Annual Report 2005

Annual Report 2005

Annual Report 2005

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

80<br />

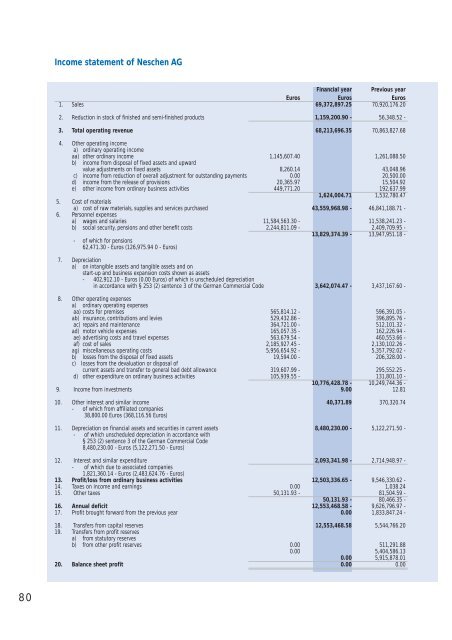

Income statement of Neschen AG<br />

Financial year Previous year<br />

Euros Euros Euros<br />

1. Sales 69,372,897.25 70,920,176.20<br />

2. Reduction in stock of finished and semi-finished products 1,159,200.90 - 56,348.52 -<br />

3. Total operating revenue 68,213,696.35 70,863,827.68<br />

4. Other operating income<br />

a) ordinary operating income<br />

aa) other ordinary income 1,145,607.40 1,261,088.50<br />

b) income from disposal of fixed assets and upward<br />

value adjustments on fixed assets 8,260.14 43,048.96<br />

c) income from reduction of overall adjustment for outstanding payments 0.00 20,500.00<br />

d) income from the release of provisions 20,365.97 15,504.92<br />

e) other income from ordinary business activities 449,771.20 192,637.99<br />

1,624,004.71 1,532,780.47<br />

5. Cost of materials<br />

a) cost of raw materials, supplies and services purchased 43,559,968.98 - 46,841,188.71 -<br />

6. Personnel expenses<br />

a) wages and salaries 11,584,563.30 - 11,538,241.23 -<br />

b) social security, pensions and other benefit costs 2,244,811.09 - 2,409,709.95 -<br />

13,829,374.39 - 13,947,951.18 -<br />

- of which for pensions<br />

62,471.30 - Euros (126,975.94 0 - Euros)<br />

7. Depreciation<br />

a) on intangible assets and tangible assets and on<br />

start-up and business expansion costs shown as assets<br />

- 402,912.10 - Euros (0.00 Euros) of which is unscheduled depreciation<br />

in accordance with § 253 (2) sentence 3 of the German Commercial Code 3,642,074.47 - 3,437,167.60 -<br />

8. Other operating expenses<br />

a) ordinary operating expenses<br />

aa) costs for premises 565,814.12 - 596,391.05 -<br />

ab) insurance, contributions and levies 529,432.86 - 396,895.76 -<br />

ac) repairs and maintenance 364,721.00 - 512,101.32 -<br />

ad) motor vehicle expenses 165,057.35 - 162,226.94 -<br />

ae) advertising costs and travel expenses 563,679.54 - 460,553.66 -<br />

af) cost of sales 2,185,927.45 - 2,130,102.26 -<br />

ag) miscellaneous operating costs 5,956,654.92 - 5,357,792.02 -<br />

b) losses from the disposal of fixed assets 19,594.00 - 206,328.00 -<br />

c) losses from the devaluation or disposal of<br />

current assets and transfer to general bad debt allowance 319,607.99 - 295,552.25 -<br />

d) other expenditure on ordinary business activities 105,939.55 - 131,801.10 -<br />

10,776,428.78 - 10,249,744.36 -<br />

9. Income from investments 9.00 12.81<br />

10. Other interest and similar income 40,371.89 370,320.74<br />

- of which from affiliated companies<br />

38,800.00 Euros (368,116.56 Euros)<br />

11. Depreciation on financial assets and securities in current assets 8,480,230.00 - 5,122,271.50 -<br />

- of which unscheduled depreciation in accordance with<br />

§ 253 (2) sentence 3 of the German Commercial Code<br />

8,480,230.00 - Euros (5,122,271.50 - Euros)<br />

12. Interest and similar expenditure 2,093,341.98 - 2,714,948.97 -<br />

- of which due to associated companies<br />

1,821,360.14 - Euros (2,483,624.76 - Euros)<br />

13. Profit/loss from ordinary business activities 12,503,336.65 - 9,546,330.62 -<br />

14. Taxes on income and earnings 0.00 1,038.24<br />

15. Other taxes 50,131.93 - 81,504.59 -<br />

50,131.93 - 80,466.35 -<br />

16. <strong>Annual</strong> deficit 12,553,468.58 - 9,626,796.97 -<br />

17. Profit brought forward from the previous year 0.00 1,833,847.24 -<br />

18. Transfers from capital reserves 12,553,468.58 5,544,766.20<br />

19. Transfers from profit reserves<br />

a) from statutory reserves<br />

b) from other profit reserves 0.00 511,291.88<br />

0.00 5,404,586.13<br />

0.00 5,915,878.01<br />

20. Balance sheet profit 0.00 0.00