Download - Globe

Download - Globe

Download - Globe

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

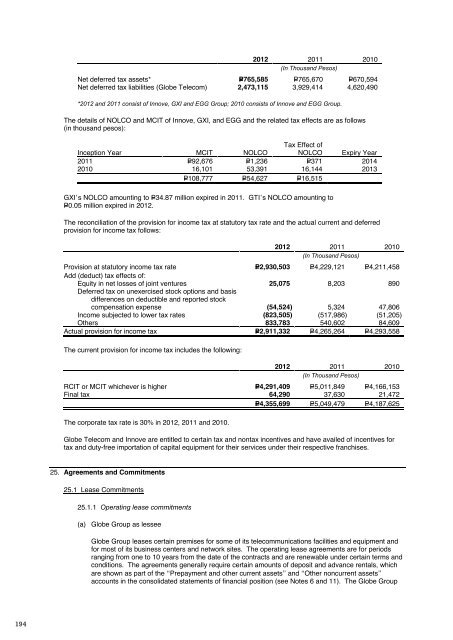

<strong>Globe</strong> 2012 annual reportfinancial report2012 2011 2010(In Thousand Pesos)Net deferred tax assets* P=765,585 P=765,670 P=670,594Net deferred tax liabilities (<strong>Globe</strong> Telecom) 2,473,115 3,929,414 4,620,490*2012 and 2011 consist of Innove, GXI and EGG Group; 2010 consists of Innove and EGG Group.The details of NOLCO and MCIT of Innove, GXI, and EGG and the related tax effects are as follows(in thousand pesos):Tax Effect ofInception Year MCIT NOLCO NOLCO Expiry Year2011 P=92,676 P=1,236 P=371 20142010 16,101 53,391 16,144 2013P=108,777 P=54,627 P=16,515GXI’s NOLCO amounting to P=34.87 million expired in 2011. GTI’s NOLCO amounting toP=0.05 million expired in 2012.The reconciliation of the provision for income tax at statutory tax rate and the actual current and deferredprovision for income tax follows:2012 2011 2010(In Thousand Pesos)Provision at statutory income tax rate P=2,930,503 P=4,229,121 P=4,211,458Add (deduct) tax effects of:Equity in net losses of joint ventures 25,075 8,203 890Deferred tax on unexercised stock options and basisdifferences on deductible and reported stockcompensation expense (54,524) 5,324 47,806Income subjected to lower tax rates (823,505) (517,986) (51,205)Others 833,783 540,602 84,609Actual provision for income tax P=2,911,332 P=4,265,264 P=4,293,558The current provision for income tax includes the following:2012 2011 2010(In Thousand Pesos)RCIT or MCIT whichever is higher P=4,291,409 P=5,011,849 P=4,166,153Final tax 64,290 37,630 21,472P=4,355,699 P=5,049,479 P=4,187,625The corporate tax rate is 30% in 2012, 2011 and 2010.<strong>Globe</strong> Telecom and Innove are entitled to certain tax and nontax incentives and have availed of incentives fortax and duty-free importation of capital equipment for their services under their respective franchises.25. Agreements and Commitments25.1 Lease Commitments25.1.1 Operating lease commitments(a) <strong>Globe</strong> Group as lessee<strong>Globe</strong> Group leases certain premises for some of its telecommunications facilities and equipment andfor most of its business centers and network sites. The operating lease agreements are for periodsranging from one to 10 years from the date of the contracts and are renewable under certain terms andconditions. The agreements generally require certain amounts of deposit and advance rentals, whichare shown as part of the “Prepayment and other current assets” and “Other noncurrent assets”accounts in the consolidated statements of financial position (see Notes 6 and 11). The <strong>Globe</strong> Groupalso has short term renewable leases on transmission cables and equipment. The <strong>Globe</strong> Group’srentals incurred on these various leases (included in “General, selling and administrative expenses”account in the consolidated statements of comprehensive income) amounted to P=3,153.51 million,P=2,830.38 million and P=2,808.91 million for the years ended December 31, 2012, 2011 and 2010,respectively (see Note 21).As of December 31, 2012, the future minimum lease payments under these operating leases are asfollows (in thousand pesos):Not later than one yearP=786,356After one year but not more than five years 4,799,558After five years 3,337,817P=8,923,731(b) <strong>Globe</strong> Group as lessor<strong>Globe</strong> Telecom and Innove have certain lease agreements on equipment and office spaces. Theoperating lease agreements are for periods ranging from one (1) to fourteen (14) years from the date ofcontracts. These include <strong>Globe</strong> Telecom’s lease agreement with C2C Pte. Ltd. (C2C) (see Note 25.4).Total lease income amounted to P=172.50 million for the years ended December 31, 2012, 2011 and2010, respectively (included in “Other income” account in the consolidated statements ofcomprehensive income).The future minimum lease receivables under these operating leases are as follows (in thousandpesos):Within one yearP=146,615After one year but not more than five years 329,884P=476,49925.1.2 Finance lease commitments<strong>Globe</strong> Group as lesseeThe <strong>Globe</strong> Group engaged the services of various suppliers for the upgrade of its wireless, data andtelephony network. In partnership with equipment and service providers and the appointment of a projectand program manager, <strong>Globe</strong> Group will undertake a transformation upgrade and overhaul of its businesssupport systems within the USD790.00 million modernization project.Part of the managed service engagement with the service provider is a lease for hardware infrastructureand information equipment valued over the seven-year term of the lease at P=785.00 million. Total leasepayments as of December 31, 2012, which is equivalent to one year advance lease, amounted toP=112.00 million. The managed service engagement has terms of renewal and purchase options, amongothers.Future minimum lease payments under finance leases with the present value of the net minimum leasepayments as of December 31, 2012 are as follows (in thousand pesos):MinimumpaymentsPresent value ofpaymentsWithin one year P=112,171 P=99,941After one year but not more than five years 448,684 417,878More than five years 224,342 220,267Total minimum lease payments 785,197 738,086Less amounts representing finance charges (47,111) –Present value of minimum lease payments P=738,086 P=738,086In addition, total payments to service providers based on the seven-year agreement for the maintenance ofservers, which includes application development and maintenance, service design, managed networkservices, office automation or end-user computing, service desk services and business supports systemsamounted to P=49.00 million as of December 31, 2012.194 195