Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

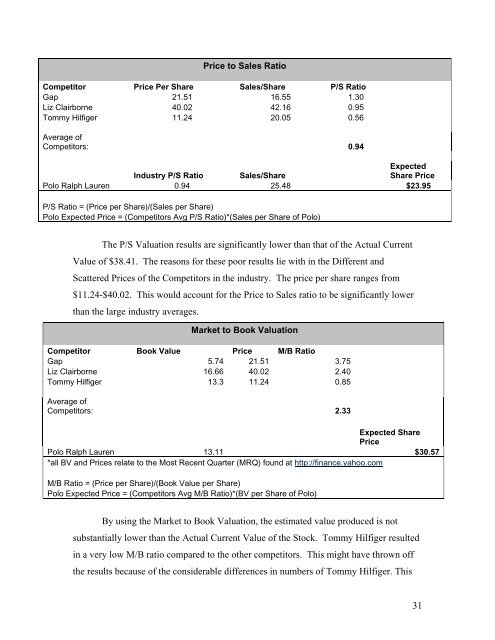

Price to Sales RatioCompetitor Price Per Share Sales/Share P/S RatioGap 21.51 16.55 1.30Liz Clairborne 40.02 42.16 0.95Tommy Hilfiger 11.24 20.05 0.56Average <strong>of</strong>Competitors: 0.94ExpectedIndustry P/S Ratio Sales/ShareShare Price<strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> 0.94 25.48 $23.95P/S Ratio = (Price per Share)/(Sales per Share)<strong>Polo</strong> Expected Price = (Competitors Avg P/S Ratio)*(Sales per Share <strong>of</strong> <strong>Polo</strong>)The P/S <strong>Valuation</strong> results are significantly lower than that <strong>of</strong> the Actual CurrentValue <strong>of</strong> $38.41. The reasons for these poor results lie with in the Different andScattered Prices <strong>of</strong> the Competitors in the industry. The price per share ranges from$11.24-$40.02. This would account for the Price to Sales ratio to be significantly lowerthan the large industry averages.<strong>Mark</strong>et to Book <strong>Valuation</strong>Competitor Book Value Price M/B RatioGap 5.74 21.51 3.75Liz Clairborne 16.66 40.02 2.40Tommy Hilfiger 13.3 11.24 0.85Average <strong>of</strong>Competitors: 2.33Expected SharePrice<strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> 13.11 $30.57*all BV and Prices relate to the Most Recent Quarter (MRQ) found at http://finance.yahoo.comM/B Ratio = (Price per Share)/(Book Value per Share)<strong>Polo</strong> Expected Price = (Competitors Avg M/B Ratio)*(BV per Share <strong>of</strong> <strong>Polo</strong>)By using the <strong>Mark</strong>et to Book <strong>Valuation</strong>, the estimated value produced is notsubstantially lower than the Actual Current Value <strong>of</strong> the Stock. Tommy Hilfiger resultedin a very low M/B ratio compared to the other competitors. This might have thrown <strong>of</strong>fthe results because <strong>of</strong> the considerable differences in numbers <strong>of</strong> Tommy Hilfiger. This31