98 <strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 2009Notes to the consolidated financial statements In millions of US dollars, except where indicated19 LONG-TERM DEBT<strong>Shire</strong> 2.75% Convertible Bonds due 2014On May 9, 2007 <strong>Shire</strong> issued $1,100 million in principal amount of 2.75% convertible bonds due 2014 and convertible into fully paid OrdinaryShares of <strong>Shire</strong> plc (the ‘Bonds’). The net proceeds of issuing the Bonds, after deducting the commissions and other direct costs of issue, totaled$1,081.7 million. In connection with the Scheme of Arrangement the Trust Deed was amended and restated in 2008 in order to provide that, followingthe substitution of <strong>Shire</strong> plc in place of Old <strong>Shire</strong> as the principal obligor and issuer of the Convertible Bonds, the Bonds would be convertible intoOrdinary Shares of <strong>Shire</strong> plc.The Bonds were issued at 100% of their principal amount, and unless previously purchased and canceled, redeemed or converted, will be redeemedon May 9, 2014 (the ‘Final Maturity Date’) at their principal amount.The Bonds bear interest at 2.75% per annum, payable semi-annually in arrears on November 9 and May 9. The Bonds constitute direct, unconditional,unsubordinated and unsecured obligations of the Company, and rank pari passu and ratably, without any preference amongst themselves, and equallywith all other existing and future unsecured and unsubordinated obligations of the Company.The Bonds may be redeemed at the option of the Company (the ‘Call Option’), at their principal amount together with accrued and unpaid interest if:(i) at any time after May 23, 2012 if on no less than 20 dealing days in any period of 30 consecutive dealing days the value of <strong>Shire</strong>’s Ordinary Sharesunderlying each Bond in the principal amount of $100,000 would exceed $130,000; or (ii) at any time conversion rights have been exercised, and/orpurchases and corresponding cancellations, and/or redemptions effected in respect of 85% or more in principal amount of Bonds originally issued.The Bonds may also be redeemed at the option of the Bond holder at their principal amount including accrued but unpaid interest on May 9, 2012(the ‘Put Option’), or following the occurrence of a change of control. The Bonds are repayable in US dollars, but also contain provisions entitlingthe Company to settle redemption amounts in Pounds sterling, or in the case of the Final Maturity Date and following exercise of the Put Option,by delivery of the underlying Ordinary Shares and a cash top-up amount.The Bonds are convertible into Ordinary Shares during the conversion period, being the period from June 18, 2007 until the earlier of: (i) the close of businesson the date falling 14 days prior to the Final Maturity Date; (ii) if the Bonds have been called for redemption by the Company, the close of business14 days before the date fixed for redemption; (iii) the close of business on the day prior to a Bond holder giving notice of redemption in accordance withthe conditions; and (iv) the giving of notice by the trustee that the Bonds are accelerated by reason of the occurrence of an event of default.Upon conversion, the Bond holder is entitled to receive Ordinary Shares at the conversion price of $33.17 per Ordinary Share, (subject to adjustmentas outlined below).The conversion price is subject to adjustment in respect of (i) any dividend or distribution by the Company, (ii) a change of control and (iii) customaryanti-dilution adjustments for, inter alia, share consolidations, share splits, spin-off events, rights issues, bonus issues and reorganizations. The initialconversion price of $33.5879 was adjusted to $33.17 with effect from March 11, 2009 as a result of cumulative dividend payments during the periodfrom October 2007 to April 2009 inclusive. The shares issued on conversion will be delivered credited as fully paid, and will rank pari passu in allrespects with all fully paid shares in issue on the relevant conversion date.The Bonds have been recorded at their principal amount within Non-current liabilities. Direct costs of issue of the Bonds paid in the year to December31, 2007 totaled $18.3 million. These costs are being amortized to interest expense using the effective interest method over the five year period to thePut Option date. At December 31, 2009 $8.8 million was deferred ($3.8 million within other current assets and $5.0 million within other non-current assets).Revolving Credit Facilities Agreement<strong>Shire</strong> has a committed revolving credit facility (the ‘RCF’) in an aggregate amount of $1,200 million with ABN Amro Bank N.V.; Barclays Capital;Citigroup Global Markets Limited; The Royal Bank of Scotland plc; Lloyds TSB Bank plc; Bank of America N.A.; and Morgan Stanley Bank. The RCF,which includes a $250 million swingline facility, may be used for general corporate purposes and matures on February 20, 2012. There were noborrowings under the RCF as of December 31, 2009.The interest rate on each loan drawn under the RCF for each interest period, is the percentage rate per annum which is the aggregate of the applicablemargin (ranging from 0.40 to 0.80% per annum) and LIBOR for the applicable currency and interest period. <strong>Shire</strong> also pays a commitment fee onundrawn amounts at 35% per annum of the applicable margin.Under the RCF it is required that (i) <strong>Shire</strong>’s ratio of Net Debt to EBITDA (as defined within the Multicurrency Term and Revolving Facilities Agreement(‘the RCF Agreement’)) does not exceed 3.5 to 1 for either the 12 month period ending December 31 or June 30 unless <strong>Shire</strong> has exercised its option(which is subject to certain conditions) to increase it to 4.0 to 1 for two consecutive testing dates; (ii) the ratio of EBITDA to Net Interest (as definedin the RCF Agreement) must not be less than 4.0 to 1, for either the 12 month period ending December 31 or June 30 and (iii) additional limitationson the creation of liens, disposal of assets, incurrence of indebtedness, making of loans, giving of guarantees and granting security over assets.

