26 Macroeconomic Development and Economic Policy <strong>2012</strong>–2016Diagram 43 Repo RatePercent, daily values543210080910111213NIER´s forecastRIBA futures, <strong>August</strong> 20 <strong>2012</strong><strong>The</strong> Riksbank, July <strong>2012</strong>Sources: NASDAQ OMX, <strong>The</strong> Riksbank and NIER.14Diagram 44 Exchange RatesSEK per currency unit, daily values, 5-daysmoving average11109876510USDEURSource: Macrobond.Diagram 45 Lending from FinancialInstitutions in SwedenAnnual percentage change, monthly values20151050-51115121654321011109876520151050-5until the third quarter of 2013, when it will start being raised. 10Market pricing, as expressed in so-called RIBA futures, reflectsexpectations that the repo rate will be lowered once during theautumn and possibly one more time during the spring of 2013(see Diagram 43).<strong>The</strong> picture of how resource utilization develops in the<strong>Swedish</strong> economy is not totally clear. Employment increased,and GDP growth was strong in the second quarter of this year,according to the preliminary National Accounts. Several otherindicators of resource utilization, however, suggest that theeconomy has weakened. <strong>The</strong> outlook for the <strong>Swedish</strong> economyin the immediate future is relatively weak. GDP growth in thesecond half-year will be lower, and the labour market is softening.Resource utilization is thus weakening further.<strong>The</strong> krona has appreciated strongly over the summer(see Diagram 44). Compared with May, the krona in mid-<strong>August</strong>was almost 7 percent stronger in effective terms. All else beingequal, the stronger krona will lead to lower resource utilizationand inflation in the <strong>Swedish</strong> economy and calls for a lower policyrate.Lending to households has continued to slow down. In Junethe rate of increase in lending to households was just over4.5 percent, half the rate of increase compared with 2010 andthe lowest rate of increase since 1997 (see Diagram 45).All factors considered, the NIER’s assessment is that basedon the latest economic information, the Riksbank, after havingleft the repo rate unchanged in September, will lower it by0.25 percentage points in October of this year and thereafter byan additional 0.25 percentage points in December in order toincrease resource utilization and to facilitate achievement of theinflation target.<strong>The</strong> NIER’s assessment is admittedly that the krona willweaken somewhat in the coming year, but also that a large proportionof the recent appreciation will be lasting (see the section”Krona Strenghtened by Weakness in Other Countries” below).<strong>The</strong> stronger krona means that prices of imports will show aweak tendency this year and next year. This will help to ensurethat the increase in prices of the goods and services in the consumerprice index will be relatively limited both this year andnext year. CPIF inflation will be only 1.1 percent this year and1.3 percent next year (see Diagram 42).If the krona develops more strongly than in the forecast, itmay be necessary to lower the repo rate below 1 percent in orderto prevent an excessively large drop in resource utilization and ininflation (see the special analysis “Effects on the <strong>Swedish</strong> <strong>Economy</strong>of a Delayed Recovery in the Euro Area”).-109799010305To householdsTo non-finacial corporations07Note. Quarterly data prior to 2003.Source: Statitics Sweden.0911-1010 Through downward adjustment of the short-term repo rate forecast, however,the Riksbank was signaling that the probability of lowering the repo rate in theautumn of <strong>2012</strong> is somewhat greater than the probability that it will be raised. <strong>The</strong>judgement was also made that the repo rate would be raised at a slightly slowerpace beginning in mid-2013.

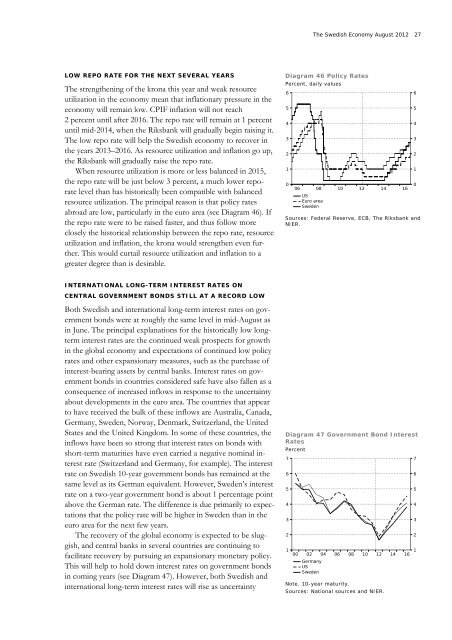

<strong>The</strong> <strong>Swedish</strong> <strong>Economy</strong> <strong>August</strong> <strong>2012</strong> 27LOW REPO RATE FOR THE NEXT SEVERAL YEARS<strong>The</strong> strengthening of the krona this year and weak resourceutilization in the economy mean that inflationary pressure in theeconomy will remain low. CPIF inflation will not reach2 percent until after 2016. <strong>The</strong> repo rate will remain at 1 percentuntil mid-2014, when the Riksbank will gradually begin raising it.<strong>The</strong> low repo rate will help the <strong>Swedish</strong> economy to recover inthe years 2013–2016. As resource utilization and inflation go up,the Riksbank will gradually raise the repo rate.When resource utilization is more or less balanced in 2015,the repo rate will be just below 3 percent, a much lower reporatelevel than has historically been compatible with balancedresource utilization. <strong>The</strong> principal reason is that policy ratesabroad are low, particularly in the euro area (see Diagram 46). Ifthe repo rate were to be raised faster, and thus follow moreclosely the historical relationship between the repo rate, resourceutilization and inflation, the krona would strengthen even further.This would curtail resource utilization and inflation to agreater degree than is desirable.Diagram 46 Policy RatesPercent, daily values65432100608USEuro areaSweden10Sources: Federal Reserve, ECB, <strong>The</strong> Riksbank andNIER.1214166543210INTERNATIONAL LONG-TERM INTEREST RATES ONCENTRAL GOVERNMENT BONDS STILL AT A RECORD LOWBoth <strong>Swedish</strong> and international long-term interest rates on governmentbonds were at roughly the same level in mid-<strong>August</strong> asin June. <strong>The</strong> principal explanations for the historically low longterminterest rates are the continued weak prospects for growthin the global economy and expectations of continued low policyrates and other expansionary measures, such as the purchase ofinterest-bearing assets by central banks. Interest rates on governmentbonds in countries considered safe have also fallen as aconsequence of increased inflows in response to the uncertaintyabout developments in the euro area. <strong>The</strong> countries that appearto have received the bulk of these inflows are Australia, Canada,Germany, Sweden, Norway, Denmark, Switzerland, the UnitedStates and the United Kingdom. In some of these countries, theinflows have been so strong that interest rates on bonds withshort-term maturities have even carried a negative nominal interestrate (Switzerland and Germany, for example). <strong>The</strong> interestrate on <strong>Swedish</strong> 10-year government bonds has remained at thesame level as its German equivalent. However, Sweden’s interestrate on a two-year government bond is about 1 percentage pointabove the German rate. <strong>The</strong> difference is due primarily to expectationsthat the policy rate will be higher in Sweden than in theeuro area for the next few years.<strong>The</strong> recovery of the global economy is expected to be sluggish,and central banks in several countries are continuing tofacilitate recovery by pursuing an expansionary monetary policy.This will help to hold down interest rates on government bondsin coming years (see Diagram 47). However, both <strong>Swedish</strong> andinternational long-term interest rates will rise as uncertaintyDiagram 47 Government Bond InterestRatesPercent76543210002GermanyUSSweden0406Note. 10-year maturity.081012Sources: National sources and NIER.14167654321