7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

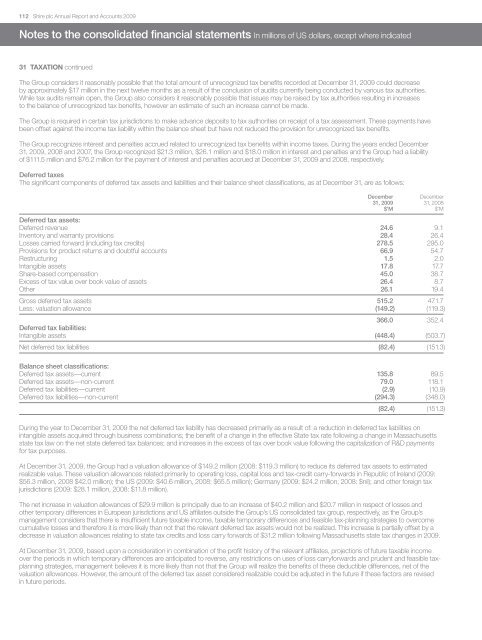

112 <strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 2009Notes to the consolidated financial statements In millions of US dollars, except where indicated31 TAXATION continuedThe Group considers it reasonably possible that the total amount of unrecognized tax benefits recorded at December 31, 2009 could decreaseby approximately $17 million in the next twelve months as a result of the conclusion of audits currently being conducted by various tax authorities.While tax audits remain open, the Group also considers it reasonably possible that issues may be raised by tax authorities resulting in increasesto the balance of unrecognized tax benefits, however an estimate of such an increase cannot be made.The Group is required in certain tax jurisdictions to make advance deposits to tax authorities on receipt of a tax assessment. These payments havebeen offset against the income tax liability within the balance sheet but have not reduced the provision for unrecognized tax benefits.The Group recognizes interest and penalties accrued related to unrecognized tax benefits within income taxes. During the years ended December31, 2009, 2008 and 2007, the Group recognized $21.3 million, $26.1 million and $18.0 million in interest and penalties and the Group had a liabilityof $111.5 million and $76.2 million for the payment of interest and penalties accrued at December 31, 2009 and 2008, respectively.Deferred taxesThe significant components of deferred tax assets and liabilities and their balance sheet classifications, as at December 31, are as follows:December December31, 2009 31, 2008$’M$’MDeferred tax assets:Deferred revenue 24.6 9.1Inventory and warranty provisions 28.4 26.4Losses carried forward (including tax credits) 278.5 295.0Provisions for product returns and doubtful accounts 66.9 54.7Restructuring 1.5 2.0Intangible assets 17.8 17.7Share-based compensation 45.0 38.7Excess of tax value over book value of assets 26.4 8.7Other 26.1 19.4Gross deferred tax assets 515.2 471.7Less: valuation allowance (149.2) (119.3)366.0 352.4Deferred tax liabilities:Intangible assets (448.4) (503.7)Net deferred tax liabilities (82.4) (151.3)Balance sheet classifications:Deferred tax assets—current 135.8 89.5Deferred tax assets—non-current 79.0 118.1Deferred tax liabilities—current (2.9) (10.9)Deferred tax liabilities—non-current (294.3) (348.0)(82.4) (151.3)During the year to December 31, 2009 the net deferred tax liability has decreased primarily as a result of: a reduction in deferred tax liabilities onintangible assets acquired through business combinations; the benefit of a change in the effective State tax rate following a change in Massachusettsstate tax law on the net state deferred tax balances; and increases in the excess of tax over book value following the capitalization of R&D paymentsfor tax purposes.At December 31, 2009, the Group had a valuation allowance of $149.2 million (2008: $119.3 million) to reduce its deferred tax assets to estimatedrealizable value. These valuation allowances related primarily to operating loss, capital loss and tax-credit carry-forwards in Republic of Ireland (2009:$56.3 million, 2008 $42.0 million); the US (2009: $40.6 million, 2008: $65.5 million); Germany (2009: $24.2 million, 2008: $nil); and other foreign taxjurisdictions (2009: $28.1 million, 2008: $11.8 million).The net increase in valuation allowances of $29.9 million is principally due to an increase of $40.2 million and $20.7 million in respect of losses andother temporary differences in European jurisdictions and US affiliates outside the Group’s US consolidated tax group, respectively, as the Group’smanagement considers that there is insufficient future taxable income, taxable temporary differences and feasible tax-planning strategies to overcomecumulative losses and therefore it is more likely than not that the relevant deferred tax assets would not be realized. This increase is partially offset by adecrease in valuation allowances relating to state tax credits and loss carry forwards of $31.2 million following Massachusetts state tax changes in 2009.At December 31, 2009, based upon a consideration in combination of the profit history of the relevant affiliates, projections of future taxable incomeover the periods in which temporary differences are anticipated to reverse, any restrictions on uses of loss carryforwards and prudent and feasible taxplanningstrategies, management believes it is more likely than not that the Group will realize the benefits of these deductible differences, net of thevaluation allowances. However, the amount of the deferred tax asset considered realizable could be adjusted in the future if these factors are revisedin future periods.