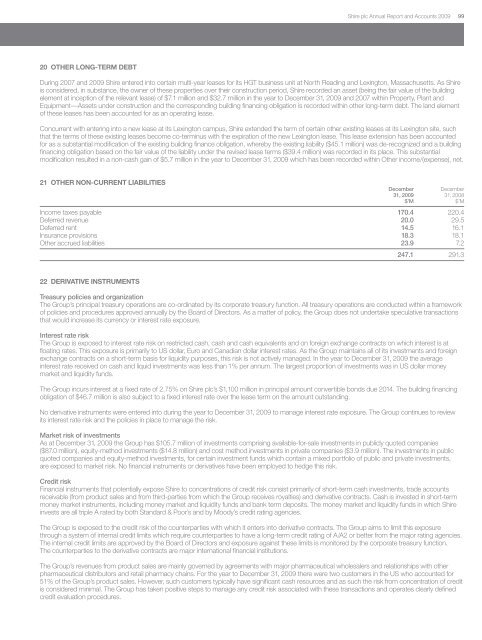

<strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 20099920 OTHER LONG-TERM DEBTDuring 2007 and 2009 <strong>Shire</strong> entered into certain multi-year leases for its HGT business unit at North Reading and Lexington, Massachusetts. As <strong>Shire</strong>is considered, in substance, the owner of these properties over their construction period, <strong>Shire</strong> recorded an asset (being the fair value of the buildingelement at inception of the relevant lease) of $7.1 million and $32.7 million in the year to December 31, 2009 and 2007 within Property, Plant andEquipment—Assets under construction and the corresponding building financing obligation is recorded within other long-term debt. The land elementof these leases has been accounted for as an operating lease.Concurrent with entering into a new lease at its Lexington campus, <strong>Shire</strong> extended the term of certain other existing leases at its Lexington site, suchthat the terms of these existing leases become co-terminus with the expiration of the new Lexington lease. This lease extension has been accountedfor as a substantial modification of the existing building finance obligation, whereby the existing liability ($45.1 million) was de-recognized and a buildingfinancing obligation based on the fair value of the liability under the revised lease terms ($39.4 million) was recorded in its place. This substantialmodification resulted in a non-cash gain of $5.7 million in the year to December 31, 2009 which has been recorded within Other income/(expense), net.21 OTHER NON-CURRENT LIABILITIESDecember December31, 2009 31, 2008$’M$’MIncome taxes payable 170.4 220.4Deferred revenue 20.0 29.5Deferred rent 14.5 16.1Insurance provisions 18.3 18.1Other accrued liabilities 23.9 7.2247.1 291.322 DERIVATIVE INSTRUMENTSTreasury policies and organizationThe Group’s principal treasury operations are co-ordinated by its corporate treasury function. All treasury operations are conducted within a frameworkof policies and procedures approved annually by the Board of Directors. As a matter of policy, the Group does not undertake speculative transactionsthat would increase its currency or interest rate exposure.Interest rate riskThe Group is exposed to interest rate risk on restricted cash, cash and cash equivalents and on foreign exchange contracts on which interest is atfloating rates. This exposure is primarily to US dollar, Euro and Canadian dollar interest rates. As the Group maintains all of its investments and foreignexchange contracts on a short-term basis for liquidity purposes, this risk is not actively managed. In the year to December 31, 2009 the averageinterest rate received on cash and liquid investments was less than 1% per annum. The largest proportion of investments was in US dollar moneymarket and liquidity funds.The Group incurs interest at a fixed rate of 2.75% on <strong>Shire</strong> plc’s $1,100 million in principal amount convertible bonds due 2014. The building financingobligation of $46.7 million is also subject to a fixed interest rate over the lease term on the amount outstanding.No derivative instruments were entered into during the year to December 31, 2009 to manage interest rate exposure. The Group continues to reviewits interest rate risk and the policies in place to manage the risk.Market risk of investmentsAs at December 31, 2009 the Group has $105.7 million of investments comprising available-for-sale investments in publicly quoted companies($87.0 million), equity-method investments ($14.8 million) and cost method investments in private companies ($3.9 million). The investments in publicquoted companies and equity-method investments, for certain investment funds which contain a mixed portfolio of public and private investments,are exposed to market risk. No financial instruments or derivatives have been employed to hedge this risk.Credit riskFinancial instruments that potentially expose <strong>Shire</strong> to concentrations of credit risk consist primarily of short-term cash investments, trade accountsreceivable (from product sales and from third-parties from which the Group receives royalties) and derivative contracts. Cash is invested in short-termmoney market instruments, including money market and liquidity funds and bank term deposits. The money market and liquidity funds in which <strong>Shire</strong>invests are all triple A rated by both Standard & Poor’s and by Moody’s credit rating agencies.The Group is exposed to the credit risk of the counterparties with which it enters into derivative contracts. The Group aims to limit this exposurethrough a system of internal credit limits which require counterparties to have a long-term credit rating of A/A2 or better from the major rating agencies.The internal credit limits are approved by the Board of Directors and exposure against these limits is monitored by the corporate treasury function.The counterparties to the derivative contracts are major international financial institutions.The Group’s revenues from product sales are mainly governed by agreements with major pharmaceutical wholesalers and relationships with otherpharmaceutical distributors and retail pharmacy chains. For the year to December 31, 2009 there were two customers in the US who accounted for51% of the Group’s product sales. However, such customers typically have significant cash resources and as such the risk from concentration of creditis considered minimal. The Group has taken positive steps to manage any credit risk associated with these transactions and operates clearly definedcredit evaluation procedures.