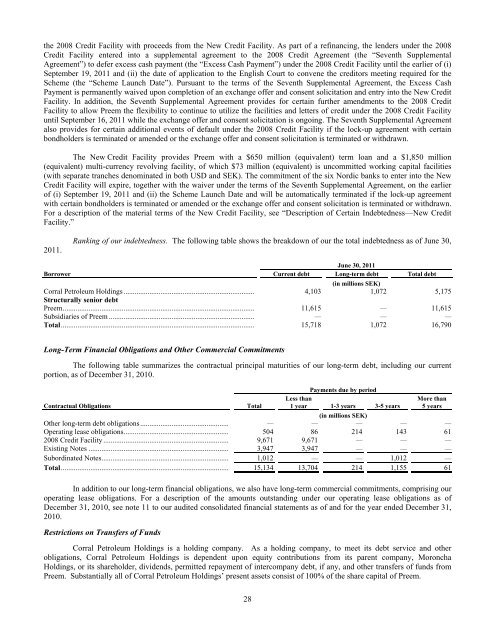

the 2008 Credit Facility with proceeds from the New Credit Facility. As part of a refinancing, the lenders under the 2008Credit Facility entered into a supplemental agreement to the 2008 Credit Agreement (the “Seventh SupplementalAgreement”) to defer excess cash payment (the “Excess Cash Payment”) under the 2008 Credit Facility until the earlier of (i)September 19, 2011 and (ii) the date of application to the English Court to convene the creditors meeting required for theScheme (the “Scheme Launch Date”). Pursuant to the terms of the Seventh Supplemental Agreement, the Excess CashPayment is permanently waived upon completion of an exchange offer and consent solicitation and entry into the New CreditFacility. In addition, the Seventh Supplemental Agreement provides for certain further amendments to the 2008 CreditFacility to allow <strong>Preem</strong> the flexibility to continue to utilize the facilities and letters of credit under the 2008 Credit Facilityuntil September 16, 2011 while the exchange offer and consent solicitation is ongoing. The Seventh Supplemental Agreementalso provides for certain additional events of default under the 2008 Credit Facility if the lock-up agreement with certainbondholders is terminated or amended or the exchange offer and consent solicitation is terminated or withdrawn.The New Credit Facility provides <strong>Preem</strong> with a $650 million (equivalent) term loan and a $1,850 million(equivalent) multi-currency revolving facility, of which $73 million (equivalent) is uncommitted working capital facilities(with separate tranches denominated in both USD and SEK). The commitment of the six Nordic banks to enter into the NewCredit Facility will expire, together with the waiver under the terms of the Seventh Supplemental Agreement, on the earlierof (i) September 19, 2011 and (ii) the Scheme Launch Date and will be automatically terminated if the lock-up agreementwith certain bondholders is terminated or amended or the exchange offer and consent solicitation is terminated or withdrawn.For a description of the material terms of the New Credit Facility, see “Description of Certain Indebtedness—New CreditFacility.”2011.Ranking of our indebtedness. The following table shows the breakdown of our the total indebtedness as of June 30,June 30, 2011Borrower Current debt Long-term debt Total debt(in millions SEK)<strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong> ....................................................................... 4,103 1,072 5,175Structurally senior debt<strong>Preem</strong>........................................................................................................ 11,615 — 11,615Subsidiaries of <strong>Preem</strong> ............................................................................... — — —Total......................................................................................................... 15,718 1,072 16,790Long-Term Financial Obligations and Other Commercial CommitmentsThe following table summarizes the contractual principal maturities of our long-term debt, including our currentportion, as of December 31, 2010.Contractual ObligationsTotalPayments due by periodLess than1 year 1-3 years 3-5 yearsMore than5 years(in millions SEK)Other long-term debt obligations................................................ — — — — —Operating lease obligations......................................................... 504 86 214 143 612008 Credit Facility .................................................................... 9,671 9,671 — — —Existing Notes ............................................................................ 3,947 3,947 — — —Subordinated Notes..................................................................... 1,012 — — 1,012 —Total........................................................................................... 15,134 13,704 214 1,155 61In addition to our long-term financial obligations, we also have long-term commercial commitments, comprising ouroperating lease obligations. For a description of the amounts outstanding under our operating lease obligations as ofDecember 31, 2010, see note 11 to our audited consolidated financial statements as of and for the year ended December 31,2010.Restrictions on Transfers of Funds<strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong> is a holding company. As a holding company, to meet its debt service and otherobligations, <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong> is dependent upon equity contributions from its parent company, Moroncha<strong>Holdings</strong>, or its shareholder, dividends, permitted repayment of intercompany debt, if any, and other transfers of funds from<strong>Preem</strong>. Substantially all of <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong>’ present assets consist of 100% of the share capital of <strong>Preem</strong>.28

