Download - Globe

Download - Globe

Download - Globe

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

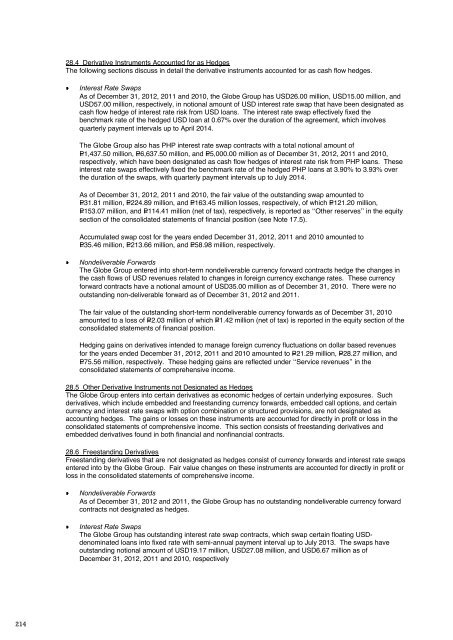

<strong>Globe</strong> 2012 annual reportfinancial report28.4 Derivative Instruments Accounted for as HedgesThe following sections discuss in detail the derivative instruments accounted for as cash flow hedges.Interest Rate SwapsAs of December 31, 2012, 2011 and 2010, the <strong>Globe</strong> Group has USD26.00 million, USD15.00 million, andUSD57.00 million, respectively, in notional amount of USD interest rate swap that have been designated ascash flow hedge of interest rate risk from USD loans. The interest rate swap effectively fixed thebenchmark rate of the hedged USD loan at 0.67% over the duration of the agreement, which involvesquarterly payment intervals up to April 2014.The <strong>Globe</strong> Group also has PHP interest rate swap contracts with a total notional amount ofP=1,437.50 million, P=6,637.50 million, and P=5,000.00 million as of December 31, 2012, 2011 and 2010,respectively, which have been designated as cash flow hedges of interest rate risk from PHP loans. Theseinterest rate swaps effectively fixed the benchmark rate of the hedged PHP loans at 3.90% to 3.93% overthe duration of the swaps, with quarterly payment intervals up to July 2014.As of December 31, 2012, 2011 and 2010, the fair value of the outstanding swap amounted toP=31.81 million, P=224.89 million, and P=163.45 million losses, respectively, of which P=121.20 million,P=153.07 million, and P=114.41 million (net of tax), respectively, is reported as “Other reserves” in the equitysection of the consolidated statements of financial position (see Note 17.5).Accumulated swap cost for the years ended December 31, 2012, 2011 and 2010 amounted toP=35.46 million, P=213.66 million, and P=58.98 million, respectively.Nondeliverable ForwardsThe <strong>Globe</strong> Group entered into short-term nondeliverable currency forward contracts hedge the changes inthe cash flows of USD revenues related to changes in foreign currency exchange rates. These currencyforward contracts have a notional amount of USD35.00 million as of December 31, 2010. There were nooutstanding non-deliverable forward as of December 31, 2012 and 2011.The fair value of the outstanding short-term nondeliverable currency forwards as of December 31, 2010amounted to a loss of P=2.03 million of which P=1.42 million (net of tax) is reported in the equity section of theconsolidated statements of financial position.Hedging gains on derivatives intended to manage foreign currency fluctuations on dollar based revenuesfor the years ended December 31, 2012, 2011 and 2010 amounted to P=21.29 million, P=28.27 million, andP=75.56 million, respectively. These hedging gains are reflected under “Service revenues” in theconsolidated statements of comprehensive income.28.5 Other Derivative Instruments not Designated as HedgesThe <strong>Globe</strong> Group enters into certain derivatives as economic hedges of certain underlying exposures. Suchderivatives, which include embedded and freestanding currency forwards, embedded call options, and certaincurrency and interest rate swaps with option combination or structured provisions, are not designated asaccounting hedges. The gains or losses on these instruments are accounted for directly in profit or loss in theconsolidated statements of comprehensive income. This section consists of freestanding derivatives andembedded derivatives found in both financial and nonfinancial contracts.28.6 Freestanding DerivativesFreestanding derivatives that are not designated as hedges consist of currency forwards and interest rate swapsentered into by the <strong>Globe</strong> Group. Fair value changes on these instruments are accounted for directly in profit orloss in the consolidated statements of comprehensive income.Nondeliverable