Statement on Equalisation for GMPs AND the application of a ...

Statement on Equalisation for GMPs AND the application of a ...

Statement on Equalisation for GMPs AND the application of a ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

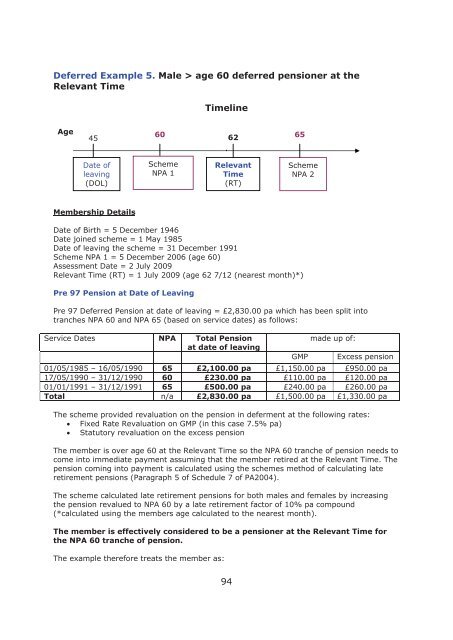

Deferred Example 5. Male > age 60 deferred pensi<strong>on</strong>er at <strong>the</strong>Relevant TimeTimelineAge 60456265Date <strong>of</strong>leaving(DOL)SchemeNPA 1RelevantTime(RT)SchemeNPA 2Membership DetailsDate <strong>of</strong> Birth = 5 December 1946Date joined scheme = 1 May 1985Date <strong>of</strong> leaving <strong>the</strong> scheme = 31 December 1991Scheme NPA 1 = 5 December 2006 (age 60)Assessment Date = 2 July 2009Relevant Time (RT) = 1 July 2009 (age 62 7/12 (nearest m<strong>on</strong>th)*)Pre 97 Pensi<strong>on</strong> at Date <strong>of</strong> LeavingPre 97 Deferred Pensi<strong>on</strong> at date <strong>of</strong> leaving = £2,830.00 pa which has been split intotranches NPA 60 and NPA 65 (based <strong>on</strong> service dates) as follows:Service Dates NPA Total Pensi<strong>on</strong>at date <strong>of</strong> leavingGMPmade up <strong>of</strong>:Excess pensi<strong>on</strong>01/05/1985 – 16/05/1990 65 £2,100.00 pa £1,150.00 pa £950.00 pa17/05/1990 – 31/12/1990 60 £230.00 pa £110.00 pa £120.00 pa01/01/1991 – 31/12/1991 65 £500.00 pa £240.00 pa £260.00 paTotal n/a £2,830.00 pa £1,500.00 pa £1,330.00 paThe scheme provided revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> pensi<strong>on</strong> in deferment at <strong>the</strong> following rates: Fixed Rate Revaluati<strong>on</strong> <strong>on</strong> GMP (in this case 7.5% pa) Statutory revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> excess pensi<strong>on</strong>The member is over age 60 at <strong>the</strong> Relevant Time so <strong>the</strong> NPA 60 tranche <strong>of</strong> pensi<strong>on</strong> needs tocome into immediate payment assuming that <strong>the</strong> member retired at <strong>the</strong> Relevant Time. Thepensi<strong>on</strong> coming into payment is calculated using <strong>the</strong> schemes method <strong>of</strong> calculating lateretirement pensi<strong>on</strong>s (Paragraph 5 <strong>of</strong> Schedule 7 <strong>of</strong> PA2004).The scheme calculated late retirement pensi<strong>on</strong>s <strong>for</strong> both males and females by increasing<strong>the</strong> pensi<strong>on</strong> revalued to NPA 60 by a late retirement factor <strong>of</strong> 10% pa compound(*calculated using <strong>the</strong> members age calculated to <strong>the</strong> nearest m<strong>on</strong>th).The member is effectively c<strong>on</strong>sidered to be a pensi<strong>on</strong>er at <strong>the</strong> Relevant Time <strong>for</strong><strong>the</strong> NPA 60 tranche <strong>of</strong> pensi<strong>on</strong>.The example <strong>the</strong>re<strong>for</strong>e treats <strong>the</strong> member as:94