Since 2006, <strong>Preem</strong> has not been permitted to expend any cash, declare any dividends or otherwise transfer any fundsto <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong>, except that it may do so provided it maintains certain financial ratios and repays or prepaysspecified amounts. These restrictions remain in the 2008 Credit Facility. Under the 2008 Credit Facility, <strong>Preem</strong> obtained anadditional right to declare and pay dividends or lend money to <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong>, at any time on or prior to April 15,2010, up to the maximum of $130 million over the life of the 2008 Credit Facility, provided (i) certain defaults are notoutstanding under the 2008 Credit Facility; and (ii) the proceeds are either used for the purpose of paying interest that is nextdue under the Existing Notes in cash or for repaying the Moroncha Note; or administrative costs to <strong>Corral</strong> <strong>Petroleum</strong><strong>Holdings</strong> up to a maximum of $500,000 in any calendar year. However, this additional right was removed by way of anamendment to the 2008 Credit Facility on January 25, 2010. The New Credit Facility will also contain certain restrictions on<strong>Preem</strong>’s ability to make dividend payments, distributions or other payments (including by way of a subordinated loan) to<strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong>. At any time, <strong>Preem</strong> is permitted to make group tax contributions (Sw: Koncernbidrag) to <strong>Corral</strong><strong>Petroleum</strong> <strong>Holdings</strong> by way of dividend, provided that such amount is funded by way of equity contribution or asubordinated loan and that it is effected by accounting entries only and not by movement of cash. <strong>Preem</strong> is also permitted topay administrative costs of CPH up to a maximum amount of $500,000 in any calendar year.At any time following payment of all arrangement fees under the New Credit Facility, subject to minimum liquidityrequirements of $100 million and provided that no event of default is outstanding under the New Credit Facility, <strong>Preem</strong> ispermitted to make a distribution, dividend or payment to <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong> to allow for the payment of cash-payinterest on any new notes issued in a refinancing up to a maximum of 4% per annum.At any time following payment of all arrangement fees under the New Credit Facility, subject to minimum liquidityrequirements of $200 million and provided that (i) the term loan facility has been repaid in full (ii) all fees due under the NewCredit Facility have been paid (iii) the Total Net Debt (as defined in the New Credit Facility) to consolidated EBITDA ratiohas been equal or below 4.0x for two successive quarters and would not be breached on a pro forma last twelve months basisafter making the payment and (iv) no event of default is outstanding, <strong>Preem</strong> is permitted to make a distribution, dividend orpayment to <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong> for any purpose.Notwithstanding the above, the aggregate of dividends, payments or other distributions out of <strong>Preem</strong> from theClosing Date to the maturity date of the New Credit Facility (other than with respect to group tax contributions) shall notexceed 100% of the net income of <strong>Preem</strong> arising after the Closing Date.Additional restrictions on the distribution of cash to <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong> arise from, among other things,applicable corporate and other laws and regulations and by the terms of other agreements to which <strong>Preem</strong> is or may becomesubject. Under Swedish law, <strong>Preem</strong> may only pay a dividend to the extent that it has sufficient distributable equity accordingto its adopted balance sheet in its latest annual report; provided, however, that any distribution of equity may not be made inany amount which, considering the requirements on the size of its equity in view of the nature, scope and risks of the businessas well as the financing needs of <strong>Preem</strong> or the <strong>Preem</strong> group, including the need for consolidation, liquidity or financialposition of <strong>Preem</strong> and the <strong>Preem</strong> group, would not be defendable.As a result of the above, <strong>Corral</strong> <strong>Petroleum</strong> <strong>Holdings</strong>’ ability to service cash interest payments or other cash needs isconsiderably restricted. Pursuant to the terms of the New Credit Facility, <strong>Preem</strong> would not be currently permitted and is notpermitted to pay a dividend until all fees under the New Credit Facility have been paid in full, which is expected not to occurbefore June 27, 2013.Quantitative and Qualitative Disclosures about Market RiskOur primary market risk exposures are commodity price risk, foreign currency risk and interest rate risk.Commodity Price RiskChanges in the price of commodities, such as crude oil, can affect our cost of goods sold and the price of our refinedproducts. Commodity price changes can trigger a price effect on inventory, which can affect our revenues, gross profit andoperating income. Our inventory management strategies include the purchase and sale of exchange-traded, oil-related futuresand options with a duration of twelve months or less. To a lesser extent, we also use oil swap agreements similar to thosetraded on international exchanges such as the Intercontinental Exchange, including “crack” spreads (which areintercommodity spreads based on the difference between the price of a refined product and crude oil) or intercommodityspreads, and options that, because they contain certain terms, such as point of delivery, customized to the market in which wesell, are better suited to hedge against the specific price movements in our markets. The number of barrels of crude oil andrefined products covered by such contracts varies from time to time. Nevertheless, we seek to maintain our “normalposition” of crude oil, finished products and intermediates. Our “normal position,” which is 1,840,000 cubic meters(approximately 12 million barrels), is evaluated based on the average optimal inventory level in our depot system, therequired inventory levels to allow for continuous flow and operations and the amount of crude oil and products that are29