Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

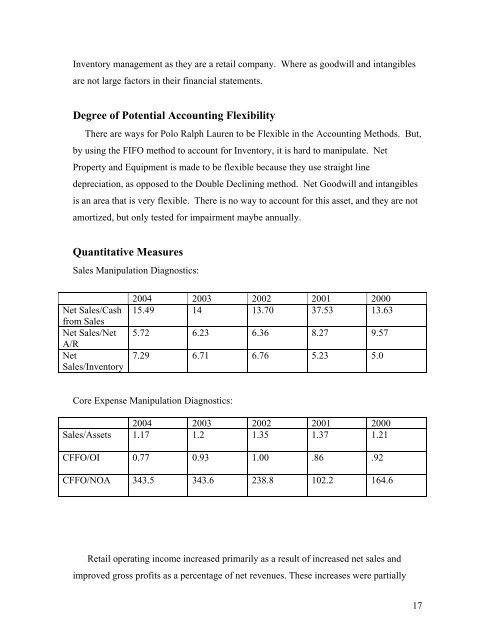

Inventory management as they are a retail company. Where as goodwill and intangiblesare not large factors in their financial statements.Degree <strong>of</strong> Potential Accounting FlexibilityThere are ways for <strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> to be Flexible in the Accounting Methods. But,by using the FIFO method to account for Inventory, it is hard to manipulate. NetProperty and Equipment is made to be flexible because they use straight linedepreciation, as opposed to the Double Declining method. Net Goodwill and intangiblesis an area that is very flexible. There is no way to account for this asset, and they are notamortized, but only tested for impairment maybe annually.Quantitative MeasuresSales Manipulation Diagnostics:Net Sales/Cashfrom SalesNet Sales/NetA/RNetSales/Inventory2004 2003 2002 2001 200015.49 14 13.70 37.53 13.635.72 6.23 6.36 8.27 9.577.29 6.71 6.76 5.23 5.0Core Expense Manipulation Diagnostics:2004 2003 2002 2001 2000Sales/Assets 1.17 1.2 1.35 1.37 1.21CFFO/OI 0.77 0.93 1.00 .86 .92CFFO/NOA 343.5 343.6 238.8 102.2 164.6Retail operating income increased primarily as a result <strong>of</strong> increased net sales andimproved gross pr<strong>of</strong>its as a percentage <strong>of</strong> net revenues. These increases were partially17