Download - Globe

Download - Globe

Download - Globe

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

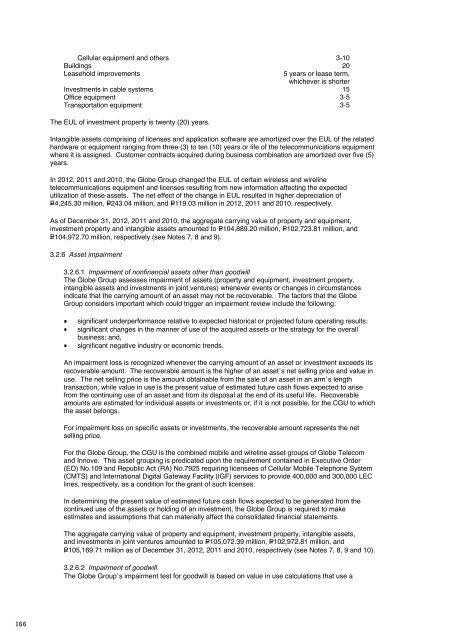

<strong>Globe</strong> 2012 annual reportfinancial reportCellular equipment and others 3-10Buildings 20Leasehold improvements5 years or lease term,whichever is shorterInvestments in cable systems 15Office equipment 3-5Transportation equipment 3-5The EUL of investment property is twenty (20) years.Intangible assets comprising of licenses and application software are amortized over the EUL of the relatedhardware or equipment ranging from three (3) to ten (10) years or life of the telecommunications equipmentwhere it is assigned. Customer contracts acquired during business combination are amortized over five (5)years.In 2012, 2011 and 2010, the <strong>Globe</strong> Group changed the EUL of certain wireless and wirelinetelecommunications equipment and licenses resulting from new information affecting the expectedutilization of these assets. The net effect of the change in EUL resulted in higher depreciation ofP=4,245.30 million, P=243.04 million, and P=119.03 million in 2012, 2011 and 2010, respectively.As of December 31, 2012, 2011 and 2010, the aggregate carrying value of property and equipment,investment property and intangible assets amounted to P=104,889.20 million, P=102,723.81 million, andP=104,972.70 million, respectively (see Notes 7, 8 and 9).3.2.6 Asset impairment3.2.6.1 Impairment of nonfinancial assets other than goodwillThe <strong>Globe</strong> Group assesses impairment of assets (property and equipment, investment property,intangible assets and investments in joint ventures) whenever events or changes in circumstancesindicate that the carrying amount of an asset may not be recoverable. The factors that the <strong>Globe</strong>Group considers important which could trigger an impairment review include the following:significant underperformance relative to expected historical or projected future operating results;significant changes in the manner of use of the acquired assets or the strategy for the overallbusiness; and,significant negative industry or economic trends.An impairment loss is recognized whenever the carrying amount of an asset or investment exceeds itsrecoverable amount. The recoverable amount is the higher of an asset’s net selling price and value inuse. The net selling price is the amount obtainable from the sale of an asset in an arm’s lengthtransaction, while value in use is the present value of estimated future cash flows expected to arisefrom the continuing use of an asset and from its disposal at the end of its useful life. Recoverableamounts are estimated for individual assets or investments or, if it is not possible, for the CGU to whichthe asset belongs.For impairment loss on specific assets or investments, the recoverable amount represents the netselling price.For the <strong>Globe</strong> Group, the CGU is the combined mobile and wireline asset groups of <strong>Globe</strong> Telecomand Innove. This asset grouping is predicated upon the requirement contained in Executive Order(EO) No.109 and Republic Act (RA) No.7925 requiring licensees of Cellular Mobile Telephone System(CMTS) and International Digital Gateway Facility (IGF) services to provide 400,000 and 300,000 LEClines, respectively, as a condition for the grant of such licenses.In determining the present value of estimated future cash flows expected to be generated from thecontinued use of the assets or holding of an investment, the <strong>Globe</strong> Group is required to makeestimates and assumptions that can materially affect the consolidated financial statements.The aggregate carrying value of property and equipment, investment property, intangible assets,and investments in joint ventures amounted to P=105,072.39 million, P=102,972.81 million, andP=105,169.71 million as of December 31, 2012, 2011 and 2010, respectively (see Notes 7, 8, 9 and 10).3.2.6.2 Impairment of goodwillThe <strong>Globe</strong> Group’s impairment test for goodwill is based on value in use calculations that use adiscounted cash flow model. The cash flows are derived from the budget for the next five years and donot include restructuring activities that the Group is not yet committed to or significant futureinvestments that will enhance the asset base of the CGU being tested. The