Today, Wavin - Jaarverslag.com

Today, Wavin - Jaarverslag.com

Today, Wavin - Jaarverslag.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

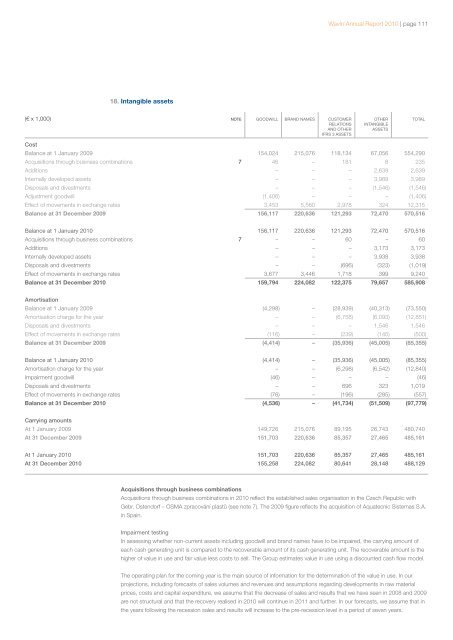

<strong>Wavin</strong> Annual Report 2010 | page 11118. Intangible assets(€ x 1,000) NOTE GOODWILL BRAND NAMES CUSTOMERRELATIONSAND OTHERIFRS 3 ASSETSOTHERINTANGIBLEASSETSTOTALCostBalance at 1 January 2009 154,024 215,076 118,134 67,056 554,290Acquisitions through business <strong>com</strong>binations 7 46 – 181 8 235Additions – – – 2,639 2,639Internally developed assets – – – 3,989 3,989Disposals and divestments – – – (1,546) (1,546)Adjustment goodwill (1,406) – – – (1,406)Effect of movements in exchange rates 3,453 5,560 2,978 324 12,315Balance at 31 December 2009 156,117 220,636 121,293 72,470 570,516Balance at 1 January 2010 156,117 220,636 121,293 72,470 570,516Acquisitions through business <strong>com</strong>binations 7 – – 60 – 60Additions – – – 3,173 3,173Internally developed assets – – – 3,938 3,938Disposals and divestments – – (696) (323) (1,019)Effect of movements in exchange rates 3,677 3,446 1,718 399 9,240Balance at 31 December 2010 159,794 224,082 122,375 79,657 585,908AmortisationBalance at 1 January 2009 (4,298) – (28,939) (40,313) (73,550)Amortisation charge for the year – – (6,758) (6,093) (12,851)Disposals and divestments – – – 1,546 1,546Effect of movements in exchange rates (116) – (239) (145) (500)Balance at 31 December 2009 (4,414) – (35,936) (45,005) (85,355)Balance at 1 January 2010 (4,414) – (35,936) (45,005) (85,355)Amortisation charge for the year – – (6,298) (6,542) (12,840)Impairment goodwill (46) – – – (46)Disposals and divestments – – 696 323 1,019Effect of movements in exchange rates (76) – (196) (285) (557)Balance at 31 December 2010 (4,536) – (41,734) (51,509) (97,779)Carrying amountsAt 1 January 2009 149,726 215,076 89,195 26,743 480,740At 31 December 2009 151,703 220,636 85,357 27,465 485,161At 1 January 2010 151,703 220,636 85,357 27,465 485,161At 31 December 2010 155,258 224,082 80,641 28,148 488,129Acquisitions through business <strong>com</strong>binationsAcquisitions through business <strong>com</strong>binations in 2010 refl ect the established sales organisation in the Czech Republic withGebr. Ostendorf – OSMA zpracování plastu (see note 7). The 2009 fi gure refl ects the acquisition of Aquatecnic Sistemas S.A.in Spain.Impairment testingIn assessing whether non-current assets including goodwill and brand names have to be impaired, the carrying amount ofeach cash generating unit is <strong>com</strong>pared to the recoverable amount of its cash generating unit. The recoverable amount is thehigher of value in use and fair value less costs to sell. The Group estimates value in use using a discounted cash fl ow model.The operating plan for the <strong>com</strong>ing year is the main source of information for the determination of the value in use. In ourprojections, including forecasts of sales volumes and revenues and assumptions regarding developments in raw materialprices, costs and capital expenditure, we assume that the decrease of sales and results that we have seen in 2008 and 2009are not structural and that the recovery realised in 2010 will continue in 2011 and further. In our forecasts, we assume that inthe years following the recession sales and results will increase to the pre-recession level in a period of seven years.