Today, Wavin - Jaarverslag.com

Today, Wavin - Jaarverslag.com

Today, Wavin - Jaarverslag.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

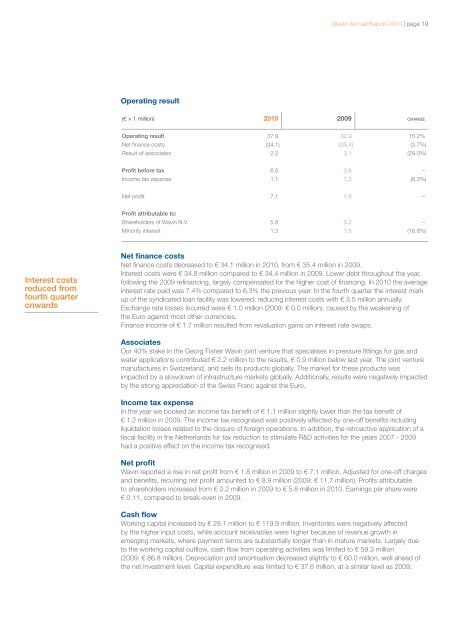

<strong>Wavin</strong> Annual Report 2010 | page 19Operating result(€ × 1 million) 2010 2009 CHANGEOperating result 37.9 32.9 15.2%Net fi nance costs (34.1) (35.4) (3.7%)Result of associates 2.2 3.1 (29.0%)Profit before tax 6.0 0.6 –In<strong>com</strong>e tax expense 1.1 1.2 (8.3%)Net profi t 7.1 1.8 –Profit attributable to:Shareholders of <strong>Wavin</strong> N.V. 5.8 0.2 –Minority interest 1.3 1.6 (18.8%)Interest costsreduced fromfourth quarteronwardsNet finance costsNet fi nance costs decreased to € 34.1 million in 2010, from € 35.4 million in 2009.Interest costs were € 34.8 million <strong>com</strong>pared to € 34.4 million in 2009. Lower debt throughout the year,following the 2009 refi nancing, largely <strong>com</strong>pensated for the higher cost of fi nancing. In 2010 the averageinterest rate paid was 7.4% <strong>com</strong>pared to 6.3% the previous year. In the fourth quarter the interest markup of the syndicated loan facility was lowered, reducing interest costs with € 3.5 million annually.Exchange rate losses incurred were € 1.0 million (2009: € 0.0 million), caused by the weakening ofthe Euro against most other currencies.Finance in<strong>com</strong>e of € 1.7 million resulted from revaluation gains on interest rate swaps.AssociatesOur 40% stake in the Georg Fisher <strong>Wavin</strong> joint venture that specialises in pressure fi ttings for gas andwater applications contributed € 2.2 million to the results, € 0.9 million below last year. The joint venturemanufactures in Switzerland, and sells its products globally. The market for these products wasimpacted by a slowdown of infrastructure markets globally. Additionally, results were negatively impactedby the strong appreciation of the Swiss Franc against the Euro.In<strong>com</strong>e tax expenseIn the year we booked an in<strong>com</strong>e tax benefi t of € 1.1 million slightly lower than the tax benefi t of€ 1.2 million in 2009. The in<strong>com</strong>e tax recognised was positively affected by one-off benefi ts includingliquidation losses related to the closure of foreign operations. In addition, the retroactive application of afi scal facility in the Netherlands for tax reduction to stimulate R&D activities for the years 2007 - 2009had a positive effect on the in<strong>com</strong>e tax recognised.Net profit<strong>Wavin</strong> reported a rise in net profi t from € 1.8 million in 2009 to € 7.1 million. Adjusted for one-off chargesand benefi ts, recurring net profi t amounted to € 8.9 million (2009: € 11.7 million). Profi ts attributableto shareholders increased from € 0.2 million in 2009 to € 5.8 million in 2010. Earnings per share were€ 0.11, <strong>com</strong>pared to break-even in 2009.Cash flowWorking capital increased by € 29.1 million to € 119.9 million. Inventories were negatively affectedby the higher input costs, while account receivables were higher because of revenue growth inemerging markets, where payment terms are substantially longer than in mature markets. Largely dueto the working capital outfl ow, cash fl ow from operating activities was limited to € 59.3 million(2009: € 86.8 million). Depreciation and amortisation decreased slightly to € 60.0 million, well ahead ofthe net investment level. Capital expenditure was limited to € 37.6 million, at a similar level as 2009.