Corral Petroleum Holdings AB (publ) Business Update ... - Preem

Corral Petroleum Holdings AB (publ) Business Update ... - Preem

Corral Petroleum Holdings AB (publ) Business Update ... - Preem

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

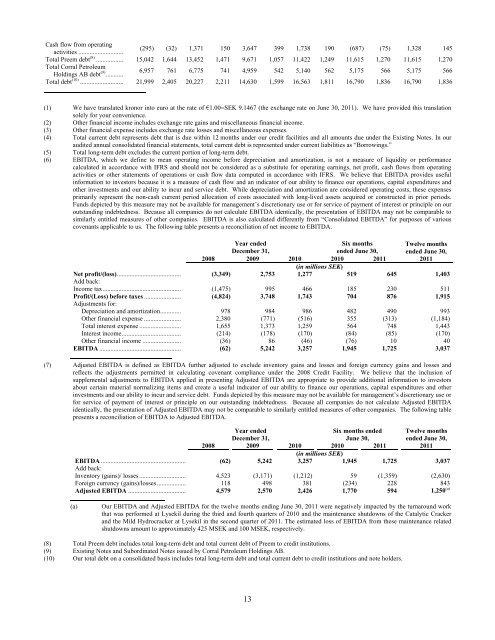

Cash flow from operatingactivities ............................(295) (32) 1,371 150 3,647 399 1,738 190 (687) (75) 1,328 145Total <strong>Preem</strong> debt (8) ................. 15,042 1,644 13,452 1,471 9,671 1,057 11,422 1,249 11,615 1,270 11,615 1,270Total <strong>Corral</strong> <strong>Petroleum</strong><strong>Holdings</strong> <strong>AB</strong> debt (9) ...........6,957 761 6,775 741 4,959 542 5,140 562 5,175 566 5,175 566Total debt (10) ........................... 21,999 2,405 20,227 2,211 14,630 1,599 16,563 1,811 16,790 1,836 16,790 1,836(1) We have translated kronor into euro at the rate of €1.00=SEK 9.1467 (the exchange rate on June 30, 2011). We have provided this translationsolely for your convenience.(2) Other financial income includes exchange rate gains and miscellaneous financial income.(3) Other financial expense includes exchange rate losses and miscellaneous expenses.(4) Total current debt represents debt that is due within 12 months under our credit facilities and all amounts due under the Existing Notes. In ouraudited annual consolidated financial statements, total current debt is represented under current liabilities as “Borrowings.”(5) Total long-term debt excludes the current portion of long-term debt.(6) EBITDA, which we define to mean operating income before depreciation and amortization, is not a measure of liquidity or performancecalculated in accordance with IFRS and should not be considered as a substitute for operating earnings, net profit, cash flows from operatingactivities or other statements of operations or cash flow data computed in accordance with IFRS. We believe that EBITDA provides usefulinformation to investors because it is a measure of cash flow and an indicator of our ability to finance our operations, capital expenditures andother investments and our ability to incur and service debt. While depreciation and amortization are considered operating costs, these expensesprimarily represent the non-cash current period allocation of costs associated with long-lived assets acquired or constructed in prior periods.Funds depicted by this measure may not be available for management’s discretionary use or for service of payment of interest or principle on ouroutstanding indebtedness. Because all companies do not calculate EBITDA identically, the presentation of EBITDA may not be comparable tosimilarly entitled measures of other companies. EBITDA is also calculated differently from “Consolidated EBITDA” for purposes of variouscovenants applicable to us. The following table presents a reconciliation of net income to EBITDA.Year endedDecember 31,Six monthsended June 30,Twelve monthsended June 30,2008 2009 2010 2010 20112011(in millions SEK)Net profit/(loss)........................................ (3,349) 2,753 1,277 519 645 1,403Add back:Income tax................................................. (1,475) 995 466 185 230 511Profit/(Loss) before taxes ....................... (4,824) 3,748 1,743 704 876 1,915Adjustments for:Depreciation and amortization............. 978 984 986 482 490 993Other financial expense ....................... 2,380 (771) (516) 355 (313) (1,184)Total interest expense .......................... 1,655 1,373 1,259 564 748 1,443Interest income..................................... (214) (178) (170) (84) (85) (170)Other financial income ........................ (36) 86 (46) (76) 10 40EBITDA ................................................... (62) 5,242 3,257 1,945 1,725 3,037(7) Adjusted EBITDA is defined as EBITDA further adjusted to exclude inventory gains and losses and foreign currency gains and losses andreflects the adjustments permitted in calculating covenant compliance under the 2008 Credit Facility. We believe that the inclusion ofsupplemental adjustments to EBITDA applied in presenting Adjusted EBITDA are appropriate to provide additional information to investorsabout certain material normalizing items and create a useful indicator of our ability to finance our operations, capital expenditures and otherinvestments and our ability to incur and service debt. Funds depicted by this measure may not be available for management’s discretionary use orfor service of payment of interest or principle on our outstanding indebtedness. Because all companies do not calculate Adjusted EBITDAidentically, the presentation of Adjusted EBITDA may not be comparable to similarly entitled measures of other companies. The following tablepresents a reconciliation of EBITDA to Adjusted EBITDA.Year endedDecember 31,Six months endedJune 30,Twelve monthsended June 30,2008 2009 2010 2010 20112011(in millions SEK)EBITDA ..................................................... (62) 5,242 3,257 1,945 1,725 3,037Add back:Inventory (gains)/ losses............................. 4,523 (3,171) (1,212) 59 (1,359) (2,630)Foreign currency (gains)/losses.................. 118 498 381 (234) 228 843Adjusted EBITDA .................................... 4,579 2,570 2,426 1,770 594 1,250 (a)(a)Our EBITDA and Adjusted EBITDA for the twelve months ending June 30, 2011 were negatively impacted by the turnaround workthat was performed at Lysekil during the third and fourth quarters of 2010 and the maintenance shutdowns of the Catalytic Crackerand the Mild Hydrocracker at Lysekil in the second quarter of 2011. The estimated loss of EBITDA from these maintenance relatedshutdowns amount to approximately 425 MSEK and 100 MSEK, respectively.(8) Total <strong>Preem</strong> debt includes total long-term debt and total current debt of <strong>Preem</strong> to credit institutions.(9) Existing Notes and Subordinated Notes issued by <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong> <strong>AB</strong>.(10) Our total debt on a consolidated basis includes total long-term debt and total current debt to credit institutions and note holders.13