Unit 1 Resources: Foundations of American Citizenship - Deerlake ...

Unit 1 Resources: Foundations of American Citizenship - Deerlake ...

Unit 1 Resources: Foundations of American Citizenship - Deerlake ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

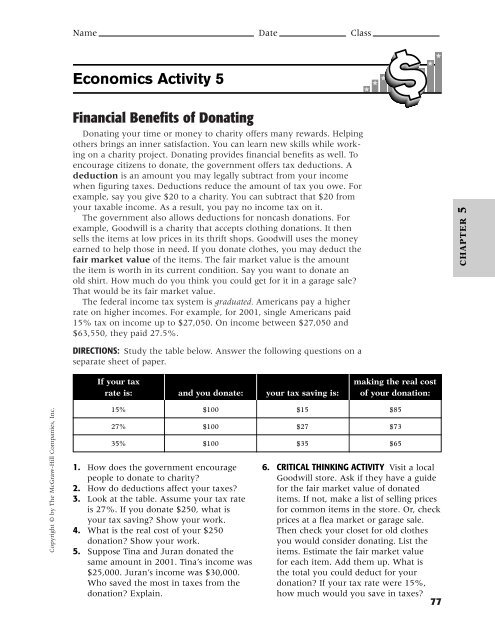

Name Date ClassEconomics Activity 5Financial Benefits <strong>of</strong> DonatingDonating your time or money to charity <strong>of</strong>fers many rewards. Helpingothers brings an inner satisfaction. You can learn new skills while workingon a charity project. Donating provides financial benefits as well. Toencourage citizens to donate, the government <strong>of</strong>fers tax deductions. Adeduction is an amount you may legally subtract from your incomewhen figuring taxes. Deductions reduce the amount <strong>of</strong> tax you owe. Forexample, say you give $20 to a charity. You can subtract that $20 fromyour taxable income. As a result, you pay no income tax on it.The government also allows deductions for noncash donations. Forexample, Goodwill is a charity that accepts clothing donations. It thensells the items at low prices in its thrift shops. Goodwill uses the moneyearned to help those in need. If you donate clothes, you may deduct thefair market value <strong>of</strong> the items. The fair market value is the amountthe item is worth in its current condition. Say you want to donate anold shirt. How much do you think you could get for it in a garage sale?That would be its fair market value.The federal income tax system is graduated. <strong>American</strong>s pay a higherrate on higher incomes. For example, for 2001, single <strong>American</strong>s paid15% tax on income up to $27,050. On income between $27,050 and$63,550, they paid 27.5%.CHAPTER 5DIRECTIONS: Study the table below. Answer the following questions on aseparate sheet <strong>of</strong> paper.If your taxmaking the real costrate is: and you donate: your tax saving is: <strong>of</strong> your donation:Copyright © by The McGraw-Hill Companies, Inc.15% $100 $15 $8527% $100 $27 $7335% $100 $35 $651. How does the government encouragepeople to donate to charity?2. How do deductions affect your taxes?3. Look at the table. Assume your tax rateis 27%. If you donate $250, what isyour tax saving? Show your work.4. What is the real cost <strong>of</strong> your $250donation? Show your work.5. Suppose Tina and Juran donated thesame amount in 2001. Tina’s income was$25,000. Juran’s income was $30,000.Who saved the most in taxes from thedonation? Explain.6. CRITICAL THINKING ACTIVITY Visit a localGoodwill store. Ask if they have a guidefor the fair market value <strong>of</strong> donateditems. If not, make a list <strong>of</strong> selling pricesfor common items in the store. Or, checkprices at a flea market or garage sale.Then check your closet for old clothesyou would consider donating. List theitems. Estimate the fair market valuefor each item. Add them up. What isthe total you could deduct for yourdonation? If your tax rate were 15%,how much would you save in taxes?77