You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

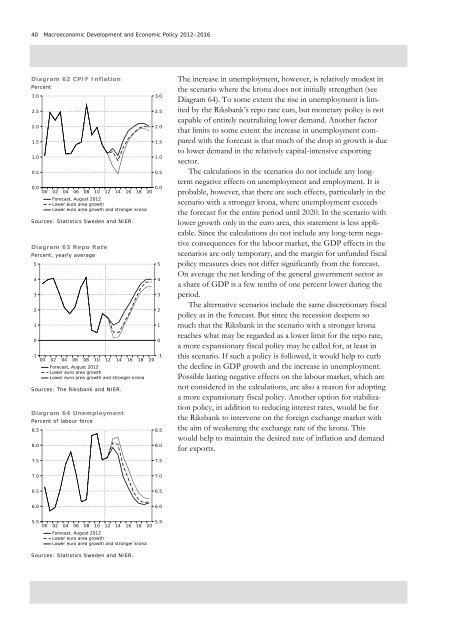

40 Macroeconomic Development and Economic Policy <strong>2012</strong>–2016Diagram 62 CPIF InflationPercent3.02.52.01.51.00.50.000020406081012141618Forecast, <strong>August</strong> <strong>2012</strong>Lower euro area growthLower euro area growth and stronger kronaSources: Statistics Sweden and NIER.Diagram 63 Repo RatePercent, yearly average543210-100020406081012141618Forecast, <strong>August</strong> <strong>2012</strong>Lower euro area growthLower euro area growth and stronger kronaSources: <strong>The</strong> Riksbank and NIER.Diagram 64 UnemploymentPercent of labour force8.58.03.02.52.01.51.00.50.020543210-1208.58.0<strong>The</strong> increase in unemployment, however, is relatively modest inthe scenario where the krona does not initially strengthen (seeDiagram 64). To some extent the rise in unemployment is limitedby the Riksbank’s repo rate cuts, but monetary policy is notcapable of entirely neutralizing lower demand. Another factorthat limits to some extent the increase in unemployment comparedwith the forecast is that much of the drop in growth is dueto lower demand in the relatively capital-intensive exportingsector.<strong>The</strong> calculations in the scenarios do not include any longtermnegative effects on unemployment and employment. It isprobable, however, that there are such effects, particularly in thescenario with a stronger krona, where unemployment exceedsthe forecast for the entire period until 2020. In the scenario withlower growth only in the euro area, this statement is less applicable.Since the calculations do not include any long-term negativeconsequences for the labour market, the GDP effects in thescenarios are only temporary, and the margin for unfunded fiscalpolicy measures does not differ significantly from the forecast.On average the net lending of the general government sector asa share of GDP is a few tenths of one percent lower during theperiod.<strong>The</strong> alternative scenarios include the same discretionary fiscalpolicy as in the forecast. But since the recession deepens somuch that the Riksbank in the scenario with a stronger kronareaches what may be regarded as a lower limit for the repo rate,a more expansionary fiscal policy may be called for, at least inthis scenario. If such a policy is followed, it would help to curbthe decline in GDP growth and the increase in unemployment.Possible lasting negative effects on the labour market, which arenot considered in the calculations, are also a reason for adoptinga more expansionary fiscal policy. Another option for stabilizationpolicy, in addition to reducing interest rates, would be forthe Riksbank to intervene on the foreign exchange market withthe aim of weakening the exchange rate of the krona. Thiswould help to maintain the desired rate of inflation and demandfor exports.7.57.57.07.06.56.56.06.05.500020406081012141618Forecast, <strong>August</strong> <strong>2012</strong>Lower euro area growthLower euro area growth and stronger krona5.520Sources: Statistics Sweden and NIER.