Download - Globe

Download - Globe

Download - Globe

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

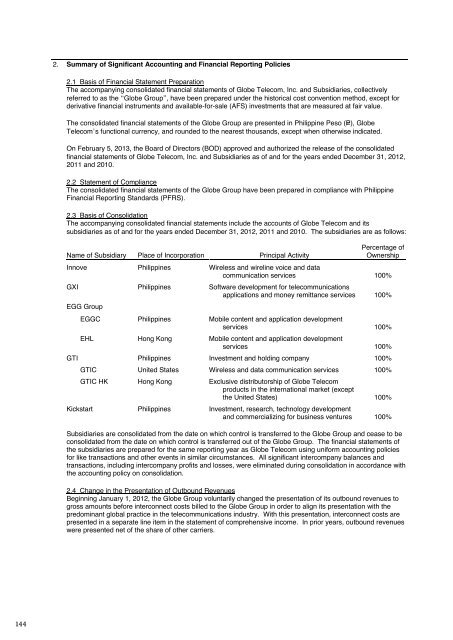

<strong>Globe</strong> 2012 annual reportfinancial report2. Summary of Significant Accounting and Financial Reporting Policies2.1 Basis of Financial Statement PreparationThe accompanying consolidated financial statements of <strong>Globe</strong> Telecom, Inc. and Subsidiaries, collectivelyreferred to as the “<strong>Globe</strong> Group”, have been prepared under the historical cost convention method, except forderivative financial instruments and available-for-sale (AFS) investments that are measured at fair value.The consolidated financial statements of the <strong>Globe</strong> Group are presented in Philippine Peso (P=), <strong>Globe</strong>Telecom’s functional currency, and rounded to the nearest thousands, except when otherwise indicated.On February 5, 2013, the Board of Directors (BOD) approved and authorized the release of the consolidatedfinancial statements of <strong>Globe</strong> Telecom, Inc. and Subsidiaries as of and for the years ended December 31, 2012,2011 and 2010.2.2 Statement of ComplianceThe consolidated financial statements of the <strong>Globe</strong> Group have been prepared in compliance with PhilippineFinancial Reporting Standards (PFRS).2.3 Basis of ConsolidationThe accompanying consolidated financial statements include the accounts of <strong>Globe</strong> Telecom and itssubsidiaries as of and for the years ended December 31, 2012, 2011 and 2010. The subsidiaries are as follows:Name of Subsidiary Place of Incorporation Principal ActivityPercentage ofOwnershipInnove Philippines Wireless and wireline voice and datacommunication services 100%GXI Philippines Software development for telecommunicationsapplications and money remittance services 100%EGG GroupEGGC Philippines Mobile content and application developmentservices 100%EHL Hong Kong Mobile content and application developmentservices 100%GTI Philippines Investment and holding company 100%GTIC United States Wireless and data communication services 100%GTIC HK Hong Kong Exclusive distributorship of <strong>Globe</strong> Telecomproducts in the international market (exceptthe United States) 100%Kickstart Philippines Investment, research, technology developmentand commercializing for business ventures 100%Subsidiaries are consolidated from the date on which control is transferred to the <strong>Globe</strong> Group and cease to beconsolidated from the date on which control is transferred out of the <strong>Globe</strong> Group. The financial statements ofthe subsidiaries are prepared for the same reporting year as <strong>Globe</strong> Telecom using uniform accounting policiesfor like transactions and other events in similar circumstances. All significant intercompany balances andtransactions, including intercompany profits and losses, were eliminated during consolidation in accordance withthe accounting policy on consolidation.2.4 Change in the Presentation of Outbound RevenuesBeginning January 1, 2012, the <strong>Globe</strong> Group voluntarily changed the presentation of its outbound revenues togross amounts before interconnect costs billed to the <strong>Globe</strong> Group in order to align its presentation with thepredominant global practice in the telecommunications industry. With this presentation, interconnect costs arepresented in a separate line item in the statement of comprehensive income. In prior years, outbound revenueswere presented net of the share of other carriers.The change was accounted for retrospectively, and accordingly, the <strong>Globe</strong> Group restated its comparativestatements of comprehensive income. The change has no impact on consolidated net income, earnings pershare, cash flows and statements of financial position. The table below shows the affected line items in ourfinancial information for the year ended December 31, 2011 and 2010:As restatedDecember 31, 2011 December 31, 2010As previouslypresented Change As restated(In Thousand Pesos)As previouslypresentedChangeRevenues P=77,764,964 