DAP 2009/10 Final 1 - Taranaki District Health Board

DAP 2009/10 Final 1 - Taranaki District Health Board

DAP 2009/10 Final 1 - Taranaki District Health Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

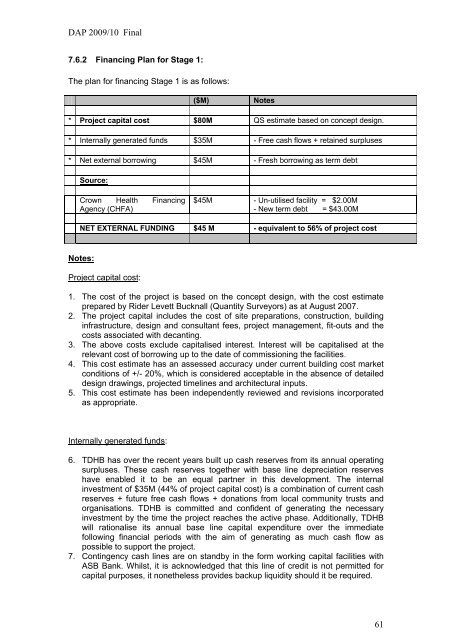

<strong>DAP</strong> <strong>2009</strong>/<strong>10</strong> <strong>Final</strong>7.6.2 Financing Plan for Stage 1:The plan for financing Stage 1 is as follows:($M)Notes* Project capital cost $80M QS estimate based on concept design.* Internally generated funds $35M - Free cash flows + retained surpluses* Net external borrowing $45M - Fresh borrowing as term debtSource:Crown <strong>Health</strong> FinancingAgency (CHFA)$45M - Un-utilised facility = $2.00M- New term debt = $43.00MNET EXTERNAL FUNDING $45 M - equivalent to 56% of project costNotes:Project capital cost:1. The cost of the project is based on the concept design, with the cost estimateprepared by Rider Levett Bucknall (Quantity Surveyors) as at August 2007.2. The project capital includes the cost of site preparations, construction, buildinginfrastructure, design and consultant fees, project management, fit-outs and thecosts associated with decanting.3. The above costs exclude capitalised interest. Interest will be capitalised at therelevant cost of borrowing up to the date of commissioning the facilities.4. This cost estimate has an assessed accuracy under current building cost marketconditions of +/- 20%, which is considered acceptable in the absence of detaileddesign drawings, projected timelines and architectural inputs.5. This cost estimate has been independently reviewed and revisions incorporatedas appropriate.Internally generated funds:6. TDHB has over the recent years built up cash reserves from its annual operatingsurpluses. These cash reserves together with base line depreciation reserveshave enabled it to be an equal partner in this development. The internalinvestment of $35M (44% of project capital cost) is a combination of current cashreserves + future free cash flows + donations from local community trusts andorganisations. TDHB is committed and confident of generating the necessaryinvestment by the time the project reaches the active phase. Additionally, TDHBwill rationalise its annual base line capital expenditure over the immediatefollowing financial periods with the aim of generating as much cash flow aspossible to support the project.7. Contingency cash lines are on standby in the form working capital facilities withASB Bank. Whilst, it is acknowledged that this line of credit is not permitted forcapital purposes, it nonetheless provides backup liquidity should it be required.61