ForwardsAs of December 31, 2012 and 2011, the <strong>Globe</strong> Group has no outstanding nondeliverable currency forwardcontracts not designated as hedges.Interest Rate SwapsThe <strong>Globe</strong> Group has outstanding interest rate swap contracts, which swap certain floating USDdenominatedloans into fixed rate with semi-annual payment interval up to July 2013. The swaps haveoutstanding notional amount of USD19.17 million, USD27.08 million, and USD6.67 million as ofDecember 31, 2012, 2011 and 2010, respectivelyThe <strong>Globe</strong> Group also has an outstanding PHP interest rate swap contract which swaps a floating PHPloan into fixed rate of 4.92% and involves quarterly payment intervals up to September 2015. Outstandingnotional as of December 31, 2012 amounts to P=4,750.00 million. There were no outstanding PHP interestrate swap not designated as hedge as of December 31, 2011 and 2010.The fair values on the interest rate swaps as of December 31, 2012, 2011 and 2010 amounted to P=183.43million net loss, P=4.69 million net gain, and P=11.53 million net gain, respectively.Principal Only Currency SwapsAs of December 31, 2012, the <strong>Globe</strong> Group has no outstanding foreign principal only swap contract. Thenotional amount of the swap amounted to USD2.50 million as of December 31, 2011 and 2010. The fairvalue losses of the principal only currency swap as of December 31, 2011 and 2010 amounted to P=31.61million and P=35.52 million, respectively.28.7 Embedded DerivativesThe <strong>Globe</strong> Group has instituted a process to identify any derivatives embedded in its financial or nonfinancialcontracts. Based on PAS 39, the <strong>Globe</strong> Group assesses whether these derivatives are required to be bifurcatedor are exempted based on the qualifications provided by the said standard. The <strong>Globe</strong> Group’s embeddedderivatives include embedded currency derivatives noted in non-financial contracts.Embedded Currency ForwardsAs of December 31, 2012, 2011 and 2010, the total outstanding notional amount of currency forwardsembedded in nonfinancial contracts amounted to USD12.29 million, USD10.58 million and USD14.65million, respectively. The nonfinancial contracts consist mainly of foreign currency-denominated purchaseorders with various expected delivery dates and unbilled leaselines receivables and payables denominatedin foreign currency with domestic counterparties. The net fair value losses of the embedded currencyforwards as of December 31, 2012, 2011 and 2010 amounted to P=24.99 million, P=5.04 million, andP=36.51 million, respectively.Embedded Currency OptionsAs of December 31, 2012, the <strong>Globe</strong> Group does not have an outstanding currency option embedded innon-financial contracts.28.8 Fair Value Changes on DerivativesThe net movements in fair value changes of all derivative instruments are as follows:December 312012 2011 2010(In Thousand Pesos)At beginning of year (P=256,851) (P=225,977) (P=56,151)Net changes in fair value of derivatives:Designated as cash flow hedges (555) (239,094) (116,679)Not designated as cash flow hedges (190,444) 28,261 (27,631)(447,850) (436,810) (200,461)Less fair value of settled instruments (207,617) (179,959) 25,516At end of year (P=240,233) (P=256,851) (P=225,977)28.9 Hedge Effectiveness ResultsAs of December 31, 2012, 2011 and 2010, the effective fair value changes on the <strong>Globe</strong> Group’s cash flowhedges that were deferred in equity amounted to P=121.20 million, P=153.07 million, and P=115.83 million losses,net of tax, respectively. Total ineffectiveness for the years ended December 31, 2012, 2011 and 2010 isimmaterial.The distinction of the results of hedge accounting into “Effective” or “Ineffective” represent designations basedon PAS 39 and are not necessarily reflective of the economic effectiveness of the instruments.214 215