7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

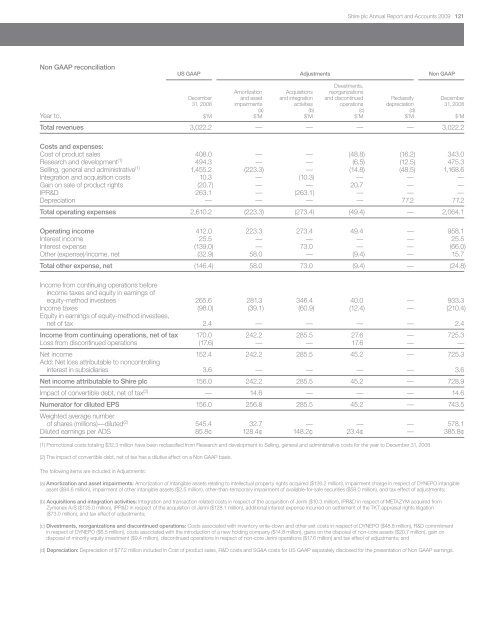

<strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 2009 121Non GAAP reconciliationUS GAAP Adjustments Non GAAPDivestments,Amortization Acquisitions reorganizationsDecember and asset and integration and discontinued Reclassify December31, 2008 impairments activities operations depreciation 31, 2008Year to,(a) (b) (c) (d)$’M $’M $’M $’M $’M $’MTotal revenues 3,022.2 — — — — 3,022.2Costs and expenses:Cost of product sales 408.0 — — (48.8) (16.2) 343.0Research and development (1) 494.3 — — (6.5) (12.5) 475.3Selling, general and administrative (1) 1,455.2 (223.3) — (14.8) (48.5) 1,168.6Integration and acquisition costs 10.3 — (10.3) — — —Gain on sale of product rights (20.7) — — 20.7 — —IPR&D 263.1 — (263.1) — — —Depreciation — — — — 77.2 77.2Total operating expenses 2,610.2 (223.3) (273.4) (49.4) — 2,064.1Operating income 412.0 223.3 273.4 49.4 — 958.1Interest income 25.5 — — — — 25.5Interest expense (139.0) — 73.0 — — (66.0)Other (expense)/income, net (32.9) 58.0 — (9.4) — 15.7Total other expense, net (146.4) 58.0 73.0 (9.4) — (24.8)Income from continuing operations beforeincome taxes and equity in earnings ofequity-method investees 265.6 281.3 346.4 40.0 — 933.3Income taxes (98.0) (39.1) (60.9) (12.4) — (210.4)Equity in earnings of equity-method investees,net of tax 2.4 — — — — 2.4Income from continuing operations, net of tax 170.0 242.2 285.5 27.6 — 725.3Loss from discontinued operations (17.6) — — 17.6 — —Net income 152.4 242.2 285.5 45.2 — 725.3Add: Net loss attributable to noncontrollinginterest in subsidiaries 3.6 — — — — 3.6Net income attributable to <strong>Shire</strong> plc 156.0 242.2 285.5 45.2 — 728.9Impact of convertible debt, net of tax (2) — 14.6 — — — 14.6Numerator for diluted EPS 156.0 256.8 285.5 45.2 — 743.5Weighted average numberof shares (millions)—diluted (2) 545.4 32.7 — — — 578.1Diluted earnings per ADS 85.8¢ 128.4¢ 148.2¢ 23.4¢ — 385.8¢(1) Promotional costs totaling $32.3 million have been reclassified from Research and development to Selling, general and administrative costs for the year to December 31, 2008.(2) The impact of convertible debt, net of tax has a dilutive effect on a Non GAAP basis.The following items are included in Adjustments:(a) Amortization and asset impairments: Amortization of intangible assets relating to intellectual property rights acquired ($126.2 million), impairment charge in respect of DYNEPO intangibleasset ($94.6 million), impairment of other intangible assets ($2.5 million), other-than-temporary impairment of available-for-sale securities ($58.0 million), and tax effect of adjustments;(b) Acquisitions and integration activities: Integration and transaction related costs in respect of the acquisition of Jerini ($10.3 million), IPR&D in respect of METAZYM acquired fromZymenex A/S ($135.0 million), IPR&D in respect of the acquisition of Jerini ($128.1 million), additional interest expense incurred on settlement of the TKT appraisal rights litigation($73.0 million), and tax effect of adjustments;(c) Divestments, reorganizations and discontinued operations: Costs associated with inventory write-down and other exit costs in respect of DYNEPO ($48.8 million), R&D commitmentin respect of DYNEPO ($6.5 million), costs associated with the introduction of a new holding company ($14.8 million), gains on the disposal of non-core assets ($20.7 million), gain ondisposal of minority equity investment ($9.4 million), discontinued operations in respect of non-core Jerini operations ($17.6 million) and tax effect of adjustments; and(d) Depreciation: Depreciation of $77.2 million included in Cost of product sales, R&D costs and SG&A costs for US GAAP separately disclosed for the presentation of Non GAAP earnings.