Comprehensive Annual Financial Report for the ... - WMATA.com

Comprehensive Annual Financial Report for the ... - WMATA.com

Comprehensive Annual Financial Report for the ... - WMATA.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

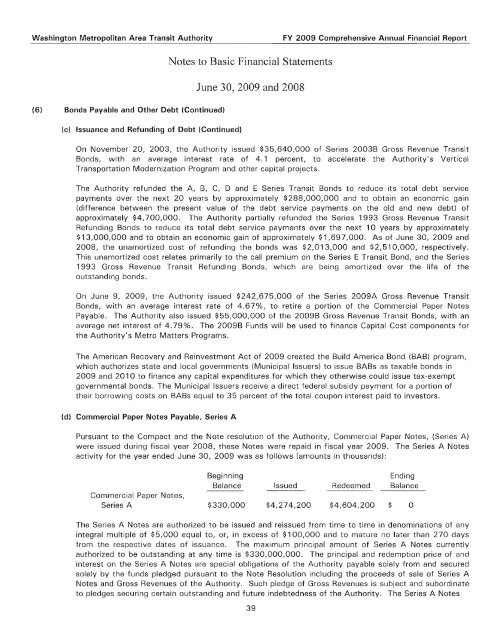

Washington Metropolitan Area Transit AuthorityFY 2009 <strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong>Notes to Basic <strong>Financial</strong> StatementsJune 30, 2009 and 2008(6) Bonds Payable and O<strong>the</strong>r Debt (Continued)(c)Issuance and Refunding of Debt (Continued)On November 20, 2003, <strong>the</strong> Authority issued $35,640,000 of Series 2003B Gross Revenue TransitBonds, with an average interest rate of 4.1 percent, to accelerate <strong>the</strong> Authority's VerticalTransportation Modernization Program and o<strong>the</strong>r capital projects.The Authority refunded <strong>the</strong> A, B, C, D and E Series Transit Bonds to reduce its total debt servicepayments over <strong>the</strong> next 20 years by approximately $288,000,000 and to obtain an economic gain(difference between <strong>the</strong> present value of <strong>the</strong> debt service payments on <strong>the</strong> old and new debt) ofapproximately $4,700,000. The Authority partially refunded <strong>the</strong> Series 1993 Gross Revenue TransitRefunding Bonds to reduce its total debt service payments over <strong>the</strong> next 10 years by approximately$13,000,000 and to obtain an economic gain of approximately $1,697,000. As of June 30, 2009 and2008, <strong>the</strong> unamortized cost of refunding <strong>the</strong> bonds was $2,013,000 and $2,510,000, respectively.This unamortized cost relates primarily to <strong>the</strong> call premium on <strong>the</strong> Series E Transit Bond, and <strong>the</strong> Series1993 Gross Revenue Transit Refunding Bonds, which are being amortized over <strong>the</strong> life of <strong>the</strong>outstanding bonds.On June 9, 2009, <strong>the</strong> Authority issued $242,675,000 of <strong>the</strong> Series 2009A Gross Revenue TransitBonds, with an average interest rate of 4.67%, to retire a portion of <strong>the</strong> Commercial Paper NotesPayable. The Authority also issued $55,000,000 of <strong>the</strong> 2009B Gross Revenue Transit Bonds, with anaverage net interest of 4.79%. The 2009B Funds will be used to finance Capital Cost <strong>com</strong>ponents <strong>for</strong><strong>the</strong> Authority's Metro Matters Programs.The American Recovery and Reinvestment Act of 2009 created <strong>the</strong> Build America Bond (BAB) program,which authorizes state and local governments (Municipal Issuers) to issue BABs as taxable bonds in2009 and 2010 to finance any capital expenditures <strong>for</strong> which <strong>the</strong>y o<strong>the</strong>rwise could issue tax-exemptgovernmental bonds. The Municipal Issuers receive a direct federal subsidy payment <strong>for</strong> a portion of<strong>the</strong>ir borrowing costs on BABs equal to 35 percent of <strong>the</strong> total coupon interest paid to investors.(d) Commercial Paper Notes Payable, Series APursuant to <strong>the</strong> Compact and <strong>the</strong> Note resolution of <strong>the</strong> Authority, Commercial Paper Notes, (Series A)were issued during fiscal year 2008, <strong>the</strong>se Notes were repaid in fiscal year 2009. The Series A Notesactivity <strong>for</strong> <strong>the</strong> year ended June 30, 2009 was as follows (amounts in thousands):BeginningBalance Issued RedeemedEndingBalanceCommercial Paper Notes,Series A $330,000 $4,274,200 $4,604,200 $ oThe Series A Notes are authorized to be issued and reissued from time to time in denominations of anyintegral multiple of $5,000 equal to, or, in excess of $100,000 and to mature no later than 270 daysfrom <strong>the</strong> respective dates of issuance. The maximum principal amount of Series A Notes currentlyauthorized to be outstanding at any time is $330,000,000. The principal and redemption price of andinterest on <strong>the</strong> Series A Notes are special obligations of <strong>the</strong> Authority payable solely from and securedsolely by <strong>the</strong> funds pledged pursuant to <strong>the</strong> Note Resolution including <strong>the</strong> proceeds of sale of Series ANotes and Gross Revenues of <strong>the</strong> Authority. Such pledge of Gross Revenues is subject and subordinateto pledges securing certain outstanding and future indebtedness of <strong>the</strong> Authority. The Series A Notes39