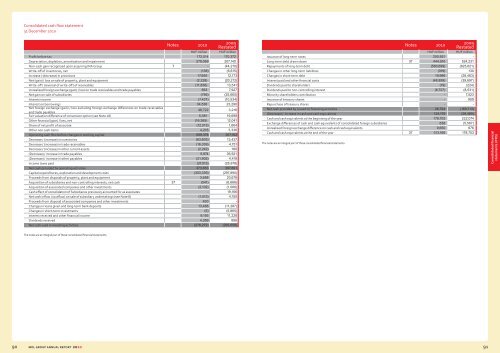

Consolidated cash flow statement31 December 2010Notes 20102009RestatedHUF million HUF millionProfit before tax 172,014 170,372Depreciation, depletion, amortisation and impairment 279,069 207,140Non-cash gain recognized upon acquiring INA Group 7 - (44,210)Write-off of inventories, net (138) (6,615)Increase / (decrease) in provisions 17,650 12,173Net (gain) / loss on sale of property, plant and equipment (2,228) (20,212)Write-off / (reversal of write-off) of receivables (11,836) 13,541Unrealised foreign exchange (gain) / loss on trade receivables and trade payables 563 7,927Net gain on sale of subsidiaries (756) (25,665)Interest income (7,437) (10,534)Interest on borrowings 34,536 23,290Net foreign exchange (gain) / loss excluding foreign exchange differences on trade receivablesand trade payables46,722 3,216Fair valuation difference of conversion option (see Note 28) 5,381 19,698Other financial (gain) / loss, net (16,365) 12,041Share of net profit of associate (12,013) 1,664Other non cash items 4,216 3,336Operating cash flow before changes in working capital 509,378 367,162Decrease / (increase) in inventories (63,603) 13,437Decrease / (increase) in trade receivables (16,339) 4,751Decrease / (increase) in other current assets (2,242) 180(Decrease) / increase in trade payables 5,874 36,921(Decrease) / increase in other payables (21,902) 4,418Income taxes paid (37,513) (28,978)Net cash provided by operating activities 373,653 397,891Capital expenditures, exploration and development costs (303,339) (297,890)Proceeds from disposals of property, plant and equipment 3,558 20,676Acquisition of subsidiaries and non-controlling interests, net cash 37 (541) (6,666)Acquisition of associated companies and other investments (2,102) (1,066)Cash effect of consolidation of Subsidiaries previously accounted for as associates - 19,166Net cash inflow / (outflow) on sale of subsidiary undertakings (see Note 8) (1,513) 4,150Proceeds from disposal of associated companies and other investments 630 -Changes in loans given and long-term bank deposits 13,488 (11,287)Changes in short-term investments (5) (5,865)Interest received and other financial income 9,193 11,228Dividends received 4,359 896Net cash used in investing activities (276,272) (266,658)Notes 20102009RestatedHUF million HUF millionIssuance of long-term notes 200,921 -Long-term debt drawn down 37 444,510 524,231Repayments of long-term debt (580,699) (625,621)Changes in other long-term liabilities (319) 130Changes in short-term debt 19,986 (28,483)Interest paid and other financial costs (48,859) (39,697)Dividends paid to shareholders (19) (224)Dividends paid to non-controlling interest (8,727) (8,531)Minority shareholders contribution - 7,523Issuance of treasury shares - 959Repurchase of treasury shares - -Net cash provided by / (used in) financing activities 26,794 (169,713)(Decrease) / increase in cash and cash equivalents 124,175 (38,480)Cash and cash equivalents at the beginning of the year 178,703 222,074Exchange differences of cash and cash equivalents of consolidated foreign subsidiaries 638 (5,567)Unrealised foreign exchange difference on cash and cash equivalents 9,650 676Cash and cash equivalents at the end of the year 37 313,166 178,703The notes are an integral part of these consolidated financial statements.Consolidated financialstatements (IFRS)The notes are an integral part of these consolidated financial statements.90 <strong>MOL</strong> Group annual report 2010 91

and the activities of the Group, there is no difference in the policies applied by the Group between IFRS and IFRS that havebeen adopted by the EU.Presentation of the financial statements complies with the requirements of the relevant standards. With respect to theconversion option embedded in the perpetual exchangeable capital securities issued in 2006, the revaluation differencearising on this option has been presented as a separate line item on the face of the income statement. The managementbelieves that by separating this non-cash item improves the transparency of the financial statements, since the gain or lossrecognized thereon is not affected by the operations of the Group or any relevant factors of the external business environmentinfluencing these operations. For further details on the conversion option see Note 17.ii) Basis of PreparationThese consolidated financial statements have been prepared in accordance with International Financial <strong>Report</strong>ing Standardsand IFRIC interpretations issued and effective on 31 December 2010. The Group has early adopted IFRS 3 BusinessCombinations (Revised) and IAS 27 Consolidated and Separate Financial Statements in 2009 in advance of their effectivedate (1 July 2009).Notes to the consolidated financial statementsprepared in accordance with InternationalFinancial <strong>Report</strong>ing Standards1 General<strong>MOL</strong> Hungarian Oil and Gas Public Limited Company (hereinafter referred to as <strong>MOL</strong> Plc., <strong>MOL</strong> or the parent company)was incorporated on 1 October 1991 on the transformation of its legal predecessor, the Országos Kőolaj- és GázipariTröszt (OKGT). In accordance with the law on the transformation of unincorporated state-owned enterprises, the assetsand