Download

Download

Download

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

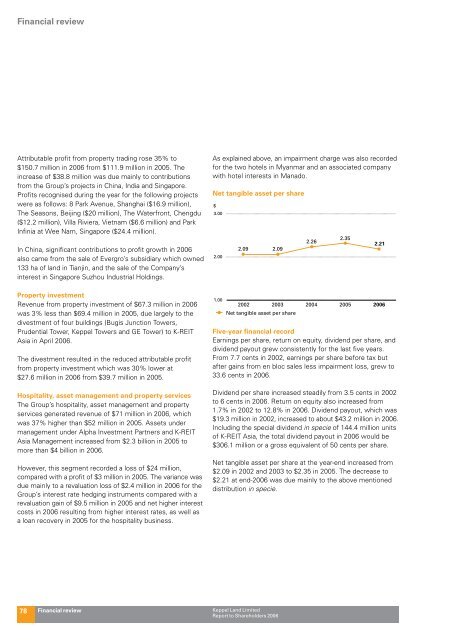

Financial reviewAttributable profit from property trading rose 35% to$150.7 million in 2006 from $111.9 million in 2005. Theincrease of $38.8 million was due mainly to contributionsfrom the Group’s projects in China, India and Singapore.Profits recognised during the year for the following projectswere as follows: 8 Park Avenue, Shanghai ($16.9 million),The Seasons, Beijing ($20 million), The Waterfront, Chengdu($12.2 million), Villa Riviera, Vietnam ($6.6 million) and ParkInfinia at Wee Nam, Singapore ($24.4 million).In China, significant contributions to profit growth in 2006also came from the sale of Evergro’s subsidiary which owned133 ha of land in Tianjin, and the sale of the Company’sinterest in Singapore Suzhou Industrial Holdings.Property investmentRevenue from property investment of $67.3 million in 2006was 3% less than $69.4 million in 2005, due largely to thedivestment of four buildings (Bugis Junction Towers,Prudential Tower, Keppel Towers and GE Tower) to K-REITAsia in April 2006.The divestment resulted in the reduced attributable profitfrom property investment which was 30% lower at$27.6 million in 2006 from $39.7 million in 2005.Hospitality, asset management and property servicesThe Group’s hospitality, asset management and propertyservices generated revenue of $71 million in 2006, whichwas 37% higher than $52 million in 2005. Assets undermanagement under Alpha Investment Partners and K-REITAsia Management increased from $2.3 billion in 2005 tomore than $4 billion in 2006.However, this segment recorded a loss of $24 million,compared with a profit of $3 million in 2005. The variance wasdue mainly to a revaluation loss of $2.4 million in 2006 for theGroup’s interest rate hedging instruments compared with arevaluation gain of $9.5 million in 2005 and net higher interestcosts in 2006 resulting from higher interest rates, as well asa loan recovery in 2005 for the hospitality business.As explained above, an impairment charge was also recordedfor the two hotels in Myanmar and an associated companywith hotel interests in Manado.Net tangible asset per share$3.002.001.002.09 2.0920022003Net tangible asset per share2.2620042.3520052.212006Five-year financial recordEarnings per share, return on equity, dividend per share, anddividend payout grew consistently for the last five years.From 7.7 cents in 2002, earnings per share before tax butafter gains from en bloc sales less impairment loss, grew to33.6 cents in 2006.Dividend per share increased steadily from 3.5 cents in 2002to 6 cents in 2006. Return on equity also increased from1.7% in 2002 to 12.8% in 2006. Dividend payout, which was$19.3 million in 2002, increased to about $43.2 million in 2006.Including the special dividend in specie of 144.4 million unitsof K-REIT Asia, the total dividend payout in 2006 would be$306.1 million or a gross equivalent of 50 cents per share.Net tangible asset per share at the year-end increased from$2.09 in 2002 and 2003 to $2.35 in 2005. The decrease to$2.21 at end-2006 was due mainly to the above mentioneddistribution in specie.78Financial reviewKeppel Land LimitedReport to Shareholders 2006