Statement on Equalisation for GMPs AND the application of a ...

Statement on Equalisation for GMPs AND the application of a ...

Statement on Equalisation for GMPs AND the application of a ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

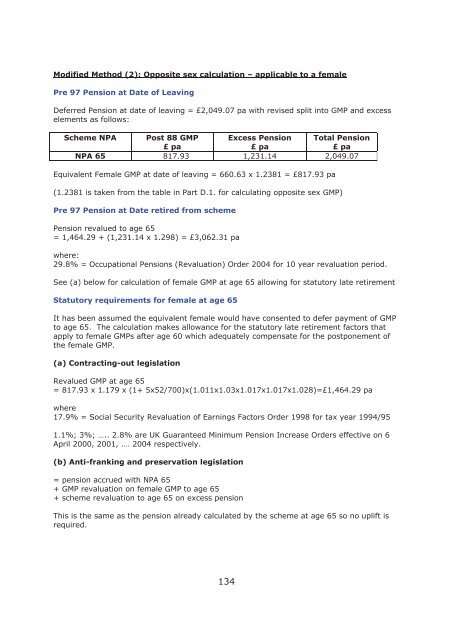

Modified Method (2): Opposite sex calculati<strong>on</strong> – applicable to a femalePre 97 Pensi<strong>on</strong> at Date <strong>of</strong> LeavingDeferred Pensi<strong>on</strong> at date <strong>of</strong> leaving = £2,049.07 pa with revised split into GMP and excesselements as follows:Scheme NPA Post 88 GMP Excess Pensi<strong>on</strong> Total Pensi<strong>on</strong>£ pa£ pa£ paNPA 65 817.93 1,231.14 2,049.07Equivalent Female GMP at date <strong>of</strong> leaving = 660.63 x 1.2381 = £817.93 pa(1.2381 is taken from <strong>the</strong> table in Part D.1. <strong>for</strong> calculating opposite sex GMP)Pre 97 Pensi<strong>on</strong> at Date retired from schemePensi<strong>on</strong> revalued to age 65= 1,464.29 + (1,231.14 x 1.298) = £3,062.31 pawhere:29.8% = Occupati<strong>on</strong>al Pensi<strong>on</strong>s (Revaluati<strong>on</strong>) Order 2004 <strong>for</strong> 10 year revaluati<strong>on</strong> period.See (a) below <strong>for</strong> calculati<strong>on</strong> <strong>of</strong> female GMP at age 65 allowing <strong>for</strong> statutory late retirementStatutory requirements <strong>for</strong> female at age 65It has been assumed <strong>the</strong> equivalent female would have c<strong>on</strong>sented to defer payment <strong>of</strong> GMPto age 65. The calculati<strong>on</strong> makes allowance <strong>for</strong> <strong>the</strong> statutory late retirement factors thatapply to female <strong>GMPs</strong> after age 60 which adequately compensate <strong>for</strong> <strong>the</strong> postp<strong>on</strong>ement <strong>of</strong><strong>the</strong> female GMP.(a) C<strong>on</strong>tracting-out legislati<strong>on</strong>Revalued GMP at age 65= 817.93 x 1.179 x (1+ 5x52/700)x(1.011x1.03x1.017x1.017x1.028)=£1,464.29 pawhere17.9% = Social Security Revaluati<strong>on</strong> <strong>of</strong> Earnings Factors Order 1998 <strong>for</strong> tax year 1994/951.1%; 3%; ….. 2.8% are UK Guaranteed Minimum Pensi<strong>on</strong> Increase Orders effective <strong>on</strong> 6April 2000, 2001, .… 2004 respectively.(b) Anti-franking and preservati<strong>on</strong> legislati<strong>on</strong>= pensi<strong>on</strong> accrued with NPA 65+ GMP revaluati<strong>on</strong> <strong>on</strong> female GMP to age 65+ scheme revaluati<strong>on</strong> to age 65 <strong>on</strong> excess pensi<strong>on</strong>This is <strong>the</strong> same as <strong>the</strong> pensi<strong>on</strong> already calculated by <strong>the</strong> scheme at age 65 so no uplift isrequired.134