liabilities of OKGT were revalued as at that date. <strong>MOL</strong> Plc. and its subsidiaries (hereinafter referred to as the Groupor <strong>MOL</strong> Group) are involved in the exploration and production of crude oil, natural gas and other gas products, refining,transportation and storage of crude oil and wholesale and retail marketing of crude oil products, production and sale ofolefins and polyolefins. The number of the employees in the Group as of 31 December 2010 and 2009 was 32,394 and 34,090,respectively. The registered office address of the Company is 1117 – Budapest, Október huszonharmadika u. 18., Hungary.The shares of the Company are listed on the Budapest and the Warsaw Stock Exchange. Depositary Receipts (DRs) are listedon the Luxembourg Stock Exchange and are quoted on the International Order Book in London and other over the countermarkets in New York, Berlin and Munich.2.1 Authorization, statement of compliance and basis of preparationi) Authorization and Statement of ComplianceThese consolidated financial statements have been approved and authorised for issue by the Board of Directors on 24 March 2011.These consolidated financial statements have been prepared in accordance with International Financial <strong>Report</strong>ing Standardsand all applicable IFRSs that have been adopted by the European Union (EU). IFRS comprise standards and interpretationsapproved by the International Accounting Standards Board (IASB) and the International Financial <strong>Report</strong>ing InterpretationsCommittee (IFRIC).Effective 1 January 2005, the change in the Hungarian Accounting Act allows the Group to prepare its consolidated financialstatements in accordance with IFRS that have been adopted by the EU. Currently, due to the endorsement process of the EU<strong>MOL</strong> Plc. prepares its statutory unconsolidated financial statements in accordance with the requirements of the accountingregulations contained in Law C of 2000 on Accounting (HAS). Some of the accounting principles prescribed in this law differfrom IFRS.For the purposes of the application of the Historical Cost Convention, the consolidated financial statements treat theCompany as having come into existence as of 1 October 1991, at the carrying values of assets and liabilities determined atthat date, subject to the IFRS adjustments.The financial year is the same as the calendar year.iii) Principles of ConsolidationSubsidiariesThe consolidated financial statements include the accounts of <strong>MOL</strong> Plc. and the subsidiaries that it controls. This control isnormally evidenced when the Group owns, either directly or indirectly, more than 50% of the voting rights of a company’sshare capital and is able to govern the financial and operating policies of an enterprise so as to benefit from its activities. Asrequired by IAS 27, immediately exercisable voting rights are taken into account when determining control.The acquisition method of accounting is used for acquired businesses by measuring assets and liabilities at their fair valuesupon acquisition, the date of which is determined with reference to the date of obtaining control. The cost of an acquisition ismeasured at the aggregate of the consideration transferred and the amount of any non-controlling interest (formerly knownas minority interest) in the acquiree. The income and expenses of companies acquired or disposed of during the year areincluded in the consolidated financial statements from the date of acquisition or up to the date of disposal.Intercompany balances and transactions, including intercompany profits and unrealised profits and losses – unless the lossesindicate impairment of the related assets – are eliminated. The consolidated financial statements are prepared using uniformaccounting policies for like transactions and other events in similar circumstances.Non-controlling interests represent the profit or loss and net assets not held by the Group and are shown separately inthe consolidated balance sheet and the consolidated income statement, respectively. For each business combination, noncontrollinginterest is stated either at fair value or at the non-controlling interests’ proportionate share of the acquiree’sfair values of net assets. The choice of measurement basis is made on an acquisition-by-acquisition basis. Subsequently thecarrying amount of non-controlling interests is the initially recognised amount of those interests adjusted with the noncontrollinginterests’ share of changes in equity after the acquisition. Total comprehensive income is attributed to noncontrollinginterests even if this results in the non-controlling interests having a negative balance.Changes in the Group’s interests in subsidiaries that do not result in a loss of control are accounted for as equity transactions. Thecarrying amounts of the Group’s interests and the non-controlling interests are adjusted to reflect the changes in their relativeinterests in the subsidiaries. Any difference between the amount by which the non-controlling interests are adjusted and the fairvalue of the consideration paid or received is recognized directly in equity and attributed to the owners of the company.Notes to the financialstatements92 <strong>MOL</strong> Group annual report 2010 93