel in the euro area. This process has begun with a higher rateof pay increases in Germany and a tendency toward lower payhikes in Spain and some other countries.It will take a long time, however, to adjust relative cost levelswithin the euro area since the exchange rate between these countriesis fixed. In the meanwhile the development of debt burdensand the financing of budget deficits must be managed. <strong>The</strong>measures presented thus far have not succeeded in restoring theconfidence of lenders in the central government finances ofSpain, Italy and some other countries. This situation is reflectedin continued high interest rates on central government bonds inthese countries (see Diagram 4). More political will to take necessaryaction will be required in the EU.In the forecast GDP will rise slowly in the euro area beginningin 2013, but it will take a long time for resource utilizationto return to normal. It is not unlikely that the adjustment willproceed even more slowly than assumed in the forecast, withweaker growth as a consequence. <strong>The</strong> confidence of financialmarkets in the sustainability of public finances will then belower, driving up interest rates on central government bonds andfurther retarding growth. <strong>The</strong> consequences for Sweden of amore negative development like this one are described in thespecial analysis “Effects on the <strong>Swedish</strong> <strong>Economy</strong> of a DelayedRecovery in the Euro Area”.Note: 10-year maturity.Source: Macrobond.