Download

Download

Download

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

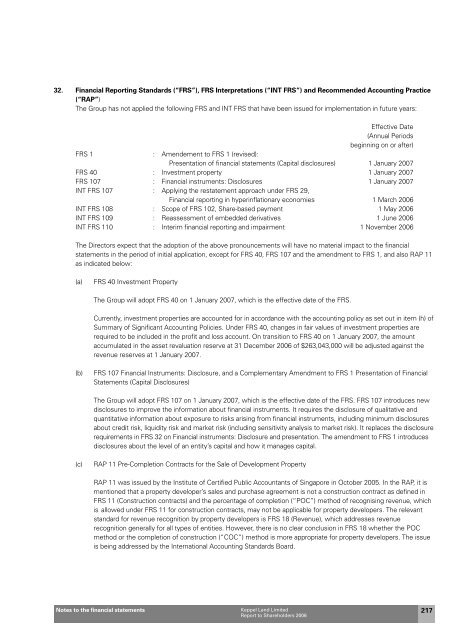

32. Financial Reporting Standards (“FRS”), FRS Interpretations (“INT FRS”) and Recommended Accounting Practice(“RAP”)The Group has not applied the following FRS and INT FRS that have been issued for implementation in future years:Effective Date(Annual Periodsbeginning on or after)FRS 1 : Amendement to FRS 1 (revised):Presentation of financial statements (Capital disclosures) 1 January 2007FRS 40 : Investment property 1 January 2007FRS 107 : Financial instruments: Disclosures 1 January 2007INT FRS 107 : Applying the restatement approach under FRS 29,Financial reporting in hyperinflationary economies 1 March 2006INT FRS 108 : Scope of FRS 102, Share-based payment 1 May 2006INT FRS 109 : Reassessment of embedded derivatives 1 June 2006INT FRS 110 : Interim financial reporting and impairment 1 November 2006The Directors expect that the adoption of the above pronouncements will have no material impact to the financialstatements in the period of initial application, except for FRS 40, FRS 107 and the amendment to FRS 1, and also RAP 11as indicated below:(a)FRS 40 Investment PropertyThe Group will adopt FRS 40 on 1 January 2007, which is the effective date of the FRS.Currently, investment properties are accounted for in accordance with the accounting policy as set out in item (h) ofSummary of Significant Accounting Policies. Under FRS 40, changes in fair values of investment properties arerequired to be included in the profit and loss account. On transition to FRS 40 on 1 January 2007, the amountaccumulated in the asset revaluation reserve at 31 December 2006 of $263,043,000 will be adjusted against therevenue reserves at 1 January 2007.(b)FRS 107 Financial Instruments: Disclosure, and a Complementary Amendment to FRS 1 Presentation of FinancialStatements (Capital Disclosures)The Group will adopt FRS 107 on 1 January 2007, which is the effective date of the FRS. FRS 107 introduces newdisclosures to improve the information about financial instruments. It requires the disclosure of qualitative andquantitative information about exposure to risks arising from financial instruments, including minimum disclosuresabout credit risk, liquidity risk and market risk (including sensitivity analysis to market risk). It replaces the disclosurerequirements in FRS 32 on Financial instruments: Disclosure and presentation. The amendment to FRS 1 introducesdisclosures about the level of an entity’s capital and how it manages capital.(c)RAP 11 Pre-Completion Contracts for the Sale of Development PropertyRAP 11 was issued by the Institute of Certified Public Accountants of Singapore in October 2005. In the RAP, it ismentioned that a property developer’s sales and purchase agreement is not a construction contract as defined inFRS 11 (Construction contracts) and the percentage of completion (“POC”) method of recognising revenue, whichis allowed under FRS 11 for construction contracts, may not be applicable for property developers. The relevantstandard for revenue recognition by property developers is FRS 18 (Revenue), which addresses revenuerecognition generally for all types of entities. However, there is no clear conclusion in FRS 18 whether the POCmethod or the completion of construction (“COC”) method is more appropriate for property developers. The issueis being addressed by the International Accounting Standards Board.Notes to the financial statementsKeppel Land LimitedReport to Shareholders 2006217