- Page 1 and 2:

Report to Shareholders 2006growbeyo

- Page 3 and 4:

In 2006, Keppel Land delivered ongr

- Page 5 and 6:

Group quarterly resultsQuarter 1 Qu

- Page 7 and 8:

Dear Shareholders,On behalf of the

- Page 9 and 10:

As appreciation of the waterfront l

- Page 11 and 12:

Keppel Land was also awarded the Be

- Page 13 and 14:

Depth and breadth...in execution en

- Page 16 and 17:

scaling heightsFinancial discipline

- Page 19 and 20:

deepening insightsDepth and breadth

- Page 21:

Meeting demand for quality housing

- Page 24 and 25:

oadening reachSpring City Golf & La

- Page 26 and 27: Group at a glanceKeppel Land Busine

- Page 28 and 29: Board of directorsA strong Board of

- Page 30 and 31: Board of directorsTan Yam Pin, 66Ch

- Page 32 and 33: Board of directorsLim Chee Onn, 62M

- Page 34 and 35: Board of directorsNiam Chiang Meng,

- Page 36 and 37: Senior managementFrom left to right

- Page 38 and 39: Senior managementChoo Chin Teck, 62

- Page 40 and 41: Profile of directors and seniormana

- Page 42 and 43: Key personnelKeppel Land LimitedLim

- Page 44 and 45: Key personnelKeppel Bay Pte LtdTan

- Page 46 and 47: Corporate governanceCommitment to h

- Page 48 and 49: Corporate governanceThe Directors

- Page 50 and 51: Corporate governanceThe Directors s

- Page 52 and 53: Corporate governanceNo member of th

- Page 54 and 55: Corporate governanceCompany’s sha

- Page 56 and 57: Corporate governanceEach item of sp

- Page 58 and 59: Investor relationsInvestors’ inte

- Page 60 and 61: Investor relationsKeppel Land conti

- Page 62 and 63: Awards and accoladesRecognition gar

- Page 64 and 65: Special feature

- Page 66 and 67: Special featureWaterfront homes - L

- Page 68 and 69: Special featureWaterfront homes - L

- Page 70 and 71: Special featureWaterfront homes - L

- Page 72 and 73: Special featureWaterfront homes - L

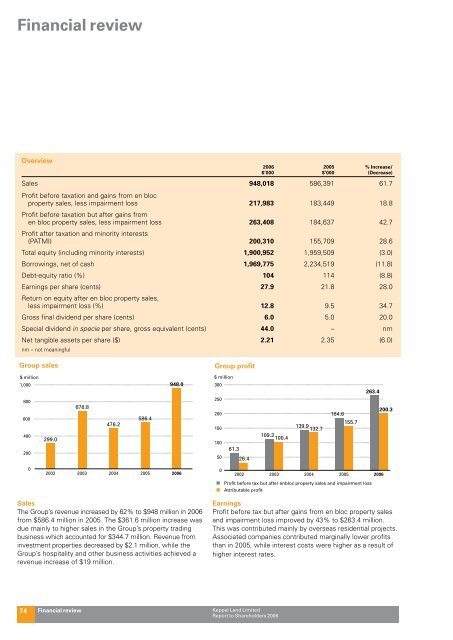

- Page 74 and 75: Key figures at a glanceSuccessful e

- Page 78 and 79: Financial reviewSources of finance$

- Page 80 and 81: Financial reviewAttributable profit

- Page 82 and 83: Property portfolio analysisAnalysis

- Page 84 and 85: Value added statementBy segmentHosp

- Page 86 and 87: Productivity analysisIn 2006, the t

- Page 88 and 89: Economic value addedYear-on-year ch

- Page 90 and 91: Consolidated Debt-equity ratio liqu

- Page 92 and 93: Risk managementIdentifying and mana

- Page 94 and 95: Business dynamics andrisk factorsTh

- Page 96 and 97: Critical accounting policies and re

- Page 98 and 99: Significant events3 4June• Keppel

- Page 100 and 101: Operations and market reviewSingapo

- Page 102 and 103: Operations and market reviewSingapo

- Page 104 and 105: Reflections Keppel Bay, at Singapor

- Page 106 and 107: Operations and market reviewUrbana

- Page 108 and 109: Operations and market reviewSingapo

- Page 110 and 111: Operations and market reviewSingapo

- Page 112 and 113: Operations and market reviewSingapo

- Page 114 and 115: Operations and market reviewSingapo

- Page 116 and 117: established with the foresight of s

- Page 118 and 119: Operations and market reviewMarket

- Page 120 and 121: Operations and market reviewSingapo

- Page 122 and 123: Operations and market reviewSingapo

- Page 124: Operations and market reviewOversea

- Page 127 and 128:

