You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

average cost of capital (WACC) at the<br />

end of 2005 was 8.7 %.<br />

<strong>Stora</strong> <strong>Enso</strong> achieved a ROCE of 3.1%<br />

(excluding non-recurring items) in 2005,<br />

which is signifi cantly below target and<br />

therefore unacceptable. The poor ROCE<br />

fi gure was impacted in particular by an<br />

extended labour dispute that affected<br />

the entire Finnish forest products sector<br />

and by increased variable costs. The<br />

Group has launched two profi t improvement<br />

initiatives to address the low profitability:<br />

Profi t 2007 and the Asset Performance<br />

Review (APR).<br />

Growth<br />

<strong>Stora</strong> <strong>Enso</strong> continues to aim for profi table<br />

growth, through both organic<br />

growth and selective mergers and acquisitions<br />

in core businesses, mainly in new<br />

growth markets.<br />

Acquisitions will only be made if<br />

they meet <strong>Stora</strong> <strong>Enso</strong>’s fi nancial targets<br />

and make a positive contribution to<br />

Earnings per Share (EPS) and Cash Earnings<br />

per Share (CEPS) after one year,<br />

excluding synergies. Over the shortterm,<br />

returns from acquisitions must<br />

exceed the Group’s pre-tax WACC of<br />

8.7%, and support the ROCE target of<br />

13% over the long term.<br />

Cash fl ow<br />

Enhancing cash fl ow from operations is<br />

a high priority at a time of low profi tability.<br />

To improve the effi ciency of the<br />

management of its working capital,<br />

<strong>Stora</strong> <strong>Enso</strong> has set an internal benchmark<br />

that cash fl ow should exceed<br />

average capital expenditure and dividends,<br />

as calculated on a three-year<br />

rolling basis.<br />

<strong>Stora</strong> <strong>Enso</strong>’s cash fl ow from operations<br />

in 2005 totalled EUR 1 057.0 million,<br />

which was not in line with the<br />

Group’s three-year rolling target. The<br />

main factors resulting to this were weak<br />

profi tability and increased working capital,<br />

especially inventories.<br />

Stability of the Company<br />

Financial<br />

Debt-to-equity ratio is a good indicator<br />

of balance sheet strength and fi nancial<br />

fl exibility. <strong>Stora</strong> <strong>Enso</strong>’s target is 0.8 or<br />

less. In 2005, the Group recorded a debtto-equity<br />

ratio of 0.66.<br />

The ratio was impacted in 2005 by<br />

share buy-backs worth EUR 344.7 million<br />

and two acquisitions in the merchant<br />

business: Papeteries de France and<br />

the Schneidersöhne Group in Germany.<br />

Volatility<br />

<strong>Stora</strong> <strong>Enso</strong> aims to reduce the volatility<br />

of its business by making its portfolio<br />

less cyclical and by diversifying its operations<br />

geographically.<br />

Shareholder return<br />

<strong>Stora</strong> <strong>Enso</strong>’s dividend policy is based<br />

on long-term stability. The current target<br />

is to distribute half of the Group’s net<br />

profi t over the cycle to shareholders as<br />

dividend.<br />

A new share buy-back programme<br />

was approved by the Annual General<br />

Meeting held on 22 March 2005 that<br />

allows the Company to buy back up to<br />

10 % of its shares outstanding under new<br />

Finnish legislation. By the end of 2005,<br />

the Company had purchased 37.3% of<br />

the authorisation for R shares.<br />

Further structural development<br />

The launch of the APR was an important<br />

fi rst step in improving the Group’s under-<br />

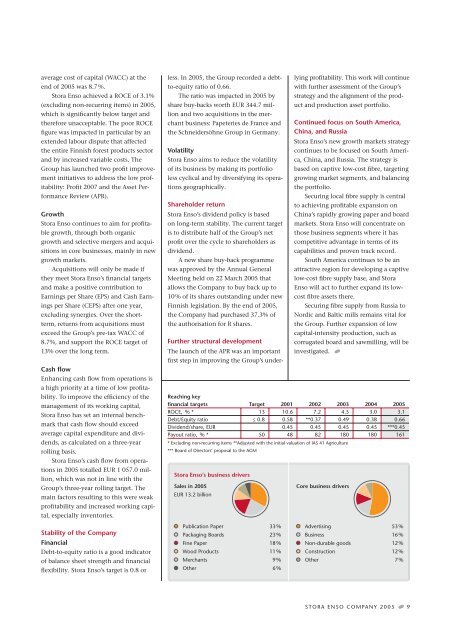

Reaching key<br />

financial targets Target 2001 2002 2003 2004 2005<br />

ROCE, % * 13 10.6 7.2 4.5 3.0 3.1<br />

Debt/Equity ratio ≤ 0.8 0.58 **0.37 0.49 0.38 0.66<br />

Dividend/share, EUR 0.45 0.45 0.45 0.45 ***0.45<br />

Payout ratio, % * 50 48 82 180 180 161<br />

* Excluding non-recurring items **Adjusted with the initial valuation of IAS 41 Agriculture<br />

*** Board of Directors’ proposal to the AGM<br />

<strong>Stora</strong> <strong>Enso</strong>’s business drivers<br />

Sales in 2005<br />

EUR 13.2 billion<br />

Publication Paper 33 %<br />

Packaging Boards 23 %<br />

Fine Paper 18 %<br />

Wood Products 11 %<br />

Merchants 9 %<br />

Other 6 %<br />

lying profi tability. This work will continue<br />

with further assessment of the Group’s<br />

strategy and the alignment of the product<br />

and production asset portfolio.<br />

Continued focus on South America,<br />

China, and Russia<br />

<strong>Stora</strong> <strong>Enso</strong>’s new growth markets strategy<br />

continues to be focused on South America,<br />

China, and Russia. The strategy is<br />

based on captive low-cost fi bre, targeting<br />

growing market segments, and balancing<br />

the portfolio.<br />

Securing local fi bre supply is central<br />

to achieving profi table expansion on<br />

China’s rapidly growing paper and board<br />

markets. <strong>Stora</strong> <strong>Enso</strong> will concentrate on<br />

those business segments where it has<br />

competitive advantage in terms of its<br />

capabilities and proven track record.<br />

South America continues to be an<br />

attractive region for developing a captive<br />

low-cost fi bre supply base, and <strong>Stora</strong><br />

<strong>Enso</strong> will act to further expand its lowcost<br />

fi bre assets there.<br />

Securing fi bre supply from Russia to<br />

Nordic and Baltic mills remains vital for<br />

the Group. Further expansion of low<br />

capital-intensity production, such as<br />

corrugated board and sawmilling, will be<br />

investigated. •<br />

Core business drivers<br />

Advertising 53 %<br />

Business 16 %<br />

Non-durable goods 12 %<br />

Construction 12 %<br />

Other 7 %<br />

STORA ENSO COMPANY 2005• 9