7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

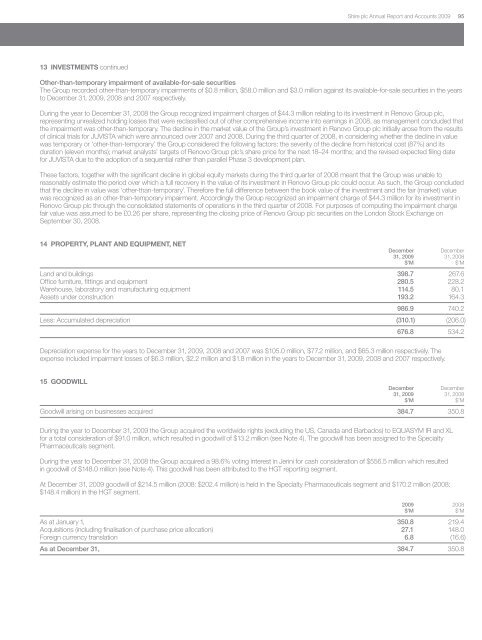

<strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 20099513 INVESTMENTS continuedOther-than-temporary impairment of available-for-sale securitiesThe Group recorded other-than-temporary impairments of $0.8 million, $58.0 million and $3.0 million against its available-for-sale securities in the yearsto December 31, 2009, 2008 and 2007 respectively.During the year to December 31, 2008 the Group recognized impairment charges of $44.3 million relating to its investment in Renovo Group plc,representing unrealized holding losses that were reclassified out of other comprehensive income into earnings in 2008, as management concluded thatthe impairment was other-than-temporary. The decline in the market value of the Group’s investment in Renovo Group plc initially arose from the resultsof clinical trials for JUVISTA which were announced over 2007 and 2008. During the third quarter of 2008, in considering whether the decline in valuewas temporary or ‘other-than-temporary’ the Group considered the following factors: the severity of the decline from historical cost (87%) and itsduration (eleven months); market analysts’ targets of Renovo Group plc’s share price for the next 18–24 months; and the revised expected filing datefor JUVISTA due to the adoption of a sequential rather than parallel Phase 3 development plan.These factors, together with the significant decline in global equity markets during the third quarter of 2008 meant that the Group was unable toreasonably estimate the period over which a full recovery in the value of its investment in Renovo Group plc could occur. As such, the Group concludedthat the decline in value was ‘other-than-temporary’. Therefore the full difference between the book value of the investment and the fair (market) valuewas recognized as an other-than-temporary impairment. Accordingly the Group recognized an impairment charge of $44.3 million for its investment inRenovo Group plc through the consolidated statements of operations in the third quarter of 2008. For purposes of computing the impairment chargefair value was assumed to be £0.26 per share, representing the closing price of Renovo Group plc securities on the London Stock Exchange onSeptember 30, 2008.14 PROPERTY, PLANT AND EQUIPMENT, NETDecember December31, 2009 31, 2008$’M$’MLand and buildings 398.7 267.6Office furniture, fittings and equipment 280.5 228.2Warehouse, laboratory and manufacturing equipment 114.5 80.1Assets under construction 193.2 164.3986.9 740.2Less: Accumulated depreciation (310.1) (206.0)676.8 534.2Depreciation expense for the years to December 31, 2009, 2008 and 2007 was $105.0 million, $77.2 million, and $65.3 million respectively. Theexpense included impairment losses of $6.3 million, $2.2 million and $1.8 million in the years to December 31, 2009, 2008 and 2007 respectively.15 GOODWILLDecember December31, 2009 31, 2008$’M$’MGoodwill arising on businesses acquired 384.7 350.8During the year to December 31, 2009 the Group acquired the worldwide rights (excluding the US, Canada and Barbados) to EQUASYM IR and XLfor a total consideration of $91.0 million, which resulted in goodwill of $13.2 million (see Note 4). The goodwill has been assigned to the SpecialtyPharmaceuticals segment.During the year to December 31, 2008 the Group acquired a 98.6% voting interest in Jerini for cash consideration of $556.5 million which resultedin goodwill of $148.0 million (see Note 4). This goodwill has been attributed to the HGT reporting segment.At December 31, 2009 goodwill of $214.5 million (2008: $202.4 million) is held in the Specialty Pharmaceuticals segment and $170.2 million (2008:$148.4 million) in the HGT segment.2009 2008$’M$’MAs at January 1, 350.8 219.4Acquisitions (including finalisation of purchase price allocation) 27.1 148.0Foreign currency translation 6.8 (16.6)As at December 31, 384.7 350.8