China’s housing market willgrow f

- Page 129 and 130:

Spring City Golf & Lake Resort, Kun

- Page 131 and 132:

The Arcadia, TianjinBy end-2006, 10

- Page 133 and 134:

The expansion of foreign companies,

- Page 135 and 136:

Elita HorizonElita Horizon is the s

- Page 137 and 138:

Operations and market reviewVietnam

- Page 139 and 140:

Villa Riviera, Ho Chi Minh CityMark

- Page 141 and 142:

Operations and market reviewIndones

- Page 143 and 144:

BG Junction, SurabayaSurabayaBG Jun

- Page 145 and 146:

Better economic outlook andrenewed

- Page 147 and 148:

Operations and market reviewPhilipp

- Page 149 and 150:

Operations and market reviewThailan

- Page 151 and 152:

52 Hong KongINDIAKolkata 55MYANMAR7

- Page 154 and 155:

People reviewExecutiveNon-executive

- Page 156 and 157:

Annual Dinner and Dance 2006Synergy

- Page 158 and 159:

Corporate and social responsibility

- Page 160 and 161:

Corporate and social responsibility

- Page 162 and 163:

Villa Arcadia at Srinakarin, Thaila

- Page 164 and 165:

Corporate and social responsibility

- Page 166 and 167:

Statutory report and accounts

- Page 168 and 169:

At 1.1.06 or Dateof Appointment At

- Page 170 and 171:

(c)The information on Directors of

- Page 172 and 173:

Statement by directorsFor the finan

- Page 174 and 175:

Consolidated profit and loss accoun

- Page 176 and 177:

Consolidated statement of changes i

- Page 178 and 179:

Company statement of changes in equ

- Page 180 and 181:

2006 2005$’000 $’000Represented

- Page 182 and 183:

Revenue RecognitionThe Group recogn

- Page 184 and 185:

(g)Fixed AssetsFixed assets are sta

- Page 186 and 187:

(iii)Available-For-Sale Financial A

- Page 188 and 189:

(t)Revenue RecognitionRental and re

- Page 190 and 191:

Notes to the financial statementsFo

- Page 192 and 193:

4. Interest and Investment IncomeGr

- Page 194 and 195:

A reconciliation between the tax ex

- Page 196 and 197:

9. Earnings per ShareGroup2006 2005

- Page 198 and 199:

(d)On 8 February 2006 and 10 August

- Page 200 and 201:

12. Long-term BorrowingsGroupCompan

- Page 202 and 203:

13. Fixed AssetsLand and Buildings

- Page 204 and 205:

14. Investment PropertiesGroupLand

- Page 206 and 207:

17. Associated CompaniesGroupCompan

- Page 208 and 209:

21. DebtorsGroupCompany2006 2005 20

- Page 210 and 211:

Advances to related companies are i

- Page 212 and 213:

Secured bank borrowing bears a fixe

- Page 214 and 215:

(c) By Geographical Location - 2005

- Page 216 and 217:

29. Significant Related Party Trans

- Page 218 and 219:

32. Financial Reporting Standards (

- Page 220 and 221:

Significant subsidiary and associat

- Page 222 and 223:

Country ofEffectiveIncorporation/Eq

- Page 224 and 225:

Country ofEffectiveIncorporation/Eq

- Page 226 and 227:

Corporate informationBoard of Direc

- Page 228 and 229:

Corporate structure100%Keppel Land

- Page 230 and 231:

Property portfolioGroup Properties

- Page 232 and 233:

Group Properties (Singapore) (cont

- Page 234 and 235:

Group Properties (Overseas)Descript

- Page 236 and 237:

Group Properties (Overseas) (cont

- Page 238 and 239:

Group Properties (Overseas) (cont

- Page 240 and 241:

Group Properties (Overseas) (cont

- Page 242 and 243:

Group Properties (Overseas) (cont

- Page 244 and 245:

Statistics of shareholdingsAs at 1

- Page 246 and 247:

Notice of annual general meeting an

- Page 248 and 249:

(2) unless varied or revoked by the

- Page 250 and 251:

Share transaction statisticsCompara

- Page 252 and 253:

Fold and glue along dotted lineProx

- Page 254:

Keppel Land Limited(Incorporated in