P=67,811,301 P=9,953,663 P=72,742,090 P=62,554,689 P=10,187,401Expenses 68,612,584 58,658,921 9,953,663 62,805,207 52,617,806 10,187,4012.5 Changes in Accounting PoliciesThe accounting policies adopted are consistent with those of the previous financial year, except for the followingnew and amended Philippine Accounting Standards (PAS) and PFRS effective as of January 1, 2012. Exceptas otherwise indicated, the adoption of the new and amended Standards and Interpretations, did not have asignificant impact on the consolidated financial statements.PAS 12, Income Taxes, Deferred Tax: Recovery of Underlying AssetsThis Amendment to PAS 12 is effective for annual periods beginning on or after January 1, 2012. TheAmendment clarifies the determination of deferred tax on investment property measured at fair value. Theamendment introduces a rebuttable presumption that deferred tax on investment property measured usingthe fair value model in PAS 40, Investment Property, should be determined on the basis that its carryingamount will be recovered through sale. Furthermore, it introduces the requirement that deferred tax on nondepreciableassets that are measured using the revaluation model in PAS 16, Property, Plant andEquipment, always be measured on a sale basis of the asset. The <strong>Globe</strong> Group accounts for its propertyand equipment and investment properties at cost, thus, the Amendment does not have an effect to the<strong>Globe</strong> Group.PFRS 7, Financial Instruments: Disclosures – Enhanced Derecognition Disclosure RequirementsThe Amendments to PFRS 7 are effective for annual periods beginning on or after July 1, 2011. Theamendments require additional disclosure about financial assets that have been transferred but notderecognized to enable the user of the entity’s financial statements to understand the relationship withthose assets that have not been derecognized and their associated liabilities. In addition, the amendmentsrequire disclosures about continuing involvement in derecognized assets to enable the user to evaluate thenature of, and risks associated with, the entity’s continuing involvement in those derecognized assets.2.6 Future Changes in Accounting PoliciesThe <strong>Globe</strong> Group will adopt the following new and amended standards enumerated below when these becomeeffective. Except as otherwise indicated, the <strong>Globe</strong> Group does not expect the adoption of these new andamended PAS and PFRS to have significant impact on the consolidated financial statements.Effective January 1, 2013Amendments to PAS 1, Financial Statement Presentation, Presentation of Items of Other ComprehensiveIncomeThe Amendment changed the grouping of items presented in other comprehensive income. Items thatcould be reclassified (or ‘recycled’) to profit or loss at a future point in time (for example, uponderecognition or settlement) would be presented separately from items that will never be reclassified.PFRS 7, Financial Instruments: Disclosures – Offsetting Financial Assets and Financial LiabilitiesThe Amendments to PFRS 7 are to be retrospectively applied for annual periods beginning on or afterJanuary 1, 2013. These Amendments require an entity to disclose information about rights of set-off andrelated arrangements (such as collateral agreements). The new disclosures are required for all recognizedfinancial instruments that are set off in accordance with PAS 32, Financial Instruments: Presentation.These disclosures also apply to recognized financial instruments that are subject to an enforceable masternetting arrangement or ‘similar agreement’, irrespective of whether they are set-off in accordance withPAS 32. The amendments require entities to disclose, in a tabular format unless another format is moreappropriate, certain minimum quantitative information.PFRS 10, Consolidated Financial StatementsPFRS 10 replaces the portion of PAS 27, Consolidated and Separate Financial Statements, that addressesthe accounting for consolidated financial statements. It also includes the issues raised in SIC 12,Consolidation - Special Purpose Entities.144 145