Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

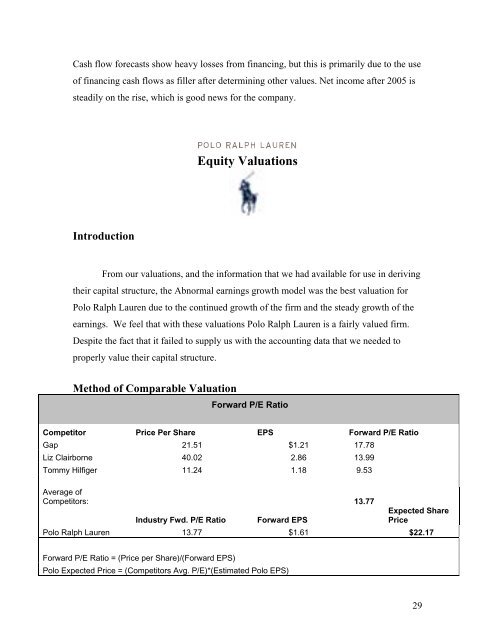

Cash flow forecasts show heavy losses from financing, but this is primarily due to the use<strong>of</strong> financing cash flows as filler after determining other values. Net income after 2005 issteadily on the rise, which is good news for the company.Equity <strong>Valuation</strong>sIntroductionFrom our valuations, and the information that we had available for use in derivingtheir capital structure, the Abnormal earnings growth model was the best valuation for<strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> due to the continued growth <strong>of</strong> the firm and the steady growth <strong>of</strong> theearnings. We feel that with these valuations <strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> is a fairly valued firm.Despite the fact that it failed to supply us with the accounting data that we needed toproperly value their capital structure.Method <strong>of</strong> Comparable <strong>Valuation</strong>Forward P/E RatioCompetitor Price Per Share EPS Forward P/E RatioGap 21.51 $1.21 17.78Liz Clairborne 40.02 2.86 13.99Tommy Hilfiger 11.24 1.18 9.53Average <strong>of</strong>Competitors: 13.77Expected SharePriceIndustry Fwd. P/E Ratio Forward EPS<strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> 13.77 $1.61 $22.17Forward P/E Ratio = (Price per Share)/(Forward EPS)<strong>Polo</strong> Expected Price = (Competitors Avg. P/E)*(Estimated <strong>Polo</strong> EPS)29