Operating income. Operating income for the year ended December 31, 2009 was SEK 4,259 million, an increase ofSEK 5,299 million, from a loss of SEK 1,040 million for the year ended December 31, 2008. The operating income of oursupply and refining segment was SEK 4,847 million for the year ended December 31, 2009, an increase of SEK 5,519million, from a loss of SEK 672 million for the year ended December 31, 2008. This increase was primarily a result of pricegains on our inventories in 2009 in combination with the significant fall in market prices for crude oil and refined productsduring the second half of 2008. Excluding price effects on inventory, our operating income amounted to SEK 1,089 millionfor the year ended December 31, 2009, a decrease of SEK 2,394 million from SEK 3,483 million for the year endedDecember 31, 2008. The decrease in our operating income was primarily attributable to lower diesel margins and a narrowerspread between Dated Brent crude oil and heavy crude oil for the year ended December 31, 2009 as compared to the yearended December 31, 2008. Our marketing segment generated an operating income of SEK 213 million for the year endedDecember 31, 2009, an increase of SEK 219 million from an operating loss of SEK 6 million for the year ended December31, 2008. The increase in the marketing segment’s operating income was primarily a result of higher sales margins and salesvolumes in our marketing operations.Financial expense, net. Our financial expense, net, for the year ended December 31, 2009 was SEK 510 million, adecrease of SEK 3,274 million from SEK 3,784 million for the year ended December 31, 2008. This improvement wasmainly attributable to foreign exchange gains on our loans denominated in dollar and euro and, to some extent, lower interestexpense as a result of lower interest rates. For the year ended December 31, 2009, the foreign exchange gains amounted toSEK 838 million compared to a loss of SEK 2,099 million for the year ended December 31, 2008. In 2009, interest expenseamounted to SEK 1,373 million, a decrease of SEK 282 million from SEK 1,655 million in 2008.Income taxes. Income taxes for the year ended December 31, 2009 were SEK 995 million, an increase of SEK2,470 million from SEK a tax benefit of 1,475 million for the year ended December 31, 2008. The increase was mainlyattributable to higher income before taxes for the year ended December 31, 2009 as compared to the year ended December31, 2008.Net income. Net income for the year ended December 31, 2009 was SEK 2,753 million, an increase of SEK 6,102million from a loss of SEK 3,349 million for the year ended December 31, 2008 as a result of the factors discussed above.Liquidity and Capital ResourcesOverviewOur primary cash requirements include purchase of feedstocks, upgrade and maintenance projects, servicingindebtedness, funding construction and general working capital needs. Our primary sources of liquidity are available cashreserves, internal cash generation, long-term debt, short-term working capital financing and short-term use of excise dutiescollected. We operate in an environment in which liquidity and capital resources are impacted by changes in the prices forcrude oil and refined products, and a variety of additional risks, including currency and regulatory risks. Historically, ourcash and short-term credit have been sufficient to finance such purchases. We depend upon a small number of suppliers andexpect to continue to rely on trade credit from our suppliers to provide a significant amount of our working capital. <strong>Preem</strong>benefits regularly from approximately $500 million to $600 million of trade credits from a small number of suppliers for thepurchase of crude oil. The trade credit lines are uncommitted and therefore there can be no assurances that <strong>Preem</strong> cancontinue to benefit from such credit lines. Certain of these credit lines have recently been suspended pending completion of arefinancing but <strong>Preem</strong> has been able to replace a portion of these suspended credit lines and we have made one letter of creditdrawing of $88 million under our uncommitted A3 credit line under the 2008 Credit Facility in June 2011. If the refinancingis not completed in a timely fashion, there is a significant risk of loss of trade credit. If our suppliers fail to provide us withsufficient trade credit in a timely manner, we may have to use our cash on hand or other sources of financing, which may notbe readily available or, if available, may not be on terms acceptable or favorable to us.As of December 31, 2008, 2009 and 2010, we had cash and cash equivalents of SEK 1,075 million (€118 million),SEK 809 million (€88 million), and SEK 603 million (€66 million), respectively. Our net debt (consisting of the 2008 CreditFacility and the Existing Notes after reduction of cash and cash equivalents) was SEK 14,027 million (€1,534 million) as ofDecember 31, 2010. As of June 30, 2010 and 2011, we had cash and cash equivalents of SEK 414 million (€45 million) andSEK 1,847 million (€202 million), respectively. Our net debt (consisting of the 2008 Credit Facility, the Existing Notes andthe Subordinated Notes after reduction of cash and cash equivalents) was SEK 14,943 million (€1,634 million) as of June 30,2011. Our debt service obligations historically consisted primarily of the 2008 Credit Facility, the Existing Notes and theSubordinated Notes. Going forward, we expect our debt service obligations to consist of (i) semi-annual interest payments onany new notes issued in a refinancing in the form of additional notes (unless the Company is able and elects to pay cashinterest) and (ii) payments of interest on amounts drawn under the New Credit Facility. In line with our strategy to makefocused capital expenditures, we expect to commit approximately SEK 1,000 million (€109.3 million) to capital expendituresin 2011 primarily for planned maintenance turnaround costs at <strong>Preem</strong>raff Gothenburg, the relocation of the central control24

