DAP 2009/10 Final 1 - Taranaki District Health Board

DAP 2009/10 Final 1 - Taranaki District Health Board

DAP 2009/10 Final 1 - Taranaki District Health Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

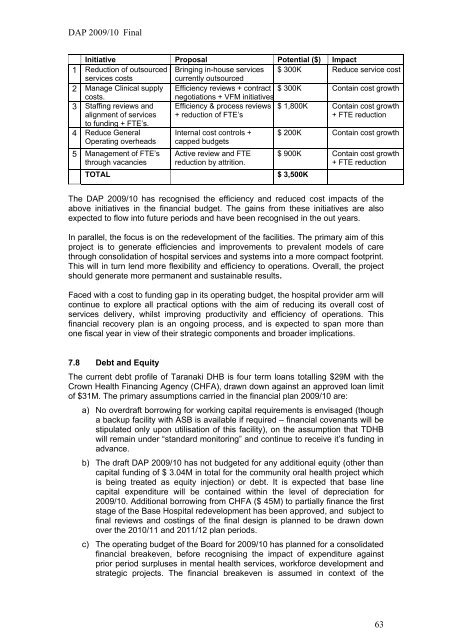

<strong>DAP</strong> <strong>2009</strong>/<strong>10</strong> <strong>Final</strong>Initiative Proposal Potential ($) Impact1 Reduction of outsourced s Bringing in-house services $ 300K Reduce service costservices costscurrently outsourced2 Manage Clinical supply Efficiency reviews + contract $ 300K Contain cost growthcosts.negotiations + VFM initiatives3 Staffing reviews andalignment of servicesto funding + FTE’s.Efficiency & process reviews+ reduction of FTE’s$ 1,800K Contain cost growth+ FTE reduction4 Reduce GeneralOperating overheads5 Management of FTE’sthrough vacanciesInternal cost controls +capped budgetsActive review and FTEreduction by attrition.TOTAL $ 3,500K$ 200K Contain cost growth$ 900K Contain cost growth+ FTE reductionThe <strong>DAP</strong> <strong>2009</strong>/<strong>10</strong> has recognised the efficiency and reduced cost impacts of theabove initiatives in the financial budget. The gains from these initiatives are alsoexpected to flow into future periods and have been recognised in the out years.In parallel, the focus is on the redevelopment of the facilities. The primary aim of thisproject is to generate efficiencies and improvements to prevalent models of carethrough consolidation of hospital services and systems into a more compact footprint.This will in turn lend more flexibility and efficiency to operations. Overall, the projectshould generate more permanent and sustainable results.Faced with a cost to funding gap in its operating budget, the hospital provider arm willcontinue to explore all practical options with the aim of reducing its overall cost ofservices delivery, whilst improving productivity and efficiency of operations. Thisfinancial recovery plan is an ongoing process, and is expected to span more thanone fiscal year in view of their strategic components and broader implications.7.8 Debt and EquityThe current debt profile of <strong>Taranaki</strong> DHB is four term loans totalling $29M with theCrown <strong>Health</strong> Financing Agency (CHFA), drawn down against an approved loan limitof $31M. The primary assumptions carried in the financial plan <strong>2009</strong>/<strong>10</strong> are:a) No overdraft borrowing for working capital requirements is envisaged (thougha backup facility with ASB is available if required – financial covenants will bestipulated only upon utilisation of this facility), on the assumption that TDHBwill remain under “standard monitoring” and continue to receive it’s funding inadvance.b) The draft <strong>DAP</strong> <strong>2009</strong>/<strong>10</strong> has not budgeted for any additional equity (other thancapital funding of $ 3.04M in total for the community oral health project whichis being treated as equity injection) or debt. It is expected that base linecapital expenditure will be contained within the level of depreciation for<strong>2009</strong>/<strong>10</strong>. Additional borrowing from CHFA ($ 45M) to partially finance the firststage of the Base Hospital redevelopment has been approved, and subject tofinal reviews and costings of the final design is planned to be drawn downover the 20<strong>10</strong>/11 and 2011/12 plan periods.c) The operating budget of the <strong>Board</strong> for <strong>2009</strong>/<strong>10</strong> has planned for a consolidatedfinancial breakeven, before recognising the impact of expenditure againstprior period surpluses in mental health services, workforce development andstrategic projects. The financial breakeven is assumed in context of the63