MOL GROUP Annual Report

MOL GROUP Annual Report

MOL GROUP Annual Report

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

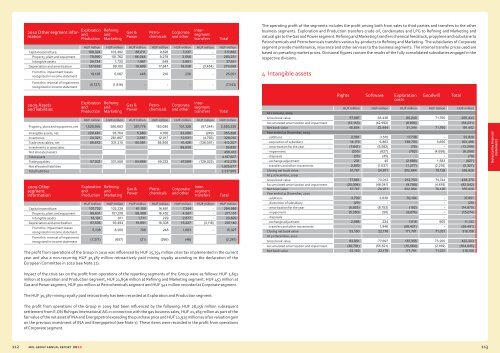

2010 Other segment informationExplorationandProductionRefiningandMarketingGas &PowerPetrochemicalsCorporateand otherIntersegmenttransfersHUF million HUF million HUF million HUF million HUF million HUF million HUF millionCapital expenditure: 109,324 103,482 88,011 9,828 7,237 - 317,882Property, plant and equipment 79,590 101,762 86,044 9,279 3,556 - 280,231Intangible assets 29,734 1,720 1,967 549 3,681 - 37,651Depreciation and amortization 127,639 99,100 19,899 17,847 18,038 (3,454) 279,069From this: impairment lossesrecognized in income statement19,128 5,067 448 210 238 - 25,091From this: reversal of impairmentrecognized in income statementTotal(5,727) (1,816) - - - - (7,543)The operating profit of the segments includes the profit arising both from sales to third parties and transfers to the otherbusiness segments. Exploration and Production transfers crude oil, condensates and LPG to Refining and Marketing andnatural gas to the Gas and Power segment. Refining and Marketing transfers chemical feedstock, propylene and isobutane toPetrochemicals and Petrochemicals transfers various by-products to Refining and Marketing. The subsidiaries of Corporatesegment provide maintenance, insurance and other services to the business segments. The internal transfer prices used arebased on prevailing market prices. Divisional figures contain the results of the fully consolidated subsidiaries engaged in therespective divisions.4 Intangible assets2009 Assetsand liabilitiesExplorationandProductionRefiningandMarketingGas &PowerPetrochemicalsCorporateand otherIntersegmenttransfersThe profit from operations of the Group in 2010 was influenced by HUF 25,754 million crisis tax implemented in the currentyear and also a non-recurring HUF 30,387 million retroactively paid mining royalty according to the declaration of theEuropean Committee in 2010 (see Note 27).TotalHUF million HUF million HUF million HUF million HUF million HUF million HUF millionProperty, plant and equipment, net 1,029,595 950,683 357,778 183,080 101,328 (67,244) 2,555,220Intangible assets, net 228,481 93,764 5,980 4,766 23,086 (249) 355,828Inventories 24,321 281,867 2,567 12,017 12,031 (4,793) 328,010Trade receivables, net 56,672 331,210 50,591 58,906 41,429 (126,501) 412,307Investments in associates 59,830 59,830Not allocated assets 456,412Total assets 4,167,607Trade payables 57,302 331,508 54,669 49,232 47,589 (128,022) 412,278Not allocated liabilities 1,925,677Total liabilities 2,337,9552009 OthersegmentinformationExplorationandProductionRefiningandMarketingGas &PowerPetrochemicalsCorporateand otherIntersegmenttransfersHUF million HUF million HUF million HUF million HUF million HUF million HUF millionCapital expenditure: 107,732 102,229 61,100 16,681 7,244 - 294,986Property, plant and equipment 89,631 101,318 59,389 16,452 4,367 - 271,157Intangible assets 18,101 911 1,711 229 2,877 - 23,829Depreciation and amortization 67,536 93,494 15,691 18,308 15,227 (3,116) 207,140From this: impairment lossesrecognized in income statement5,108 8,200 708 248 1,063 - 15,327From this: reversal of impairmentrecognized in income statement(1,271) (657) (21) (266) (46) (2,261)TotalAt 1 January, 2009Rights Software ExplorationcostsGoodwillTotalHUF million HUF million HUF million HUF million HUF millionGross book value 57,997 65,436 60,240 71,760 255,433Accumulated amortization and impairment (12,143) (42,992) (8,896) - (64,031)Net book value 45,854 22,444 51,344 71,760 191,402Year ended 31 December, 2009- additions 2,581 3,510 17,738 - 23,829- acquisition of subsidiary 14,175 6,863 138,703 3,655 163,396- amortization for the year (7,641) (5,582) (76) - (13,299)- impairment (203) (627) (782) (4,656) (6,268)- disposals (33) (45) - - (78)- exchange adjustment 231 45 (2,686) 1,583 (827)- transfers and other movements 2,803 (1,637) (1,277) (2,216) (2,327)Closing net book value 57,767 24,971 202,964 70,126 355,828At 31 December, 2009Gross book value 77,861 73,012 212,753 74,744 438,370Accumulated amortization and impairment (20,094) (48,041) (9,789) (4,618) (82,542)Net book value 57,767 24,971 202,964 70,126 355,828Year ended 31 December, 2010- additions 3,709 3,838 30,104 - 37,651- divestition of subsidiary (29) - - - (29)- amortization for the year (5,925) (8,753) (192) - (14,870)- impairment (5,350) (50) (9,674) - (15,074)- disposals - - - - -- exchange adjustment 2,988 224 7,016 905 11,133- transfers and other movements - 1,946 (58,427) - (56,481)Closing net book value 53,160 22,176 171,791 71,031 318,158At 31 December, 2010Gross book value 83,951 77,697 187,355 73,200 422,203Accumulated amortization and impairment (30,791) (55,521) (15,564) (2,169) (104,045)Net book value 53,160 22,176 171,791 71,031 318,158Notes to the financialstatementsImpact of the crisis tax on the profit from operations of the reporting segments of the Group were as follows: HUF 2,652million at Exporation and Production segment, HUF 21,896 million at Refining and Marketing segment, HUF 453 million atGas and Power segment, HUF 302 million at Petrochemicals segment and HUF 541 million recorded at Corporate segment.The HUF 30,387 mining royalty paid retroactively has been recorded at Exploration and Production segment.The profit from operations of the Group in 2009 had been influenced by the following: HUF 28,156 million subsequentsettlement from E.ON Ruhrgas International AG in connection with the gas business sales, HUF 21,285 million as part of thefair value of the net asset of INA and Energopetrol exceeding the purchase price and HUF 22,925 million as a fair valuation gainon the previous investment of INA and Energopetrol (see Note 7). These items were recorded in the profit from operationsof Corporate segment.112 <strong>MOL</strong> Group annual report 2010 113