Catalog 2010-2011 - South Texas College

Catalog 2010-2011 - South Texas College

Catalog 2010-2011 - South Texas College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

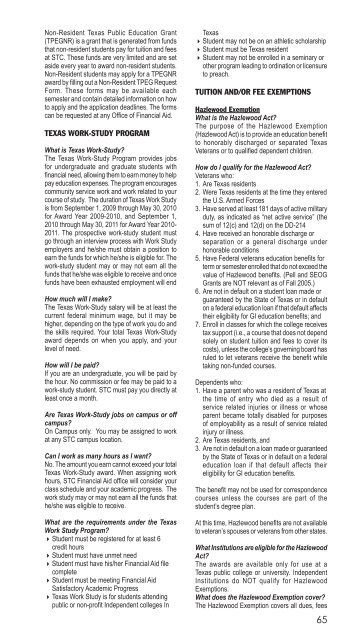

Non-Resident <strong>Texas</strong> Public Education Grant(TPEGNR) is a grant that is generated from fundsthat non-resident students pay for tuition and feesat STC. These funds are very limited and are setaside every year to award non-resident students.Non-Resident students may apply for a TPEGNRaward by filling out a Non-Resident TPEG RequestForm. These forms may be available eachsemester and contain detailed information on howto apply and the application deadlines. The formscan be requested at any Office of Financial Aid.TEXAS WORK-STUDY PROGRAMWhat is <strong>Texas</strong> Work-Study?The <strong>Texas</strong> Work-Study Program provides jobsfor undergraduate and graduate students withfinancial need, allowing them to earn money to helppay education expenses. The program encouragescommunity service work and work related to yourcourse of study. The duration of <strong>Texas</strong> Work Studyis from September 1, 2009 through May 30, <strong>2010</strong>for Award Year 2009-<strong>2010</strong>, and September 1,<strong>2010</strong> through May 30, <strong>2011</strong> for Award Year <strong>2010</strong>-<strong>2011</strong>. The prospective work-study student mustgo through an interview process with Work Studyemployers and he/she must obtain a position toearn the funds for which he/she is eligible for. Thework-study student may or may not earn all thefunds that he/she was eligible to receive and oncefunds have been exhausted employment will endHow much will I make?The <strong>Texas</strong> Work-Study salary will be at least thecurrent federal minimum wage, but it may behigher, depending on the type of work you do andthe skills required. Your total <strong>Texas</strong> Work-Studyaward depends on when you apply, and yourlevel of need.How will I be paid?If you are an undergraduate, you will be paid bythe hour. No commission or fee may be paid to awork-study student. STC must pay you directly atleast once a month.Are <strong>Texas</strong> Work-Study jobs on campus or offcampus?On Campus only. You may be assigned to workat any STC campus location.Can I work as many hours as I want?No. The amount you earn cannot exceed your total<strong>Texas</strong> Work-Study award. When assigning workhours, STC Financial Aid office will consider yourclass schedule and your academic progress. Thework study may or may not earn all the funds thathe/she was eligible to receive.What are the requirements under the <strong>Texas</strong>Work Study Program?4 Student must be registered for at least 6credit hours4 Student must have unmet need4 Student must have his/her Financial Aid filecomplete4 Student must be meeting Financial AidSatisfactory Academic Progress4 <strong>Texas</strong> Work Study is for students attendingpublic or non-profit Independent colleges In<strong>Texas</strong>4 Student may not be on an athletic scholarship4 Student must be <strong>Texas</strong> resident4 Student may not be enrolled in a seminary orother program leading to ordination or licensureto preach.TUITION AND/OR FEE EXEMPTIONSHazlewood ExemptionWhat is the Hazlewood Act?The purpose of the Hazlewood Exemption(Hazlewood Act) is to provide an education benefitto honorably discharged or separated <strong>Texas</strong>Veterans or to qualified dependent children.How do I qualify for the Hazlewood Act?Veterans who:1. Are <strong>Texas</strong> residents2. Were <strong>Texas</strong> residents at the time they enteredthe U.S. Armed Forces3. Have served at least 181 days of active militaryduty, as indicated as “net active service” (thesum of 12(c) and 12(d) on the DD-2144. Have received an honorable discharge orseparation or a general discharge underhonorable conditions5. Have Federal veterans education benefits forterm or semester enrolled that do not exceed thevalue of Hazlewood benefits. (Pell and SEOGGrants are NOT relevant as of Fall 2005.)6. Are not in default on a student loan made orguaranteed by the State of <strong>Texas</strong> or in defaulton a federal education loan if that default affectstheir eligibility for GI education benefits; and7. Enroll in classes for which the college receivestax support (i.e., a course that does not dependsolely on student tuition and fees to cover itscosts), unless the college’s governing board hasruled to let veterans receive the benefit whiletaking non-funded courses.Dependents who:1. Have a parent who was a resident of <strong>Texas</strong> atthe time of entry who died as a result ofservice related injuries or illness or whoseparent became totally disabled for purposesof employability as a result of service relatedinjury or illness.2. Are <strong>Texas</strong> residents, and3. Are not in default on a loan made or guaranteedby the State of <strong>Texas</strong> or in default on a federaleducation loan if that default affects theireligibility for GI education benefits.The benefit may not be used for correspondencecourses unless the courses are part of thestudent’s degree plan.At this time, Hazlewood benefits are not availableto veteran’s spouses or veterans from other states.What Institutions are eligible for the HazlewoodAct?The awards are available only for use at a<strong>Texas</strong> public college or university. IndependentInstitutions do NOT qualify for HazlewoodExemptions.What does the Hazlewood Exemption cover?The Hazlewood Exemption covers all dues, fees65