Download

Download

Download

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

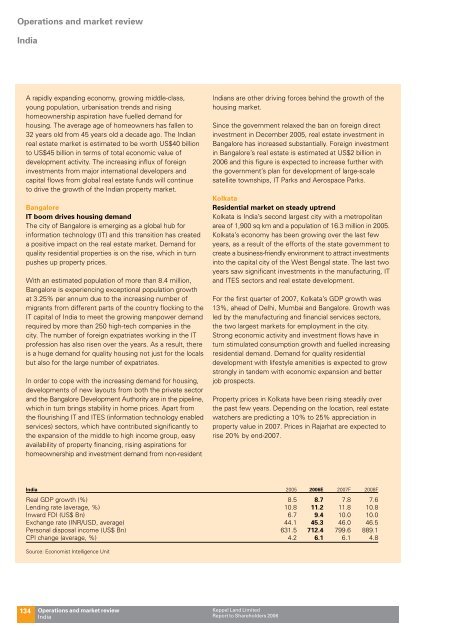

Operations and market reviewIndiaA rapidly expanding economy, growing middle-class,young population, urbanisation trends and risinghomeownership aspiration have fuelled demand forhousing. The average age of homeowners has fallen to32 years old from 45 years old a decade ago. The Indianreal estate market is estimated to be worth US$40 billionto US$45 billion in terms of total economic value ofdevelopment activity. The increasing influx of foreigninvestments from major international developers andcapital flows from global real estate funds will continueto drive the growth of the Indian property market.BangaloreIT boom drives housing demandThe city of Bangalore is emerging as a global hub forinformation technology (IT) and this transition has createda positive impact on the real estate market. Demand forquality residential properties is on the rise, which in turnpushes up property prices.With an estimated population of more than 8.4 million,Bangalore is experiencing exceptional population growthat 3.25% per annum due to the increasing number ofmigrants from different parts of the country flocking to theIT capital of India to meet the growing manpower demandrequired by more than 250 high-tech companies in thecity. The number of foreign expatriates working in the ITprofession has also risen over the years. As a result, thereis a huge demand for quality housing not just for the localsbut also for the large number of expatriates.In order to cope with the increasing demand for housing,developments of new layouts from both the private sectorand the Bangalore Development Authority are in the pipeline,which in turn brings stability in home prices. Apart fromthe flourishing IT and ITES (information technology enabledservices) sectors, which have contributed significantly tothe expansion of the middle to high income group, easyavailability of property financing, rising aspirations forhomeownership and investment demand from non-residentIndians are other driving forces behind the growth of thehousing market.Since the government relaxed the ban on foreign directinvestment in December 2005, real estate investment inBangalore has increased substantially. Foreign investmentin Bangalore’s real estate is estimated at US$2 billion in2006 and this figure is expected to increase further withthe government’s plan for development of large-scalesatellite townships, IT Parks and Aerospace Parks.KolkataResidential market on steady uptrendKolkata is India’s second largest city with a metropolitanarea of 1,900 sq km and a population of 16.3 million in 2005.Kolkata’s economy has been growing over the last fewyears, as a result of the efforts of the state government tocreate a business-friendly environment to attract investmentsinto the capital city of the West Bengal state. The last twoyears saw significant investments in the manufacturing, ITand ITES sectors and real estate development.For the first quarter of 2007, Kolkata’s GDP growth was13%, ahead of Delhi, Mumbai and Bangalore. Growth wasled by the manufacturing and financial services sectors,the two largest markets for employment in the city.Strong economic activity and investment flows have inturn stimulated consumption growth and fuelled increasingresidential demand. Demand for quality residentialdevelopment with lifestyle amenities is expected to growstrongly in tandem with economic expansion and betterjob prospects.Property prices in Kolkata have been rising steadily overthe past few years. Depending on the location, real estatewatchers are predicting a 10% to 25% appreciation inproperty value in 2007. Prices in Rajarhat are expected torise 20% by end-2007.India 2005 2006E 2007F 2008FReal GDP growth (%) 8.5 8.7 7.8 7.6Lending rate (average, %) 10.8 11.2 11.8 10.8Inward FDI (US$ Bn) 6.7 9.4 10.0 10.0Exchange rate (INR/USD, average) 44.1 45.3 46.0 46.5Personal disposal income (US$ Bn) 631.5 712.4 799.6 889.1CPI change (average, %) 4.2 6.1 6.1 4.8Source: Economist Intelligence Unit134Operations and market reviewIndiaKeppel Land LimitedReport to Shareholders 2006