Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

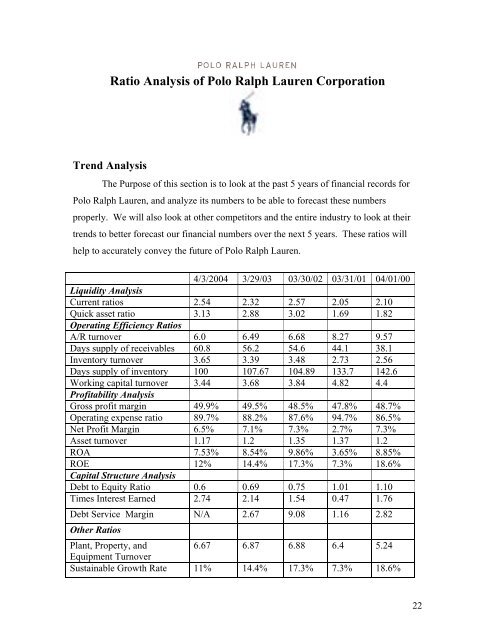

Ratio Analysis <strong>of</strong> <strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> <strong>Corporation</strong>Trend AnalysisThe Purpose <strong>of</strong> this section is to look at the past 5 years <strong>of</strong> financial records for<strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong>, and analyze its numbers to be able to forecast these numbersproperly. We will also look at other competitors and the entire industry to look at theirtrends to better forecast our financial numbers over the next 5 years. These ratios willhelp to accurately convey the future <strong>of</strong> <strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong>.4/3/2004 3/29/03 03/30/02 03/31/01 04/01/00Liquidity AnalysisCurrent ratios 2.54 2.32 2.57 2.05 2.10Quick asset ratio 3.13 2.88 3.02 1.69 1.82Operating Efficiency RatiosA/R turnover 6.0 6.49 6.68 8.27 9.57Days supply <strong>of</strong> receivables 60.8 56.2 54.6 44.1 38.1Inventory turnover 3.65 3.39 3.48 2.73 2.56Days supply <strong>of</strong> inventory 100 107.67 104.89 133.7 142.6Working capital turnover 3.44 3.68 3.84 4.82 4.4Pr<strong>of</strong>itability AnalysisGross pr<strong>of</strong>it margin 49.9% 49.5% 48.5% 47.8% 48.7%Operating expense ratio 89.7% 88.2% 87.6% 94.7% 86.5%Net Pr<strong>of</strong>it Margin 6.5% 7.1% 7.3% 2.7% 7.3%Asset turnover 1.17 1.2 1.35 1.37 1.2ROA 7.53% 8.54% 9.86% 3.65% 8.85%ROE 12% 14.4% 17.3% 7.3% 18.6%Capital Structure AnalysisDebt to Equity Ratio 0.6 0.69 0.75 1.01 1.10Times Interest Earned 2.74 2.14 1.54 0.47 1.76Debt Service Margin N/A 2.67 9.08 1.16 2.82Other RatiosPlant, Property, and 6.67 6.87 6.88 6.4 5.24Equipment TurnoverSustainable Growth Rate 11% 14.4% 17.3% 7.3% 18.6%22