MOL GROUP Annual Report

MOL GROUP Annual Report

MOL GROUP Annual Report

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

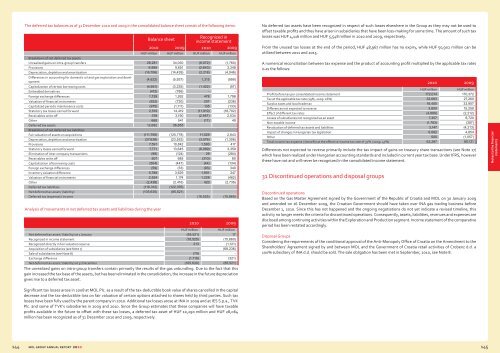

The deferred tax balances as of 31 December 2010 and 2009 in the consolidated balance sheet consist of the following items:Balance sheetRecognized inincome statement2010 2009 2010 2009HUF million HUF million HUF million HUF millionBreakdown of net deferred tax assetsUnrealized gains on intra-group transfers 28,281 34,030 (6,072) (1,760)Provisions 6,995 9,651 (2,643) 3,348Depreciation, depletion and amortization (16,706) (14,439) (2,218) (4,046)Differences in accounting for domestic oil and gas exploration and development(4,622) (5,937) 1,315 (999)Capitalization of certain borrowing costs (4,661) (3,235) (1,422) (57)Embedded derivatives (412) (786) - -Foreign exchange differences 1,739 1,262 478 1,798Valuation of financial instruments (522) (730) 207 (236)Capitalized periodic maintenance costs (975) (1,111) 135 (133)Statutory tax losses carried forward 2,519 14,419 (11,919) (18,702)Receivables write off 378 3,190 (2,957) 2,534Other 668 541 (17) 49Deferred tax assets 12,682 36,855Breakdown of net deferred tax liabilitiesFair valuation of assets on acquisitions (111,756) (125,778) 11,529 2,843Depreciation, depletion and amortization (27,638) (23,553) (3,576) (1,306)Provisions 7,591 10,842 1,593 417Statutory losses carried forward 7,771 13,645 (6,089) 3,359Elimination of inter-company transactions (98) (124) 29 (284)Receivables write off 507 685 (310) 60Capitalization of borrowing costs (504) (447) (44) (134)Foreign exchange differences (59) (33) (93) 340Inventory valuation difference 5,788 3,629 1,901 247Valuation of financial instruments 2,524 1,174 1,228 (462)Other (2,438) (2,416) 420 (2,736)Deferred tax liabilities (118,312) (122,376)Net deferred tax asset / (liability) (105,630) (85,521)Deferred tax (expense) / income (18,525) (15,860)Analysis of movements in net deferred tax assets and liabilities during the year2010 2009HUF millionHUF millionNet deferred tax asset / (liability) at 1 January (85,521) 17Recognized in income statement (18,525) (15,860)Recognized directly in fair valuation reserve 213 (1,121)Acquisition of subsidiaries (see Note 7) - (68,236)Sale of subsidiaries (see Note 8) (79) -Exchange difference (1,718) (321)Net deferred tax asset / (liability) at 31 December (105,630) (85,521)The unrealized gains on intra-group transfers contain primarily the results of the gas unbundling. Due to the fact that thisgain increased the tax base of the assets, but has been eliminated in the consolidation, the increase in the future depreciationgives rise to a deferred tax asset.No deferred tax assets have been recognized in respect of such losses elsewhere in the Group as they may not be used tooffset taxable profits and they have arisen in subsidiaries that have been loss-making for some time. The amount of such taxlosses was HUF 4,116 million and HUF 5,548 million in 2010 and 2009, respectively.From the unused tax losses at the end of the period, HUF 48,967 million has no expiry, while HUF 50,902 million can beutilized between 2011 and 2015.A numerical reconciliation between tax expense and the product of accounting profit multiplied by the applicable tax ratesis as the follows:2010 2009HUF millionHUF millionProfit before tax per consolidated income statement 172,014 170,372Tax at the applicable tax rate (19%, 2009: 16%) 32,683 27,260Surplus taxes and local trade tax 16,400 33,907Differences not expected to reverse 3,800 15,259Effect of different tax rates (4,889) (2,212)Losses of subsidiaries not recognized as an asset 7,357 6,720Non-taxable income (1,783) (387)Revaluation of deferred tax assets and liabilities 3,147 (4,213)Impact of changes in Hungarian tax legislation 6,082 4,854Other 500 (1,057)Total income tax expense / (benefit) at the effective income tax rate of 37% (2009: 47%) 63,297 80,131Differences not expected to reverse primarily include the tax impact of gains on treasury share transactions (see Note 17)which have been realized under Hungarian accounting standards and included in current year tax base. Under IFRS, howeverthese have not and will never be recognized in the consolidated income statement.31 Discontinued operations and disposal groupsDiscontinued operationsBased on the Gas Master Agreement signed by the Government of the Republic of Croatia and <strong>MOL</strong> on 30 January 2009and amended on 16 December 2009, the Croatian Government should have taken over INA gas trading business beforeDecember 1, 2010. Since this has not happened and the ongoing negotiations do not yet indicate a revised timeline, thisactivity no longer meets the criteria for discontinued operations. Consequently, assets, liabilities, revenues and expenses aredisclosed among continuing activities within the Exploration and Production segment. Income statement of the comparativeperiod has been restated accordingly.Disposal GroupsConsidering the requirements of the conditional approval of the Anti-Monopoly Office of Croatia on the Amendment to theShareholders’ Agreement signed by and between <strong>MOL</strong> and the Government of Croatia retail activities of Crobenz d.d. a100% subsidiary of INA d.d. should be sold. The sale obligation has been met in September, 2010, see Note 8.Notes to the financialstatementsSignificant tax losses arose in 2008 at <strong>MOL</strong> Plc. as a result of the tax-deductible book value of shares cancelled in the capitaldecrease and the tax-deductible loss on fair valuation of certain options attached to shares held by third parties. Such taxlosses have been fully used by the parent company in 2010. Additional tax losses arose at INA in 2009 and at IES S.p.a., TVKPlc. and some of TVK’s subsidiaries in 2009 and 2010. Since the Group estimates that these companies will have taxableprofits available in the future to offset with these tax losses, a deferred tax asset of HUF 10,290 million and HUF 28,064million has been recognized as of 31 December 2010 and 2009, respectively.144 <strong>MOL</strong> Group annual report 2010 145