7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

7817 Annual Report 2009.qxd - Shire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

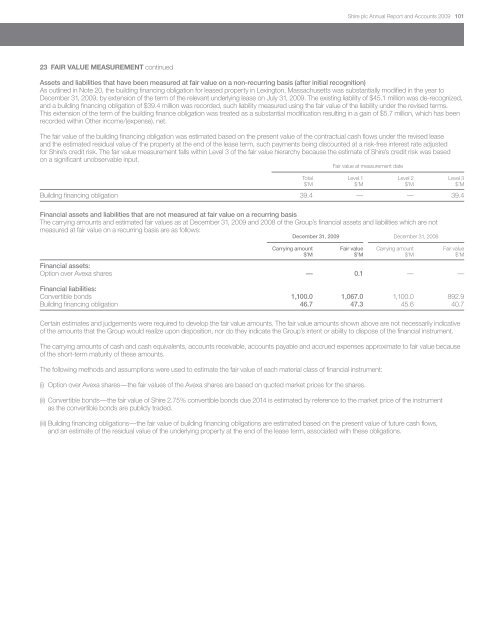

<strong>Shire</strong> plc <strong>Annual</strong> <strong>Report</strong> and Accounts 2009 10123 FAIR VALUE MEASUREMENT continuedAssets and liabilities that have been measured at fair value on a non-recurring basis (after initial recognition)As outlined in Note 20, the building financing obligation for leased property in Lexington, Massachusetts was substantially modified in the year toDecember 31, 2009, by extension of the term of the relevant underlying lease on July 31, 2009. The existing liability of $45.1 million was de-recognized,and a building financing obligation of $39.4 million was recorded, such liability measured using the fair value of the liability under the revised terms.This extension of the term of the building finance obligation was treated as a substantial modification resulting in a gain of $5.7 million, which has beenrecorded within Other income/(expense), net.The fair value of the building financing obligation was estimated based on the present value of the contractual cash flows under the revised leaseand the estimated residual value of the property at the end of the lease term, such payments being discounted at a risk-free interest rate adjustedfor <strong>Shire</strong>’s credit risk. The fair value measurement falls within Level 3 of the fair value hierarchy because the estimate of <strong>Shire</strong>’s credit risk was basedon a significant unobservable input.Fair value at measurement dateTotal Level 1 Level 2 Level 3$’M $’M $’M $’MBuilding financing obligation 39.4 — — 39.4Financial assets and liabilities that are not measured at fair value on a recurring basisThe carrying amounts and estimated fair values as at December 31, 2009 and 2008 of the Group’s financial assets and liabilities which are notmeasured at fair value on a recurring basis are as follows:December 31, 2009 December 31, 2008Carrying amount Fair value Carrying amount Fair value$’M $’M $’M $’MFinancial assets:Option over Avexa shares — 0.1 — —Financial liabilities:Convertible bonds 1,100.0 1,067.0 1,100.0 892.9Building financing obligation 46.7 47.3 45.6 40.7Certain estimates and judgements were required to develop the fair value amounts. The fair value amounts shown above are not necessarily indicativeof the amounts that the Group would realize upon disposition, nor do they indicate the Group’s intent or ability to dispose of the financial instrument.The carrying amounts of cash and cash equivalents, accounts receivable, accounts payable and accrued expenses approximate to fair value becauseof the short-term maturity of these amounts.The following methods and assumptions were used to estimate the fair value of each material class of financial instrument:(i) Option over Avexa shares—the fair values of the Avexa shares are based on quoted market prices for the shares.(ii) Convertible bonds—the fair value of <strong>Shire</strong> 2.75% convertible bonds due 2014 is estimated by reference to the market price of the instrumentas the convertible bonds are publicly traded.(iii) Building financing obligations—the fair value of building financing obligations are estimated based on the present value of future cash flows,and an estimate of the residual value of the underlying property at the end of the lease term, associated with these obligations.