Download - Globe

Download - Globe

Download - Globe

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

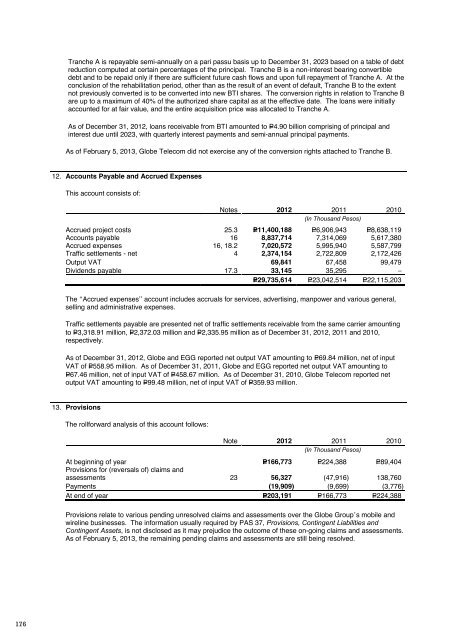

<strong>Globe</strong> 2012 annual reportfinancial reportTranche A is repayable semi-annually on a pari passu basis up to December 31, 2023 based on a table of debtreduction computed at certain percentages of the principal. Tranche B is a non-interest bearing convertibledebt and to be repaid only if there are sufficient future cash flows and upon full repayment of Tranche A. At theconclusion of the rehabilitation period, other than as the result of an event of default, Tranche B to the extentnot previously converted is to be converted into new BTI shares. The conversion rights in relation to Tranche Bare up to a maximum of 40% of the authorized share capital as at the effective date. The loans were initiallyaccounted for at fair value, and the entire acquisition price was allocated to Tranche A.As of December 31, 2012, loans receivable from BTI amounted to P=4.90 billion comprising of principal andinterest due until 2023, with quarterly interest payments and semi-annual principal payments.As of February 5, 2013, <strong>Globe</strong> Telecom did not exercise any of the conversion rights attached to Tranche B.12. Accounts Payable and Accrued ExpensesThis account consists of:Notes 2012 2011 2010(In Thousand Pesos)Accrued project costs 25.3 P=11,400,188 P=6,906,943 P=8,638,119Accounts payable 16 8,837,714 7,314,069 5,617,380Accrued expenses 16, 18.2 7,020,572 5,995,940 5,587,799Traffic settlements - net 4 2,374,154 2,722,809 2,172,426Output VAT 69,841 67,458 99,479Dividends payable 17.3 33,145 35,295 –P=29,735,614 P=23,042,514 P=22,115,203The “Accrued expenses” account includes accruals for services, advertising, manpower and various general,selling and administrative expenses.Traffic settlements payable are presented net of traffic settlements receivable from the same carrier amountingto P=3,318.91 million, P=2,372.03 million and P=2,335.95 million as of December 31, 2012, 2011 and 2010,respectively.As of December 31, 2012, <strong>Globe</strong> and EGG reported net output VAT amounting to P=69.84 million, net of inputVAT of P=558.95 million. As of December 31, 2011, <strong>Globe</strong> and EGG reported net output VAT amounting toP=67.46 million, net of input VAT of P=458.67 million. As of December 31, 2010, <strong>Globe</strong> Telecom reported netoutput VAT amounting to P=99.48 million, net of input VAT of P=359.93 million.13. ProvisionsThe rollforward analysis of this account follows:Note 2012 2011 2010(In Thousand Pesos)At beginning of year P=166,773 P=224,388 P=89,404Provisions for (reversals of) claims andassessments 23 56,327 (47,916) 138,760Payments (19,909) (9,699) (3,776)At end of year P=203,191 P=166,773 P=224,388Provisions relate to various pending unresolved claims and assessments over the <strong>Globe</strong> Group’s mobile andwireline businesses. The information usually required by PAS 37, Provisions, Contingent Liabilities andContingent Assets, is not disclosed as it may prejudice the outcome of these on-going claims and assessments.As of February 5, 2013, the remaining pending claims and assessments are still being resolved.14. Notes Payable and Long-term DebtNotes payable consist of short-term, unsecured US dollar and peso-denominated promissory notes from localbanks for working capital requirements amounting to P=2,053.90 million, which bears interest ranging from 1.12%to 1.65% and P=1,756.76 million, which bears interest ranging from 1.57% to 1.91% as of December 31, 2012and 2011, respectively. There is no outstanding notes payable as of December 31, 2010.Long-term debt consists of:2012 2011 2010(In Thousand Pesos)Banks:Local P=38,164,986 P=27,555,234 P=20,352,194Foreign 5,829,588 3,541,621 7,317,483Corporate notes 5,819,400 10,839,226 17,729,939Retail bonds 9,911,546 4,985,865 4,971,85459,725,520 46,921,946 50,371,470Less current portion 9,294,888 9,597,367 8,677,209P=50,430,632 P=37,324,579 P=41,694,261The maturities of long-term debt at nominal values, excluding unamortized debt issuance costs, as ofDecember 31, 2012 follow (amounts in thousands):Due in:2013 P=9,731,0792014 6,737,6342015 8,497,9452016 2,669,8502017 and thereafter 32,403,080P=60,039,588Unamortized debt issuance costs included in the above long-term debt as of December 31, 2012, 2011 and2010 amounted to P=314.07 million, P=212.03 million and P=279.24 million, respectively (see Note 28.2.3).Total interest expense recognized, excluding the capitalized interest, amounted to P=2,086.08 million,P=2,059.66 million and P=1,981.79 million in 2012, 2011 and 2010, respectively (see Notes 7 and 22).The interest rates and maturities of the above debt are as follows:MaturitiesInterest RatesBanks:Local 2013–2022 1.19% to 7.03% in 20121.42% to 7.03% in 20115.26% to 7.03% in 2010Foreign 2013–2022 1.83% to 4.19% in 20120.68% to 3.86% in 20110.74% to 4.13% in 2010Corporate notes 2013–2016 1.83% to 8.43% in 20122.78% to 8.43% in 20115.52% to 8.38% in 2010Retail bonds 2017–2019 5.75% to 6.00% in 20127.50% to 8.00% in 20117.50% to 8.00% in 2010176 177