recoverable amount ismost sensitive to the discount rate used for the discounted cash flow model as well, as the expectedfuture cash inflows and the growth rate used for extrapolation purposes. As of December 31, 2012,2011 and 2010, the carrying value of goodwill amounted to P=327.13 million (see Note 9).Goodwill acquired through business combination with EGG Group was allocated to the mobile contentand applications development services business CGU, which is part of the “Others” reporting segment(see Note 29).The recoverable amount of the CGU, which exceeds the carrying amount of the related goodwill byP=962.34 million, P=461.88 million, and P=165.30 million as of December 31, 2012, 2011 and 2010,respectively, has been determined based on value in use calculations using cash flow projections fromfinancial budgets covering a five-year period. The pretax discount rate applied to cash flow projectionswas 11% in 2012 and 2011 and 12% in 2010, and cash flows beyond the five-year period areextrapolated using a 3% long-term growth rate in 2012, 2011 and 2010.3.2.7 Deferred income tax assetsThe carrying amounts of deferred income tax assets are reviewed at each reporting date and reduced tothe extent that it is no longer probable that sufficient taxable income will be available to allow all or part ofthe deferred income tax assets to be utilized (see Note 24).As of December 31, 2012 and 2011, Innove, GXI and EGG Group has net deferred income tax assetsamounting to P=765.59 million and P=765.67 million, respectively, while as of December 31, 2010, Innove andEGG Group has net deferred income tax assets amounting to P=670.59 million.As of December 31, 2012, 2011 and 2010, <strong>Globe</strong> Telecom has net deferred income tax liabilities amountingto P=2,473.12 million, P=3,929.41 million, and P=4,620.49 million, respectively (see Note 24). <strong>Globe</strong> Telecomand Innove have no unrecognized deferred income tax assets as of December 31, 2012, 2011 and 2010.As of December 31, 2012 and 2011, GXI recognized deferred income tax assets from NOLCO amountingto P=15.01 million and P=1.01 million, respectively (see Note 24).As of December 31, 2010, Innove and EGG Group’s recognized deferred income tax assets from NOLCOamounted to P=13.50 million and MCIT amounted to P=0.95 million (see Note 24).3.2.8 Financial assets and financial liabilities<strong>Globe</strong> Group carries certain financial assets and liabilities at fair value, which requires extensive use ofaccounting estimates and judgment. While significant components of fair value measurement weredetermined using verifiable objective evidence (i.e., foreign exchange rates, interest rates), the amount ofchanges in fair value would differ if the <strong>Globe</strong> Group utilized different valuation methodologies. Anychanges in fair value of these financial assets and financial liabilities would affect the consolidatedstatements of comprehensive income and consolidated statements of changes in equity.Financial assets comprising AFS investments and derivative assets carried at fair values as ofDecember 31, 2012, 2011 and 2010, amounted to P=141.87 million, P=109.09 million, and P=121.77 million,respectively, and financial liabilities comprising of derivative liabilities carried at fair values as ofDecember 31, 2012, 2011 and 2010, amounted to P=240.65 million, P=266.62 million, and P=245.87 million,respectively (see Note 28.11).3.2.9 Pension and other employee benefitsThe determination of the obligation and cost of pension is dependent on the selection of certainassumptions used in calculating such amounts. Those assumptions include, among others, discount rates,expected returns on plan assets and salary rates increase (see Note 18). In accordance with PAS 19,actual results that differ from the <strong>Globe</strong> Group’s assumptions, subject to the 10% corridor test, areaccumulated and amortized over future periods and therefore, generally affect the recognized expense andrecorded obligation in such future periods.As of December 31, 2012, 2011 and 2010, <strong>Globe</strong> Group has unrecognized net actuarial losses ofP=1,512.30 million, P=1,215.69 million, and P=781.01 million, respectively (see Note 18.2). As of the samedates, net pension asset amounted to P=671.08 million, P=872.10 million and P=950.52 million, respectively.166 167