DAP 2009/10 Final 1 - Taranaki District Health Board

DAP 2009/10 Final 1 - Taranaki District Health Board

DAP 2009/10 Final 1 - Taranaki District Health Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

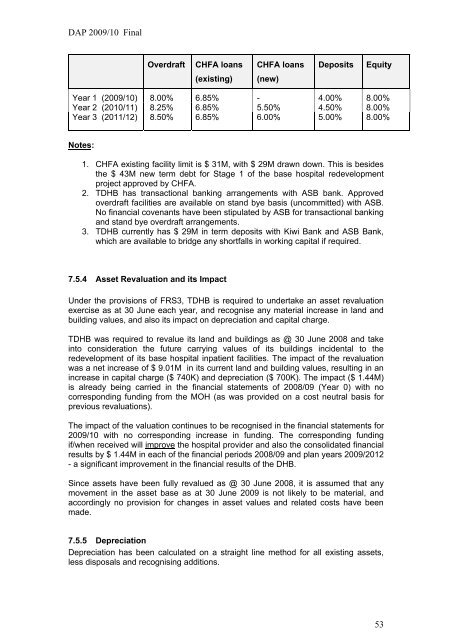

<strong>DAP</strong> <strong>2009</strong>/<strong>10</strong> <strong>Final</strong>OverdraftCHFA loansCHFA loansDepositsEquity(existing)(new)Year 1 (<strong>2009</strong>/<strong>10</strong>) 8.00% 6.85% - 4.00% 8.00%Year 2 (20<strong>10</strong>/11) 8.25% 6.85% 5.50% 4.50% 8.00%Year 3 (2011/12) 8.50% 6.85% 6.00% 5.00% 8.00%Notes:1. CHFA existing facility limit is $ 31M, with $ 29M drawn down. This is besidesthe $ 43M new term debt for Stage 1 of the base hospital redevelopmentproject approved by CHFA.2. TDHB has transactional banking arrangements with ASB bank. Approvedoverdraft facilities are available on stand bye basis (uncommitted) with ASB.No financial covenants have been stipulated by ASB for transactional bankingand stand bye overdraft arrangements.3. TDHB currently has $ 29M in term deposits with Kiwi Bank and ASB Bank,which are available to bridge any shortfalls in working capital if required.7.5.4 Asset Revaluation and its ImpactUnder the provisions of FRS3, TDHB is required to undertake an asset revaluationexercise as at 30 June each year, and recognise any material increase in land andbuilding values, and also its impact on depreciation and capital charge.TDHB was required to revalue its land and buildings as @ 30 June 2008 and takeinto consideration the future carrying values of its buildings incidental to theredevelopment of its base hospital inpatient facilities. The impact of the revaluationwas a net increase of $ 9.01M in its current land and building values, resulting in anincrease in capital charge ($ 740K) and depreciation ($ 700K). The impact ($ 1.44M)is already being carried in the financial statements of 2008/09 (Year 0) with nocorresponding funding from the MOH (as was provided on a cost neutral basis forprevious revaluations).The impact of the valuation continues to be recognised in the financial statements for<strong>2009</strong>/<strong>10</strong> with no corresponding increase in funding. The corresponding fundingif/when received will improve the hospital provider and also the consolidated financialresults by $ 1.44M in each of the financial periods 2008/09 and plan years <strong>2009</strong>/2012- a significant improvement in the financial results of the DHB.Since assets have been fully revalued as @ 30 June 2008, it is assumed that anymovement in the asset base as at 30 June <strong>2009</strong> is not likely to be material, andaccordingly no provision for changes in asset values and related costs have beenmade.7.5.5 DepreciationDepreciation has been calculated on a straight line method for all existing assets,less disposals and recognising additions.53