Statement on Equalisation for GMPs AND the application of a ...

Statement on Equalisation for GMPs AND the application of a ...

Statement on Equalisation for GMPs AND the application of a ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

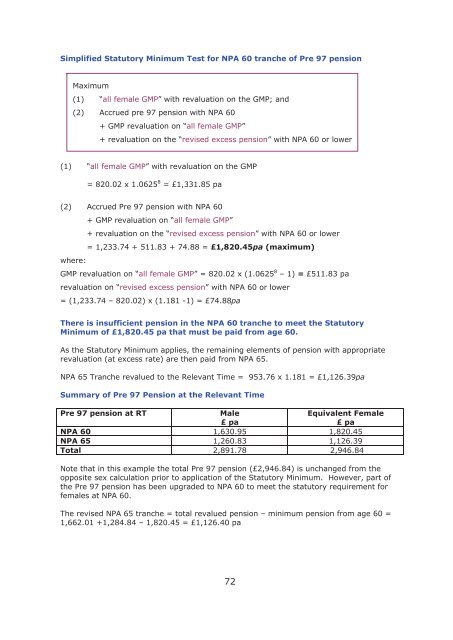

Simplified Statutory Minimum Test <strong>for</strong> NPA 60 tranche <strong>of</strong> Pre 97 pensi<strong>on</strong>Maximum(1) “all female GMP” with revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> GMP; and(2) Accrued pre 97 pensi<strong>on</strong> with NPA 60+ GMP revaluati<strong>on</strong> <strong>on</strong> “all female GMP”+ revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> “revised excess pensi<strong>on</strong>” with NPA 60 or lower(1) “all female GMP” with revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> GMP= 820.02 x 1.0625 8 = £1,331.85 pa(2) Accrued Pre 97 pensi<strong>on</strong> with NPA 60+ GMP revaluati<strong>on</strong> <strong>on</strong> “all female GMP”+ revaluati<strong>on</strong> <strong>on</strong> <strong>the</strong> “revised excess pensi<strong>on</strong>” with NPA 60 or lower= 1,233.74 + 511.83 + 74.88 = £1,820.45pa (maximum)where:GMP revaluati<strong>on</strong> <strong>on</strong> “all female GMP” = 820.02 x (1.0625 8 – 1) = £511.83 parevaluati<strong>on</strong> <strong>on</strong> “revised excess pensi<strong>on</strong>” with NPA 60 or lower= (1,233.74 – 820.02) x (1.181 -1) = £74.88paThere is insufficient pensi<strong>on</strong> in <strong>the</strong> NPA 60 tranche to meet <strong>the</strong> StatutoryMinimum <strong>of</strong> £1,820.45 pa that must be paid from age 60.As <strong>the</strong> Statutory Minimum applies, <strong>the</strong> remaining elements <strong>of</strong> pensi<strong>on</strong> with appropriaterevaluati<strong>on</strong> (at excess rate) are <strong>the</strong>n paid from NPA 65.NPA 65 Tranche revalued to <strong>the</strong> Relevant Time = 953.76 x 1.181 = £1,126.39paSummary <strong>of</strong> Pre 97 Pensi<strong>on</strong> at <strong>the</strong> Relevant TimePre 97 pensi<strong>on</strong> at RTMale£ paEquivalent Female£ paNPA 60 1,630.95 1,820.45NPA 65 1,260.83 1,126.39Total 2,891.78 2,946.84Note that in this example <strong>the</strong> total Pre 97 pensi<strong>on</strong> (£2,946.84) is unchanged from <strong>the</strong>opposite sex calculati<strong>on</strong> prior to applicati<strong>on</strong> <strong>of</strong> <strong>the</strong> Statutory Minimum. However, part <strong>of</strong><strong>the</strong> Pre 97 pensi<strong>on</strong> has been upgraded to NPA 60 to meet <strong>the</strong> statutory requirement <strong>for</strong>females at NPA 60.The revised NPA 65 tranche = total revalued pensi<strong>on</strong> – minimum pensi<strong>on</strong> from age 60 =1,662.01 +1,284.84 – 1,820.45 = £1,126.40 pa72