Corral Petroleum Holdings AB (publ) Business Update ... - Preem

Corral Petroleum Holdings AB (publ) Business Update ... - Preem

Corral Petroleum Holdings AB (publ) Business Update ... - Preem

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

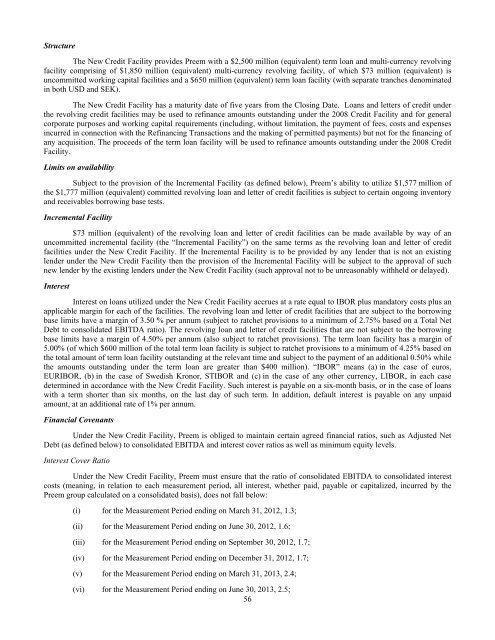

StructureThe New Credit Facility provides <strong>Preem</strong> with a $2,500 million (equivalent) term loan and multi-currency revolvingfacility comprising of $1,850 million (equivalent) multi-currency revolving facility, of which $73 million (equivalent) isuncommitted working capital facilities and a $650 million (equivalent) term loan facility (with separate tranches denominatedin both USD and SEK).The New Credit Facility has a maturity date of five years from the Closing Date. Loans and letters of credit underthe revolving credit facilities may be used to refinance amounts outstanding under the 2008 Credit Facility and for generalcorporate purposes and working capital requirements (including, without limitation, the payment of fees, costs and expensesincurred in connection with the Refinancing Transactions and the making of permitted payments) but not for the financing ofany acquisition. The proceeds of the term loan facility will be used to refinance amounts outstanding under the 2008 CreditFacility.Limits on availabilitySubject to the provision of the Incremental Facility (as defined below), <strong>Preem</strong>’s ability to utilize $1,577 million ofthe $1,777 million (equivalent) committed revolving loan and letter of credit facilities is subject to certain ongoing inventoryand receivables borrowing base tests.Incremental Facility$73 million (equivalent) of the revolving loan and letter of credit facilities can be made available by way of anuncommitted incremental facility (the “Incremental Facility”) on the same terms as the revolving loan and letter of creditfacilities under the New Credit Facility. If the Incremental Facility is to be provided by any lender that is not an existinglender under the New Credit Facility then the provision of the Incremental Facility will be subject to the approval of suchnew lender by the existing lenders under the New Credit Facility (such approval not to be unreasonably withheld or delayed).InterestInterest on loans utilized under the New Credit Facility accrues at a rate equal to IBOR plus mandatory costs plus anapplicable margin for each of the facilities. The revolving loan and letter of credit facilities that are subject to the borrowingbase limits have a margin of 3.50 % per annum (subject to ratchet provisions to a minimum of 2.75% based on a Total NetDebt to consolidated EBITDA ratio). The revolving loan and letter of credit facilities that are not subject to the borrowingbase limits have a margin of 4.50% per annum (also subject to ratchet provisions). The term loan facility has a margin of5.00% (of which $600 million of the total term loan facility is subject to ratchet provisions to a minimum of 4.25% based onthe total amount of term loan facility outstanding at the relevant time and subject to the payment of an additional 0.50% whilethe amounts outstanding under the term loan are greater than $400 million). “IBOR” means (a) in the case of euros,EURIBOR, (b) in the case of Swedish Kronor, STIBOR and (c) in the case of any other currency, LIBOR, in each casedetermined in accordance with the New Credit Facility. Such interest is payable on a six-month basis, or in the case of loanswith a term shorter than six months, on the last day of such term. In addition, default interest is payable on any unpaidamount, at an additional rate of 1% per annum.Financial CovenantsUnder the New Credit Facility, <strong>Preem</strong> is obliged to maintain certain agreed financial ratios, such as Adjusted NetDebt (as defined below) to consolidated EBITDA and interest cover ratios as well as minimum equity levels.Interest Cover RatioUnder the New Credit Facility, <strong>Preem</strong> must ensure that the ratio of consolidated EBITDA to consolidated interestcosts (meaning, in relation to each measurement period, all interest, whether paid, payable or capitalized, incurred by the<strong>Preem</strong> group calculated on a consolidated basis), does not fall below:(i) for the Measurement Period ending on March 31, 2012, 1.3;(ii) for the Measurement Period ending on June 30, 2012, 1.6;(iii) for the Measurement Period ending on September 30, 2012, 1.7;(iv) for the Measurement Period ending on December 31, 2012, 1.7;(v) for the Measurement Period ending on March 31, 2013, 2.4;(vi) for the Measurement Period ending on June 30, 2013, 2.5;56