Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

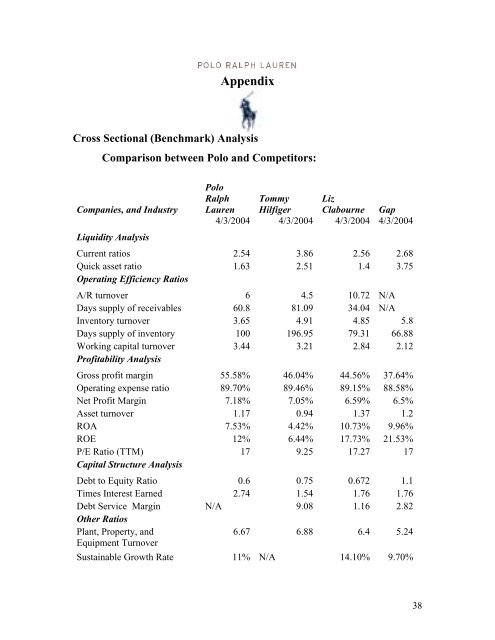

AppendixCross Sectional (Benchmark) AnalysisComparison between <strong>Polo</strong> and Competitors:Companies, and Industry<strong>Polo</strong><strong>Ralph</strong><strong>Lauren</strong>TommyHilfigerLizClabourne Gap4/3/2004 4/3/2004 4/3/2004 4/3/2004Liquidity AnalysisCurrent ratios 2.54 3.86 2.56 2.68Quick asset ratio 1.63 2.51 1.4 3.75Operating Efficiency RatiosA/R turnover 6 4.5 10.72 N/ADays supply <strong>of</strong> receivables 60.8 81.09 34.04 N/AInventory turnover 3.65 4.91 4.85 5.8Days supply <strong>of</strong> inventory 100 196.95 79.31 66.88Working capital turnover 3.44 3.21 2.84 2.12Pr<strong>of</strong>itability AnalysisGross pr<strong>of</strong>it margin 55.58% 46.04% 44.56% 37.64%Operating expense ratio 89.70% 89.46% 89.15% 88.58%Net Pr<strong>of</strong>it Margin 7.18% 7.05% 6.59% 6.5%Asset turnover 1.17 0.94 1.37 1.2ROA 7.53% 4.42% 10.73% 9.96%ROE 12% 6.44% 17.73% 21.53%P/E Ratio (TTM) 17 9.25 17.27 17Capital Structure AnalysisDebt to Equity Ratio 0.6 0.75 0.672 1.1Times Interest Earned 2.74 1.54 1.76 1.76Debt Service Margin N/A 9.08 1.16 2.82Other RatiosPlant, Property, and6.67 6.88 6.4 5.24Equipment TurnoverSustainable Growth Rate 11% N/A 14.10% 9.70%38