Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

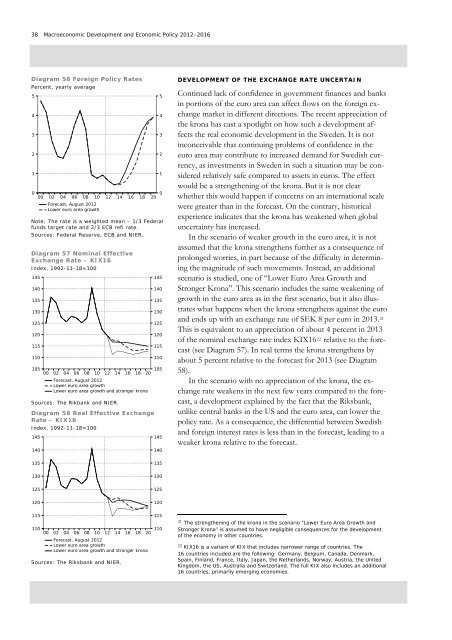

38 Macroeconomic Development and Economic Policy <strong>2012</strong>–2016Diagram 56 Foreign Policy RatesPercent, yearly average543210000204060810Forecast, <strong>August</strong> <strong>2012</strong>Lower euro area growth1214161854321020Note: <strong>The</strong> rate is a weighted mean – 1/3 Federalfunds target rate and 2/3 ECB refi rate.Sources: Federal Reserve, ECB and NIER.Diagram 57 Nominal EffectiveExchange Rate – KIX16Index, 1992-11-18=10014514013513012512011511014514013513012512011511010510500 02 04 06 08 10 12 14 16 18 20Forecast, <strong>August</strong> <strong>2012</strong>Lower euro area growthLower euro area growth and stronger kronaSources: <strong>The</strong> Rikbank and NIER.Diagram 58 Real Effective ExchangeRate – KIX16Index, 1992-11-18=100145140145140DEVELOPMENT OF THE EXCHANGE RATE UNCERTAINContinued lack of confidence in government finances and banksin portions of the euro area can affect flows on the foreign exchangemarket in different directions. <strong>The</strong> recent appreciation ofthe krona has cast a spotlight on how such a development affectsthe real economic development in the Sweden. It is notinconceivable that continuing problems of confidence in theeuro area may contribute to increased demand for <strong>Swedish</strong> currency,as investments in Sweden in such a situation may be consideredrelatively safe compared to assets in euros. <strong>The</strong> effectwould be a strengthening of the krona. But it is not clearwhether this would happen if concerns on an international scalewere greater than in the forecast. On the contrary, historicalexperience indicates that the krona has weakened when globaluncertainty has increased.In the scenario of weaker growth in the euro area, it is notassumed that the krona strengthens further as a consequence ofprolonged worries, in part because of the difficulty in determiningthe magnitude of such movements. Instead, an additionalscenario is studied, one of “Lower Euro Area Growth andStronger Krona”. This scenario includes the same weakening ofgrowth in the euro area as in the first scenario, but it also illustrateswhat happens when the krona strengthens against the euroand ends up with an exchange rate of SEK 8 per euro in 2013. 21This is equivalent to an appreciation of about 4 percent in 2013of the nominal exchange rate index KIX16 22 relative to the forecast(see Diagram 57). In real terms the krona strengthens byabout 5 percent relative to the forecast for 2013 (see Diagram58).In the scenario with no appreciation of the krona, the exchangerate weakens in the next few years compared to the forecast,a development explained by the fact that the Riksbank,unlike central banks in the US and the euro area, can lower thepolicy rate. As a consequence, the differential between <strong>Swedish</strong>and foreign interest rates is less than in the forecast, leading to aweaker krona relative to the forecast.1351351301301251251<strong>2012</strong>011511011000 02 04 06 08 10 12 14 16 18 20Forecast, <strong>August</strong> <strong>2012</strong>Lower euro area growthLower euro area growth and stronger kronaSources: <strong>The</strong> Riksbank and NIER.11521 <strong>The</strong> strengthening of the krona in the scenario ”Lower Euro Area Growth andStronger Krona” is assumed to have negligible consequences for the developmentof the economy in other countries.22 KIX16 is a variant of KIX that includes narrower range of countries. <strong>The</strong>16 countries included are the following: Germany, Belgium, Canada, Denmark,Spain, Finland, France, Italy, Japan, the Netherlands, Norway, Austria, the UnitedKingdom, the US, Australia and Switzerland. <strong>The</strong> full KIX also includes an additional16 countries, primarily emerging economies.