Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

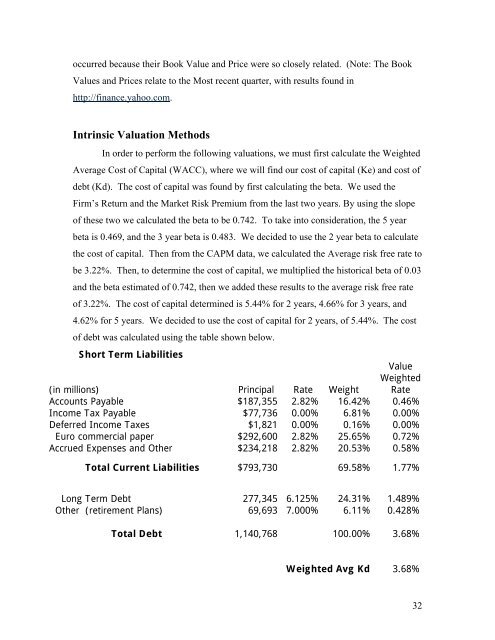

occurred because their Book Value and Price were so closely related. (Note: The BookValues and Prices relate to the Most recent quarter, with results found inhttp://finance.yahoo.com.Intrinsic <strong>Valuation</strong> MethodsIn order to perform the following valuations, we must first calculate the WeightedAverage Cost <strong>of</strong> Capital (WACC), where we will find our cost <strong>of</strong> capital (Ke) and cost <strong>of</strong>debt (Kd). The cost <strong>of</strong> capital was found by first calculating the beta. We used theFirm’s Return and the <strong>Mark</strong>et Risk Premium from the last two years. By using the slope<strong>of</strong> these two we calculated the beta to be 0.742. To take into consideration, the 5 yearbeta is 0.469, and the 3 year beta is 0.483. We decided to use the 2 year beta to calculatethe cost <strong>of</strong> capital. Then from the CAPM data, we calculated the Average risk free rate tobe 3.22%. Then, to determine the cost <strong>of</strong> capital, we multiplied the historical beta <strong>of</strong> 0.03and the beta estimated <strong>of</strong> 0.742, then we added these results to the average risk free rate<strong>of</strong> 3.22%. The cost <strong>of</strong> capital determined is 5.44% for 2 years, 4.66% for 3 years, and4.62% for 5 years. We decided to use the cost <strong>of</strong> capital for 2 years, <strong>of</strong> 5.44%. The cost<strong>of</strong> debt was calculated using the table shown below.Short Term Liabilities(in millions) Principal Rate WeightValueWeightedRateAccounts Payable $187,355 2.82% 16.42% 0.46%Income Tax Payable $77,736 0.00% 6.81% 0.00%Deferred Income Taxes $1,821 0.00% 0.16% 0.00%Euro commercial paper $292,600 2.82% 25.65% 0.72%Accrued Expenses and Other $234,218 2.82% 20.53% 0.58%Total Current Liabilities $793,730 69.58% 1.77%Long Term Debt 277,345 6.125% 24.31% 1.489%Other (retirement Plans) 69,693 7.000% 6.11% 0.428%Total Debt 1,140,768 100.00% 3.68%Weighted Avg Kd 3.68%32