T O W N R E P O R T 2007 L U N E N B U R G - Town of Lunenburg

T O W N R E P O R T 2007 L U N E N B U R G - Town of Lunenburg

T O W N R E P O R T 2007 L U N E N B U R G - Town of Lunenburg

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

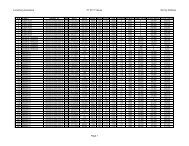

BOARD OF ASSESSORS ANNUAL REPORTFiscal <strong>2007</strong> Assessments and Revenues by Major Property ClassProperty Class Levy Percent Valuation by Class Tax Rate Tax LevyResidential 92.3029 1,1869,968,000 12.13 14,397,921.84Open Space 0.0000 -0- 12.13 -0-Commercial 4.8393 62,230,700 12.13 754,858.39Industrial 1.4794 19,024,000 12.13 230,761.12Personal Property 1.3784 17,725,200 12.13 215,006.68TOTALS 100.0000 1,285,947,900 12.13 15,598,548.03Valuation and Tax HistoryFiscal Year Tax Rate Total Valuation Accounts Tax Levy Change(%)<strong>2007</strong> 12.13 1,285,947,900 4863 15,598,548.03 1.06432006 12.41 1,270,455,200 4,805 15,766,349.03 7.05262005 13.34 1,104,022,400 4,708 14,727,658.82 4.10152004 14.20 996,295,300 4,653 14,147,393.26 16.60012003 13.12 924,787,500 4,632 12,133,212.00 5.15092002 15.60 739,669,900 4,545 11,538,850.44 7.15282001 15.95 675,146,400 4,477 10,768,585.08 6.28122000 16.62 609,637,000 4,380 10,132,166.94 6.4079Fiscal Year <strong>2007</strong> Abstract <strong>of</strong> AssessmentsProperty Class Code/Description Accts Class Valuation Avg.Value012 – 043 Mixed Use Properties 76 29,976,700 394,430101 Residential Single Family 3,389 1,030,861,500 304,179102 Residential Condominiums 168 46,372,100 276,024104 Residential Two Family 95 30,462,800 320,661105 Residential Three Family 7 2,370,800 3368,686Miscellaneous Residential 40 13,485,800 337,145111 – 125 Apartments 5 1,748,600 349,720130 – 132, 106 Vacant Land 454 36,004,500 79,305300 – 393 Commercial 136 57,285,600 421,218400 – 442 Industrial 23 19,024,000 827,130501 – 506 Personal Property 446 17,725,200 39,743600 – 821 Chapter 61, 61A, 61B 24 597,600 24,900TOTALS 4,863 1,285,947,900Assessor’s Account for Exemptions and AbatementsDescription FY2006 FY2005 FY2004 FY2003Assessor’s Overlay 97,890.55 134,938.19 88,089.03 92,035.55Overlay Deficits -0- -0- 784.52 -0-Charges to 6/30/2005 79,368.58 92,282.70 88,873.55 69,639.89Potential Liability -0- -0- -0- -0-Amount Released -0- 24,129.60 -0- -0-New Growth RevenueFiscal Year Added Valuation Tax Rate New Revenues Change(%)<strong>2007</strong> 23,809,803 12.41 295,074 -9.342006 24,399,133 13.34 325,484 -28.052005 31,855,300 14.20 452,345 32.362004 26,046,400 13.12 341,729 8.502003 20,190,107 15.60 314,966 -0.112002 19,769,200 15.95 315,319 -4.382001 19,842,600 16.62 329,783 14.862000 16,130,842 17.80 287,129 31.62Christopher M. Comeau, Chairman Carl E. Sund, Member Fred J. Liatsis, MemberBarbara Lefebvre, Admin. Assessor Harald Scheid, Regional Tax Assessor David Manzello, Associate Assessor