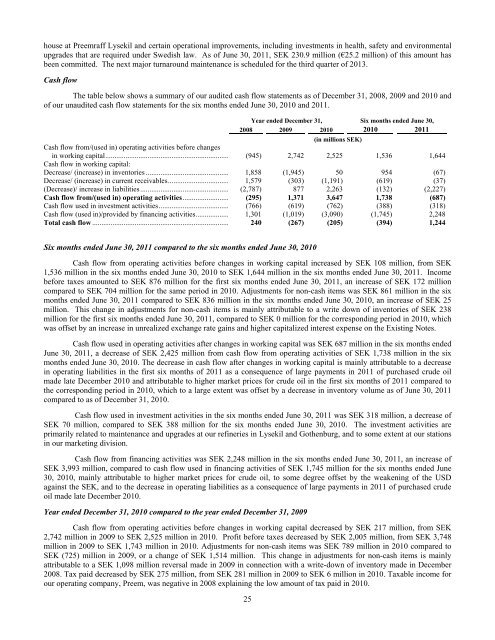

house at <strong>Preem</strong>raff Lysekil and certain operational improvements, including investments in health, safety and environmentalupgrades that are required under Swedish law. As of June 30, 2011, SEK 230.9 million (€25.2 million) of this amount hasbeen committed. The next major turnaround maintenance is scheduled for the third quarter of 2013.Cash flowThe table below shows a summary of our audited cash flow statements as of December 31, 2008, 2009 and 2010 andof our unaudited cash flow statements for the six months ended June 30, 2010 and 2011.Year ended December 31, Six months ended June 30,2008 2009 2010 2010 2011(in millions SEK)Cash flow from/(used in) operating activities before changesin working capital................................................................... (945) 2,742 2,525 1,536 1,644Cash flow in working capital:Decrease/ (increase) in inventories ............................................. 1,858 (1,945) 50 954 (67)Decrease/ (increase) in current receivables................................. 1,579 (303) (1,191) (619) (37)(Decrease)/ increase in liabilities................................................ (2,787) 877 2,263 (132) (2,227)Cash flow from/(used in) operating activities......................... (295) 1,371 3,647 1,738 (687)Cash flow used in investment activities...................................... (766) (619) (762) (388) (318)Cash flow (used in)/provided by financing activities.................. 1,301 (1,019) (3,090) (1,745) 2,248Total cash flow .......................................................................... 240 (267) (205) (394) 1,244Six months ended June 30, 2011 compared to the six months ended June 30, 2010Cash flow from operating activities before changes in working capital increased by SEK 108 million, from SEK1,536 million in the six months ended June 30, 2010 to SEK 1,644 million in the six months ended June 30, 2011. Incomebefore taxes amounted to SEK 876 million for the first six months ended June 30, 2011, an increase of SEK 172 millioncompared to SEK 704 million for the same period in 2010. Adjustments for non-cash items was SEK 861 million in the sixmonths ended June 30, 2011 compared to SEK 836 million in the six months ended June 30, 2010, an increase of SEK 25million. This change in adjustments for non-cash items is mainly attributable to a write down of inventories of SEK 238million for the first six months ended June 30, 2011, compared to SEK 0 million for the corresponding period in 2010, whichwas offset by an increase in unrealized exchange rate gains and higher capitalized interest expense on the Existing Notes.Cash flow used in operating activities after changes in working capital was SEK 687 million in the six months endedJune 30, 2011, a decrease of SEK 2,425 million from cash flow from operating activities of SEK 1,738 million in the sixmonths ended June 30, 2010. The decrease in cash flow after changes in working capital is mainly attributable to a decreasein operating liabilities in the first six months of 2011 as a consequence of large payments in 2011 of purchased crude oilmade late December 2010 and attributable to higher market prices for crude oil in the first six months of 2011 compared tothe corresponding period in 2010, which to a large extent was offset by a decrease in inventory volume as of June 30, 2011compared to as of December 31, 2010.Cash flow used in investment activities in the six months ended June 30, 2011 was SEK 318 million, a decrease ofSEK 70 million, compared to SEK 388 million for the six months ended June 30, 2010. The investment activities areprimarily related to maintenance and upgrades at our refineries in Lysekil and Gothenburg, and to some extent at our stationsin our marketing division.Cash flow from financing activities was SEK 2,248 million in the six months ended June 30, 2011, an increase ofSEK 3,993 million, compared to cash flow used in financing activities of SEK 1,745 million for the six months ended June30, 2010, mainly attributable to higher market prices for crude oil, to some degree offset by the weakening of the USDagainst the SEK, and to the decrease in operating liabilities as a consequence of large payments in 2011 of purchased crudeoil made late December 2010.Year ended December 31, 2010 compared to the year ended December 31, 2009Cash flow from operating activities before changes in working capital decreased by SEK 217 million, from SEK2,742 million in 2009 to SEK 2,525 million in 2010. Profit before taxes decreased by SEK 2,005 million, from SEK 3,748million in 2009 to SEK 1,743 million in 2010. Adjustments for non-cash items was SEK 789 million in 2010 compared toSEK (725) million in 2009, or a change of SEK 1,514 million. This change in adjustments for non-cash items is mainlyattributable to a SEK 1,098 million reversal made in 2009 in connection with a write-down of inventory made in December2008. Tax paid decreased by SEK 275 million, from SEK 281 million in 2009 to SEK 6 million in 2010. Taxable income forour operating company, <strong>Preem</strong>, was negative in 2008 explaining the low amount of tax paid in 2010.25