7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

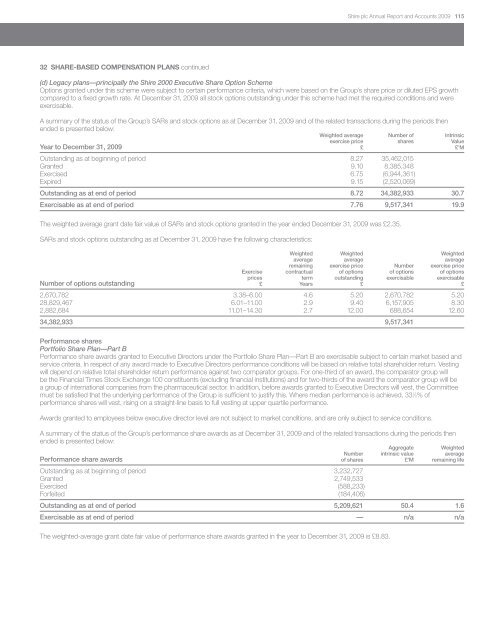

<strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 2009 11532 SHARE-BASED COMPENSATION PLANS continued(d) Legacy plans—principally the <strong>Shire</strong> 2000 Executive Share Option SchemeOptions granted under this scheme were subject to certain performance criteria, which were based on the Group’s share price or diluted EPS growthcompared to a fixed growth rate. At December 31, 2009 all stock options outstanding under this scheme had met the required conditions and wereexercisable.A summary of the status of the Group’s SARs and stock options as at December 31, 2009 and of the related transactions during the periods thenended is presented below:Weighted average Number of IntrinsicYear to December 31, 2009exercise price shares Value£ £’MOutstanding as at beginning of period 8.27 35,462,015Granted 9.10 8,385,348Exercised 6.75 (6,944,361)Expired 9.15 (2,520,069)Outstanding as at end of period 8.72 34,382,933 30.7Exercisable as at end of period 7.76 9,517,341 19.9The weighted average grant date fair value of SARs and stock options granted in the year ended December 31, 2009 was £2.35.SARs and stock options outstanding as at December 31, 2009 have the following characteristics:Weighted Weighted Weightedaverage average averageremaining exercise price Number exercise priceExercise contractual of options of options of optionsNumber of options outstandingprices term outstanding exercisable exercisable£ Years £ £2,670,782 3.38–6.00 4.6 5.20 2,670,782 5.2028,829,467 6.01–11.00 2.9 9.40 6,157,905 8.302,882,684 11.01–14.30 2.7 12.00 688,654 12.6034,382,933 9,517,341Performance sharesPortfolio Share Plan—Part BPerformance share awards granted to Executive Directors under the Portfolio Share Plan—Part B are exercisable subject to certain market based andservice criteria. In respect of any award made to Executive Directors performance conditions will be based on relative total shareholder return. Vestingwill depend on relative total shareholder return performance against two comparator groups. For one-third of an award, the comparator group willbe the Financial Times Stock Exchange 100 constituents (excluding financial institutions) and for two-thirds of the award the comparator group will bea group of international companies from the pharmaceutical sector. In addition, before awards granted to Executive Directors will vest, the Committeemust be satisfied that the underlying performance of the Group is sufficient to justify this. Where median performance is achieved, 33 1 ⁄3% ofperformance shares will vest, rising on a straight-line basis to full vesting at upper quartile performance.Awards granted to employees below executive director level are not subject to market conditions, and are only subject to service conditions.A summary of the status of the Group’s performance share awards as at December 31, 2009 and of the related transactions during the periods thenended is presented below:AggregateWeightedPerformance share awardsNumber intrinsic value averageof shares £’M remaining lifeOutstanding as at beginning of period 3,232,727Granted 2,749,533Exercised (588,233)Forfeited (184,406)Outstanding as at end of period 5,209,621 50.4 1.6Exercisable as at end of period — n/a n/aThe weighted-average grant date fair value of performance share awards granted in the year to December 31, 2009 is £8.83.