7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

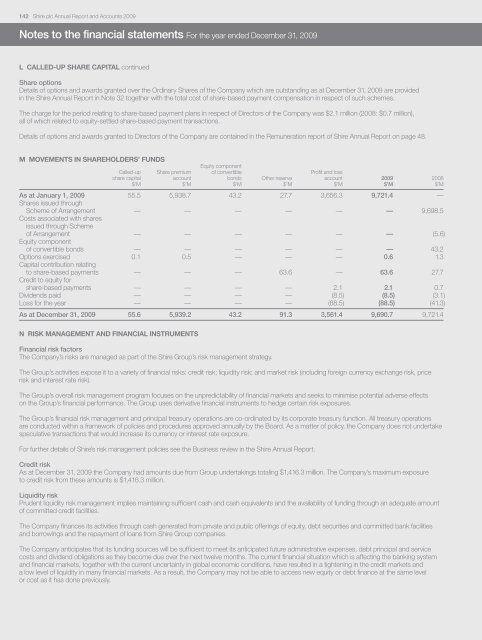

142 <strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 2009Notes to the financial statements For the year ended December 31, 2009L CALLED-UP SHARE CAPITAL continuedShare optionsDetails of options and awards granted over the Ordinary Shares of the Company which are outstanding as at December 31, 2009 are providedin the <strong>Shire</strong> <strong>Annual</strong> <strong>Report</strong> in Note 32 together with the total cost of share-based payment compensation in respect of such schemes.The charge for the period relating to share-based payment plans in respect of Directors of the Company was $2.1 million (2008: $0.7 million),all of which related to equity-settled share-based payment transactions.Details of options and awards granted to Directors of the Company are contained in the Remuneration report of <strong>Shire</strong> <strong>Annual</strong> <strong>Report</strong> on page 48.M MOVEMENTS IN SHAREHOLDERS’ FUNDSEquity componentCalled-up Share premium of convertible Profit and lossshare capital account bonds Other reserve account 2009 2008$’M $’M $’M $’M $’M $’M $’MAs at January 1, 2009 55.5 5,938.7 43.2 27.7 3,656.3 9,721.4 —Shares issued throughScheme of Arrangement — — — — — — 9,698.5Costs associated with sharesissued through Schemeof Arrangement — — — — — — (5.6)Equity componentof convertible bonds — — — — — — 43.2Options exercised 0.1 0.5 — — — 0.6 1.3Capital contribution relatingto share-based payments — — — 63.6 — 63.6 27.7Credit to equity forshare-based payments — — — — 2.1 2.1 0.7Dividends paid — — — — (8.5) (8.5) (3.1)Loss for the year — — — — (88.5) (88.5) (41.3)As at December 31, 2009 55.6 5,939.2 43.2 91.3 3,561.4 9,690.7 9,721.4N RISK MANAGEMENT AND FINANCIAL INSTRUMENTSFinancial risk factorsThe Company’s risks are managed as part of the <strong>Shire</strong> Group’s risk management strategy.The Group’s activities expose it to a variety of financial risks: credit risk; liquidity risk; and market risk (including foreign currency exchange risk, pricerisk and interest rate risk).The Group’s overall risk management program focuses on the unpredictability of financial markets and seeks to minimise potential adverse effectson the Group’s financial performance. The Group uses derivative financial instruments to hedge certain risk exposures.The Group’s financial risk management and principal treasury operations are co-ordinated by its corporate treasury function. All treasury operationsare conducted within a framework of policies and procedures approved annually by the Board. As a matter of policy, the Company does not undertakespeculative transactions that would increase its currency or interest rate exposure.For further details of <strong>Shire</strong>’s risk management policies see the Business review in the <strong>Shire</strong> <strong>Annual</strong> <strong>Report</strong>.Credit riskAs at December 31, 2009 the Company had amounts due from Group undertakings totaling $1,416.3 million. The Company’s maximum exposureto credit risk from these amounts is $1,416.3 million.Liquidity riskPrudent liquidity risk management implies maintaining sufficient cash and cash equivalents and the availability of funding through an adequate amountof committed credit facilities.The Company finances its activities through cash generated from private and public offerings of equity, debt securities and committed bank facilitiesand borrowings and the repayment of loans from <strong>Shire</strong> Group companies.The Company anticipates that its funding sources will be sufficient to meet its anticipated future administrative expenses, debt principal and servicecosts and dividend obligations as they become due over the next twelve months. The current financial situation which is affecting the banking systemand financial markets, together with the current uncertainty in global economic conditions, have resulted in a tightening in the credit markets anda low level of liquidity in many financial markets. As a result, the Company may not be able to access new equity or debt finance at the same levelor cost as it has done previously.