Statement on Equalisation for GMPs AND the application of a ...

Statement on Equalisation for GMPs AND the application of a ...

Statement on Equalisation for GMPs AND the application of a ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

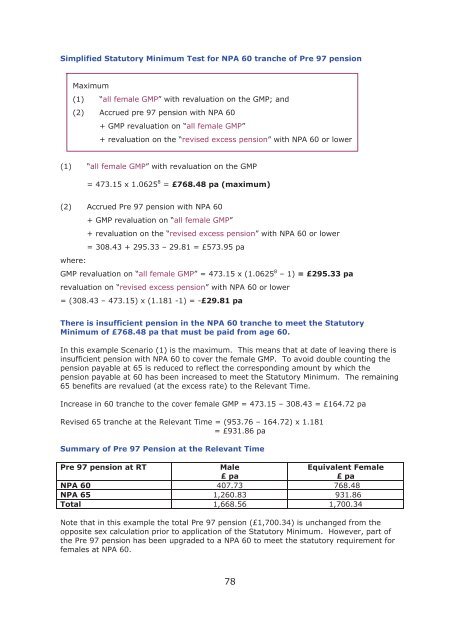

Simplified Statutory Minimum Test <strong>for</strong> NPA 60 tranche <strong>of</strong> Pre 97 pensi<strong>on</strong>Maximum(1) “all female GMP” with revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> GMP; and(2) Accrued pre 97 pensi<strong>on</strong> with NPA 60+ GMP revaluati<strong>on</strong> <strong>on</strong> “all female GMP”+ revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> “revised excess pensi<strong>on</strong>” with NPA 60 or lower(1) “all female GMP” with revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> GMP= 473.15 x 1.0625 8 = £768.48 pa (maximum)(2) Accrued Pre 97 pensi<strong>on</strong> with NPA 60+ GMP revaluati<strong>on</strong> <strong>on</strong> “all female GMP”+ revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> “revised excess pensi<strong>on</strong>” with NPA 60 or lower= 308.43 + 295.33 – 29.81 = £573.95 pawhere:GMP revaluati<strong>on</strong> <strong>on</strong> “all female GMP” = 473.15 x (1.0625 8 – 1) = £295.33 parevaluati<strong>on</strong> <strong>on</strong> “revised excess pensi<strong>on</strong>” with NPA 60 or lower= (308.43 – 473.15) x (1.181 -1) = -£29.81 paThere is insufficient pensi<strong>on</strong> in <strong>the</strong> NPA 60 tranche to meet <strong>the</strong> StatutoryMinimum <strong>of</strong> £768.48 pa that must be paid from age 60.In this example Scenario (1) is <strong>the</strong> maximum. This means that at date <strong>of</strong> leaving <strong>the</strong>re isinsufficient pensi<strong>on</strong> with NPA 60 to cover <strong>the</strong> female GMP. To avoid double counting <strong>the</strong>pensi<strong>on</strong> payable at 65 is reduced to reflect <strong>the</strong> corresp<strong>on</strong>ding amount by which <strong>the</strong>pensi<strong>on</strong> payable at 60 has been increased to meet <strong>the</strong> Statutory Minimum. The remaining65 benefits are revalued (at <strong>the</strong> excess rate) to <strong>the</strong> Relevant Time.Increase in 60 tranche to <strong>the</strong> cover female GMP = 473.15 – 308.43 = £164.72 paRevised 65 tranche at <strong>the</strong> Relevant Time = (953.76 – 164.72) x 1.181= £931.86 paSummary <strong>of</strong> Pre 97 Pensi<strong>on</strong> at <strong>the</strong> Relevant TimePre 97 pensi<strong>on</strong> at RTMale£ paEquivalent Female£ paNPA 60 407.73 768.48NPA 65 1,260.83 931.86Total 1,668.56 1,700.34Note that in this example <strong>the</strong> total Pre 97 pensi<strong>on</strong> (£1,700.34) is unchanged from <strong>the</strong>opposite sex calculati<strong>on</strong> prior to applicati<strong>on</strong> <strong>of</strong> <strong>the</strong> Statutory Minimum. However, part <strong>of</strong><strong>the</strong> Pre 97 pensi<strong>on</strong> has been upgraded to a NPA 60 to meet <strong>the</strong> statutory requirement <strong>for</strong>females at NPA 60.78