Download

Download

Download

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

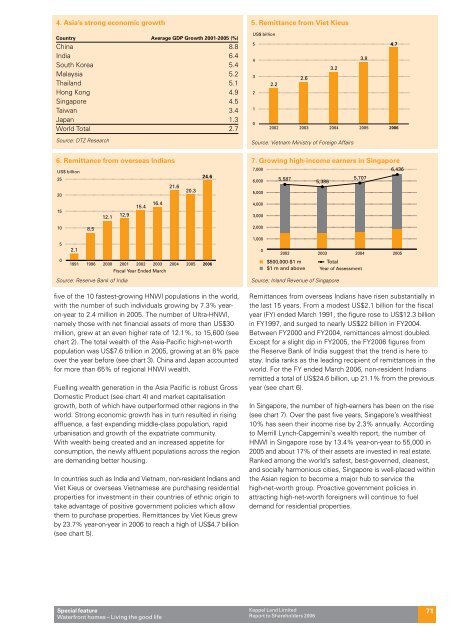

4. Asia’s strong economic growth5. Remittance from Viet KieusCountry Average GDP Growth 2001-2005 (%)China 8.8India 6.4South Korea 5.4Malaysia 5.2Thailand 5.1Hong Kong 4.9Singapore 4.5Taiwan 3.4Japan 1.3World Total 2.7US$ billion5432.221020022.620033.220043.820054.72006Source: DTZ ResearchSource: Vietnam Ministry of Foreign Affairs6. Remittance from overseas Indians7. Growing high-income earners in SingaporeUS$ billion252021.620.324.67,0006,0005,0005,5875,3865,7076,4361512.112.915.416.44,0003,000108.52,00052.11,000020022003200420050199119962000 2001 2002 2003Fiscal Year Ended March200420052006$500,000-$1 m$1 m and aboveTotalYear of AssessmentSource: Reserve Bank of Indiafive of the 10 fastest-growing HNWI populations in the world,with the number of such individuals growing by 7.3% yearon-yearto 2.4 million in 2005. The number of Ultra-HNWI,namely those with net financial assets of more than US$30million, grew at an even higher rate of 12.1%, to 15,600 (seechart 2). The total wealth of the Asia-Pacific high-net-worthpopulation was US$7.6 trillion in 2005, growing at an 8% paceover the year before (see chart 3). China and Japan accountedfor more than 65% of regional HNWI wealth.Fuelling wealth generation in the Asia Pacific is robust GrossDomestic Product (see chart 4) and market capitalisationgrowth, both of which have outperformed other regions in theworld. Strong economic growth has in turn resulted in risingaffluence, a fast expanding middle-class population, rapidurbanisation and growth of the expatriate community.With wealth being created and an increased appetite forconsumption, the newly affluent populations across the regionare demanding better housing.In countries such as India and Vietnam, non-resident Indians andViet Kieus or overseas Vietnamese are purchasing residentialproperties for investment in their countries of ethnic origin totake advantage of positive government policies which allowthem to purchase properties. Remittances by Viet Kieus grewby 23.7% year-on-year in 2006 to reach a high of US$4.7 billion(see chart 5).Source: Inland Revenue of SingaporeRemittances from overseas Indians have risen substantially inthe last 15 years. From a modest US$2.1 billion for the fiscalyear (FY) ended March 1991, the figure rose to US$12.3 billionin FY1997, and surged to nearly US$22 billion in FY2004.Between FY2000 and FY2004, remittances almost doubled.Except for a slight dip in FY2005, the FY2006 figures fromthe Reserve Bank of India suggest that the trend is here tostay. India ranks as the leading recipient of remittances in theworld. For the FY ended March 2006, non-resident Indiansremitted a total of US$24.6 billion, up 21.1% from the previousyear (see chart 6).In Singapore, the number of high-earners has been on the rise(see chart 7). Over the past five years, Singapore’s wealthiest10% has seen their income rise by 2.3% annually. Accordingto Merrill Lynch-Capgemini’s wealth report, the number ofHNWI in Singapore rose by 13.4% year-on-year to 55,000 in2005 and about 17% of their assets are invested in real estate.Ranked among the world’s safest, best-governed, cleanest,and socially harmonious cities, Singapore is well-placed withinthe Asian region to become a major hub to service thehigh-net-worth group. Proactive government policies inattracting high-net-worth foreigners will continue to fueldemand for residential properties.Special featureWaterfront homes – Living the good lifeKeppel Land LimitedReport to Shareholders 200671