7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

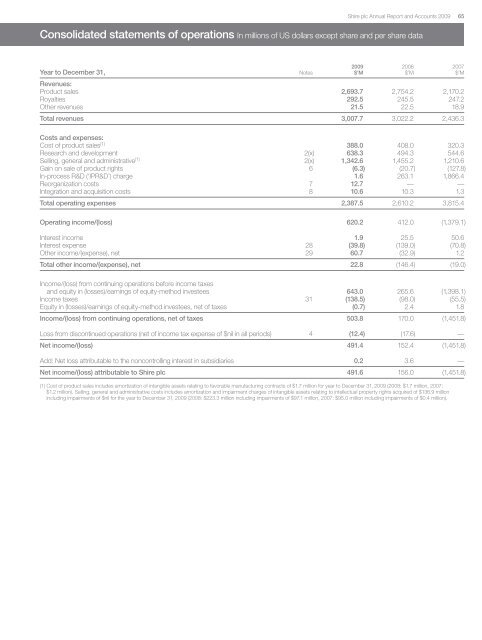

<strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 200965Consolidated statements of operations In millions of US dollars except share and per share data2009 2008 2007Year to December 31, Notes $’M $’M $’MRevenues:Product sales 2,693.7 2,754.2 2,170.2Royalties 292.5 245.5 247.2Other revenues 21.5 22.5 18.9Total revenues 3,007.7 3,022.2 2,436.3Costs and expenses:Cost of product sales (1) 388.0 408.0 320.3Research and development 2(x) 638.3 494.3 544.6Selling, general and administrative (1) 2(x) 1,342.6 1,455.2 1,210.6Gain on sale of product rights 6 (6.3) (20.7) (127.8)In-process R&D (‘IPR&D’) charge 1.6 263.1 1,866.4Reorganization costs 7 12.7 — —Integration and acquisition costs 8 10.6 10.3 1.3Total operating expenses 2,387.5 2,610.2 3,815.4Operating income/(loss) 620.2 412.0 (1,379.1)Interest income 1.9 25.5 50.6Interest expense 28 (39.8) (139.0) (70.8)Other income/(expense), net 29 60.7 (32.9) 1.2Total other income/(expense), net 22.8 (146.4) (19.0)Income/(loss) from continuing operations before income taxesand equity in (losses)/earnings of equity-method investees 643.0 265.6 (1,398.1)Income taxes 31 (138.5) (98.0) (55.5)Equity in (losses)/earnings of equity-method investees, net of taxes (0.7) 2.4 1.8Income/(loss) from continuing operations, net of taxes 503.8 170.0 (1,451.8)Loss from discontinued operations (net of income tax expense of $nil in all periods) 4 (12.4) (17.6) —Net income/(loss) 491.4 152.4 (1,451.8)Add: Net loss attributable to the noncontrolling interest in subsidiaries 0.2 3.6 —Net income/(loss) attributable to <strong>Shire</strong> plc 491.6 156.0 (1,451.8)(1) Cost of product sales includes amortization of intangible assets relating to favorable manufacturing contracts of $1.7 million for year to December 31, 2009 (2008: $1.7 million, 2007:$1.2 million). Selling, general and administrative costs includes amortization and impairment charges of intangible assets relating to intellectual property rights acquired of $136.9 millionincluding impairments of $nil for the year to December 31, 2009 (2008: $223.3 million including impairments of $97.1 million, 2007: $95.0 million including impairments of $0.4 million).